State Auto Financial Corporation (NASDAQ:STFC) reported second-quarter 2017 loss of 4 cents per share, narrower than the Zacks Consensus Estimate loss of 16 cents and the year-ago loss of 69 cents.

The quarter experienced lower premiums at Personal and Commercial insurance. However, the same at Specialty improved. Also, the combined ratio improved.

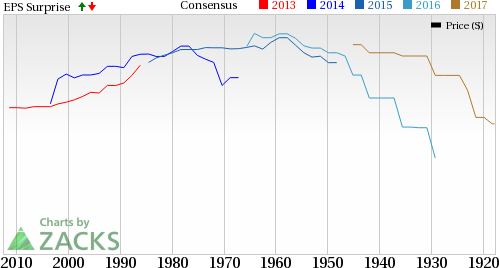

State Auto Financial Corporation Price, Consensus and EPS Surprise

Operational Update

Total operating revenue of $340 million marginally missed the Zacks Consensus Estimate by 0.41%. Top line slid 0.6% year over year on lower premiums. Net written premium dipped 1.2% year over year.

Net written premium for personal insurance declined 1.1%, attributable to lower level of homeowners’ new business counts. Commercial insurance decreased 6.1%, attributable to rate actions to improve profitability in commercial auto as well as a fall in new business opportunities in Workers’ Compensation owing to the softening of market.

However, specialty insurance premium improved 6.4%, fueled by an increase in new business for Excess and Surplus Casualty.

Total expenses reduced nearly 8% year over year to $343.8 million on lower losses and loss expenses.

Combined ratio improved 850 basis points (bps) year over year to 106.2% in the reported quarter.

Financial Update

State Auto Financial exited the second quarter with total cash of $48.8 billion compared with $51.1 billion at year-end 2016.

Debt balance remained flat with year-end 2016 at $122.1 million as of Jun 30, 2017.

Book value per share inched up 0.2% from year-end 2016 to $21.74 as of Jun 30, 2017.

Net cash from operating activities was $21.4 million in the first six months of 2017, down nearly 52% year over year.

Zacks Rank

State Auto Financial currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported second-quarter earnings so far, both Brown & Brown, Inc. (NYSE:BRO) and Fidelity National Financial, Inc’s. (NYSE:FNF) bottom lines beat their respective Zacks Consensus Estimate, while The Progressive Corporation (NYSE:PGR) missed the same.

More Stock News: Tech Opportunity Worth $386 Billion in 2017From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

State Auto Financial Corporation (STFC): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

Original post

Zacks Investment Research