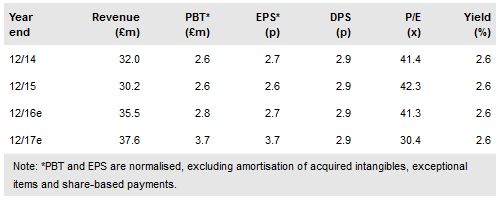

In an in-line trading update, Statpro Group (LON:SOG) says that its annualised recurring revenue (ARR) increased by 18% to £39.3m over the 12 months, which includes the two acquisitions made early last year. The ARR for StatPro Revolution, the cloud-based portfolio analysis service, increased by 68% to £15.0m, to represent 38% of the total, up from 27% a year earlier. We have maintained our FY16 P&L forecasts, which are likely to be slightly conservative due the weakness of the British pound, and have edged up our FY17 revenues, while broadly maintaining profits. With StatPro’s US-based financial software peers and SaaS companies trading on lofty multiples, we continue to believe there is significant upside in the shares.

FY16 trading update

Management says FY16 revenue and profitability remained in line with expectations. The group ended the year with £10.1m of net debt, which was £1.6m ahead of our expectations, primarily due to the fall in the British pound. StatPro increased its provision on the InfoVest (acquired in February) minority interest by £0.6m to £2.5m (ZAR42m), reflecting a strong performance, along with the rise in the South African rand against the pound. This £0.6m will be recorded as a non-operating exceptional item. StatPro is taking a £10m charge against FRI, which was acquired in 2006, and represents legacy software, but this has no impact on cash flow or tax. The group’s primary focus is to transition existing clients from the traditional performance, risk and fixed income attribution modules (which represented c £7.5m of group revenues at 30 June 2016) to its modern cloud platform over the next two years. A premium will be charged on the switch, and we note the group announced a £1.5m contract win in January with an un-named existing client.

To read the entire report Please click on the pdf File Below