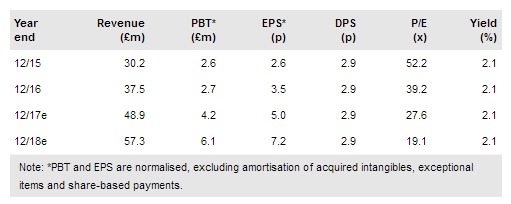

Statpro Group (LON:SOG) reported healthy interims with revenue up 23%, including 2% organic growth. Annualised recurring revenue (ARR) rose by 47% to £53.2m as at 30 June, boosted by the acquisition of UBS Delta in April. Adjusted EBITDA jumped by 35% to £2.8m as the margin expanded by 120bp to 12.9%, reflecting the increased scale of the business. We are reviewing our forecasts. Management says that the integration of Delta is on track, and we continue to see strong upside potential, given the significant valuation disparity between StatPro and its US-listed financial software peers.

H117 results: ARR jumps 47% to £53.2m

ARR jumped 47% to £53.2m, including £14.5m from Delta. New contracted revenue rose by 4% to £5.5m while cancellations fell by 10% to £4.5m. Revenue represents a function of ARR at the start of a period, plus new revenue, less churn and plus professional services. StatPro is now substantially a cloud business with 82% of group software revenue coming from cloud services (the balance is traditional software rental revenue and all revenue, apart from professional services, is recurring in nature). The average revenue per cloud client jumped by 67% to £75.5k, reflecting a focus on larger contract values and the acquisition of Delta. H1 cash flow from operations more than trebled to £7.5m and free cash flow swelled to £3.5m. StatPro commented that the “group’s sales pipeline of larger prospects continues to grow” and H217 trading is in line with market expectations.

To read the entire report Please click on the pdf File Below: