Starbucks Corporation (NASDAQ:SBUX) just released its fourth-quarter 2017 financial results, posting earnings of $0.54 per share and revenues of $5.69 billion. Currently, Starbucks is a Zacks Rank #3 (Hold) and is down nearly 6% to $51.65 per share in after-hours trading shortly after its earnings report was released.

SBUX:

Missed earnings estimates. The company posted earnings of $0.54 per share, missing the Zacks Consensus Estimate of $0.55 per share.

Missed revenue estimates. The company saw revenue figures of $5.69 billion, coming in below our consensus estimate of $5.73 billion.

Starbucks fourth-quarter revenues were down marginally year-over-year, while the company’s earnings were flat.

The coffee giant’s comparable store sales rose 2% overall. Starbucks saw its comparable store sales in the Americas jump 3%.

For the full-year, Starbucks revenues climbed 5% to $22.39 billion. On top of that, the company posted earnings of $1.97 per share for the full-year, which marked a 4% gain from the year-ago period.

Starbucks also announced on Thursday that it made a deal to sell its Tazo brand to Unilever (LON:ULVR) for $384 million.

"Today, Starbucks reported another quarter – and year – of strong performance, with each of our business segments around the world contributing to record results,” CEO Kevin Johnson said in a statement.

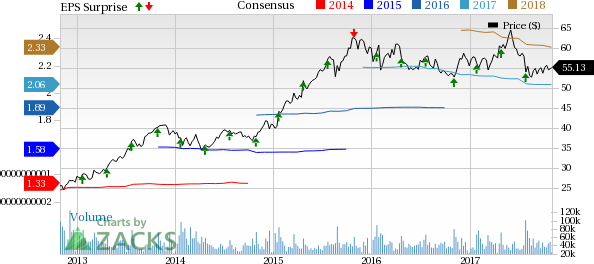

Here’s a graph that looks at SBUX’s Price, Consensus and EPS Surprise history:

Starbucks Corporation purchases and roasts high-quality whole bean coffees and sells them along with fresh, rich-brewed, Italian style espresso beverages, a variety of pastries and confections, and coffee-related equipments primarily through its company-operated retail stores. In addition to sales through its company-operated retail stores, Starbucks sells whole bean coffees through a specialty sales group and supermarkets. Additionally, Starbucks produces and sells bottled Frappuccino coffee drink and a line of premium ice creams through its joint venture partnerships and offers a line of innovative premium teas produced by its wholly owned subsidiary, Tazo Tea Company. The company's objective is to establish Starbucks as the most recognized and respected brand in the world.

Check back later for our full analysis on SBUX’s earnings report!

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, and for the next month, you can follow all Zacks’ private buys and sells in real time. Our experts cover all kinds of trades: value, momentum, ETFs, stocks under $10, stocks that corporate insiders are buying up, and companies that are about to report positive earnings surprises. You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks' private trades >>

Starbucks Corporation (SBUX): Free Stock Analysis Report

Original post

Zacks Investment Research