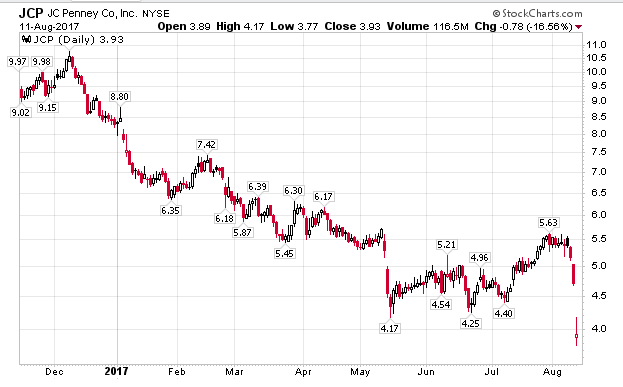

JCPenney announced a $62 million dollar loss for the quarter. With the announcement, its share price plunged 16% breaking the $4 barrier for the first time. Stocks under $5 are considered “penny” stocks.

Please consider JCPenney Nosedives to All-Time Low on Big Loss.

Yup. JCPenney is now a penny stock — a Wall Street term for a company trading under $5. JCPenney (JCP) said it lost $62 million in its second quarter. That’s more than a year ago. The retailer also said that same store sales — a measure of how well stores open at least a year are doing — fell more than 1% during the quarter.

JCPenney is the latest department store chain to announce dismal results. Macy’s Inc (NYSE:M), Kohl’s Corporation (NYSE:KSS) and Dillards Inc (NYSE:DDS) all reported a decline in same store sales on Thursday as they struggle to compete against Amazon (NASDAQ:AMZN, Tech30) and Walmart (NYSE:WMT).

The massive shift in the retail landscape has led many chains to shut down underperforming stores. JCPenney is one of them, announcing earlier this year it would be closing 138 stores. JCPenney wound up delaying the closings by a month though after consumers rushed to many of the stores to take advantage of the massive liquidation sales.

Ellison also said during the analyst call that JCPenney expects many retailers to ramp up promotions and discounts to try and lure shoppers into their stores. The CEO warned these sales may be even more aggressive than “what we’ve traditionally seen.”

Don’t Blame Amazon

Amazon is not to blame, but Amazon sure does not help either.

Retail is massively overbuilt. That’s the big problem. And it’s not just the box retailers. The fast food restaurants are all cannibalizing each other’s sales too.

Vitaliy Katsenelson accurately states It’s not just Amazon’s fault. Changing consumer habits are killing old retail biz

Retail stocks have been annihilated recently, despite the economy eking out growth. The fundamentals of the retail business look horrible: Sales are stagnating and profitability is getting worse with every passing quarter.

Jeff Bezos and Amazon get most of the credit, but this credit is misplaced. Today, online sales represent only 8.5 percent of total retail sales. Amazon, at $80 billion in sales, accounts only for 1.5 percent of total U.S. retail sales, which at the end of 2016 were around $5.5 trillion. Though it is human nature to look for the simplest explanation, in truth, the confluence of a half-dozen unrelated developments is responsible for weak retail sales.

Our consumption needs and preferences have changed significantly. Ten years ago we spent a pittance on cellphones. Today Apple (NASDAQ:AAPL) sells roughly $100 billion worth of i-goods in the U.S., and about two-thirds of those sales are iPhones.

Consumer income has not changed much since 2006, thus over the last 10 years $190 billion in consumer spending was diverted toward mobile phones. Between phones and their services, this is $340 billion that will not be spent on T-shirts and shoes.

But we are not done. The combination of mid-single-digit health-care inflation and the proliferation of high-deductible plans has increased consumer direct health-care costs and further chipped away at our discretionary dollars. Health-care spending in the U.S. is $3.3 trillion, and just 3 percent of that figure is almost $100 billion.

Then there are soft, hard-to-quantify factors. Millennials and millennial-want-to-be generations (speaking for myself here) don’t really care about clothes as much as we may have 10 years ago.

All this brings us to a hard and sad reality: The U.S. is over-retailed. We simply have too many stores. Americans have four or five times more square footage per capita than other developed countries. This bloated square footage was created for a different consumer, the one who in in the ’90s and ’00s was borrowing money against her house and spending it at her local shopping mall.

Hugely Overbuilt

Malls, retail stores, and fast food restaurants are all hugely overbuilt. Analysts still have not put 2 and 2 together on what this means.

It’s the overbuilding of all kinds of retail and fast food stores that has provided the high job growth, low wage growth environment that we are in.

You can blame (or thank) the Fed for that, depending on your view. Regardless, the expansion will come to an end at some point. And when it does, the Fed governors will not know what hit them.

Lowering interest rates further will not do a thing for the economy in this overbuilt setup, once the turn takes place.