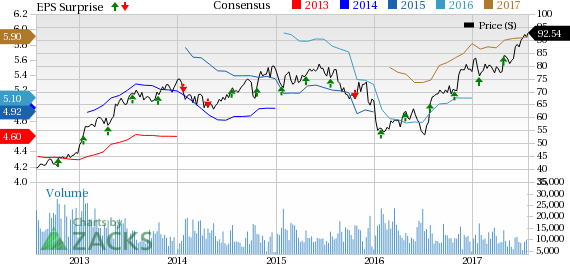

Higher interest income drove State Street Corporation’s (NYSE:STT) second-quarter 2017 operating earnings of $1.67 per share, which easily surpassed the Zacks Consensus Estimate of $1.57. Also, the figure was up 14.4% year over year.

Higher net interest income (reflecting rise in interest rates) and fee income supported the results. Further, assets under custody and administration and assets under management (AUM) recorded growth. However, an increase in expenses marginally hurt the results.

After considering certain non-recurring items, net income available to common shareholders came in at $584 million or $1.53 per share compared with $585 million or $1.47 per share in the year-ago quarter.

Revenues Improve, Expenses Rise

Revenues, on a GAAP basis totaled $2.81 billion, increasing 9.2% from the prior-year quarter. However, the top line lagged the Zacks Consensus Estimate of $2.84 billion.

Net interest revenues, on an operating basis, increased 13% from the year-ago quarter to $617 million. The rise was mainly driven by higher market interest rates in the U.S. and disciplined liability pricing. These were partly offset by smaller investment portfolio.

Also, net interest margin increased 16 basis points year over year to 1.27%.

Fee revenues grew 9.1% from the prior-year quarter to $2.32 billion. All components of fee income showed improvement except processing fees and other revenues.

On an operating basis, non-interest expenses were $1.96 billion, up 7.2% on a year-over-year basis. All expense components increased during the quarter.

As of Jun 30, 2017, total assets under custody and administration were $31 trillion, up 11.7% year over year. Moreover, AUM was $2.6 trillion, up 13.3% year over year.

Strong Capital and Profitability Ratios

Under Basel III (Advanced approach), estimated Tier 1 common ratio was 12% as of Jun 30, 2017, up from 11.2% as of Mar 31, 2017.

Return on common equity (on an operating basis) came in at 13.7% compared with 12.3% in the year-ago quarter.

Our Viewpoint

State Street is well poised to benefit from easing margin pressure and synergies from the acquisition of GE Asset Management. Also, the company remains on track to improve efficiency through its multi-year restructuring plan. However, mounting expenses are expected to continue hurting the bottom line in the upcoming quarters.

Currently, State Street carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Regional Banks

BB&T Corporation’s (NYSE:BBT) second-quarter 2017 adjusted earnings of 78 cents per share surpassed the Zacks Consensus Estimate by a penny. Results were driven by an increase in revenues and lower expenses. However, provision for credit losses increased, which was a headwind.

Comerica Inc.’s (NYSE:CMA) second-quarter 2017 adjusted earnings per share of $1.15 surpassed the Zacks Consensus Estimate of $1.07. Results reflect higher revenues and lower expenses. Moreover, lower provisions and better credit quality were the tailwinds.

Riding on higher revenues, The PNC Financial Services Group, Inc. (NYSE:PNC) reported a positive earnings surprise of 4.5% in second-quarter 2017. Earnings per share of $2.10 easily beat the Zacks Consensus Estimate of $2.01. Continued growth in loans helped the company to generate higher revenues, which were partially offset by an increase in expenses.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

BB&T Corporation (BBT): Free Stock Analysis Report

PNC Financial Services Group, Inc. (The) (PNC): Free Stock Analysis Report

Comerica Incorporated (CMA): Free Stock Analysis Report

State Street Corporation (STT): Free Stock Analysis Report

Original post