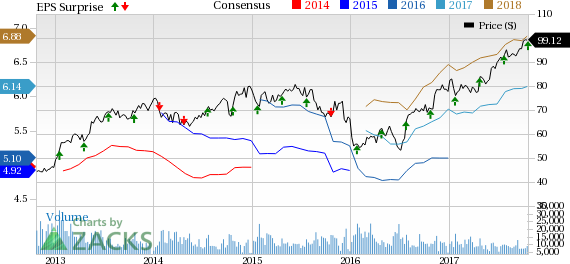

Rise in interest income drove State Street Corporation’s (NYSE:STT) third-quarter 2017 operating earnings of $1.71 per share, which handily outpaced the Zacks Consensus Estimate of $1.61. Also, the figure was up 26.7% year over year.

Higher net interest income (reflecting rise in interest rates) and fee income supported the results. Also, assets under custody and administration and assets under management (AUM) witnessed growth. However, an increase in operating expenses and lower trading servicing fees were the undermining factors.

After considering certain non-recurring items, net income available to common shareholders came in at $629 million or $1.66 per share compared with $507 million or $1.29 per share in the year-ago quarter.

Revenues Improve, Expenses Rise

Revenues, on a GAAP basis totaled $2.85 billion, increasing 8.6% from the prior-year quarter. However, the top line lagged the Zacks Consensus Estimate of $2.95 billion.

Net interest revenues, on an operating basis, jumped 20.1% from the year-ago quarter to $645 million. The rise was mainly driven by higher interest rates, lower wholesale CD balances and disciplined liability pricing. Also, net interest margin increased 29 basis points year over year to 1.35%.

Fee revenues grew 4.9% from the prior-year quarter to $2.32 billion. All components of fee income showed improvement except total trading services revenues.

On an operating basis, non-interest expenses were $1.99 billion, up 4.1% on a year-over-year basis. All expense components, except other costs, increased during the quarter.

As of Sep 30, 2017, total assets under custody and administration were $32.1 trillion, up 10% year over year. Moreover, AUM was $2.7 trillion, up 9.3% year over year.

Strong Capital and Profitability Ratios

Under Basel III (Advanced approach), estimated Tier 1 common ratio was 12.6% as of Sep 30, 2017, up from 12% as of Jun 30, 2017.

Return on common equity (on an operating basis) came in at 13.4% compared with 11.1% in the year-ago quarter.

Our Viewpoint

State Street is well poised to benefit from higher interest rates and synergies from the acquisition of GE Asset Management. Also, the company remains on track to improve efficiency through its multi-year restructuring plan. However, mounting expenses are expected to continue hurting the bottom line in the upcoming quarters.

Currently, State Street carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Regional Banks

B&T Corporation’s (NYSE:BBT) third-quarter 2017 adjusted earnings came in line with the Zacks Consensus Estimate. Results reflected an increase in revenues and higher expenses. Additionally, provision for credit losses decreased, which was a tailwind.

Comerica Incorporated’s (NYSE:CMA) adjusted earnings per share surpassed the Zacks Consensus Estimate. Results reflected increase in revenues supported by easing margin pressure and higher fee income. Also, the company was successful in reducing expenses on the back of its GEAR Up initiative. However, higher provisions and a fall in loans balance remained major headwinds.

KeyCorp’s (NYSE:KEY) third-quarter 2017 adjusted earnings were in line with the Zacks Consensus Estimate. Results were supported by revenue synergies from the First Niagara Financial Group acquisition deal (completed in August 2016) and higher interest rates. Further, lower credit cost, an increase in fee income, and improving loans and deposits were the tailwinds. On the other hand, higher operating expenses were on the downside.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

BB&T Corporation (BBT): Free Stock Analysis Report

Comerica Incorporated (CMA): Free Stock Analysis Report

KeyCorp (KEY): Free Stock Analysis Report

State Street Corporation (STT): Free Stock Analysis Report

Original post

Zacks Investment Research