Starbucks Corp. (NASDAQ:SBUX) just released its first quarter fiscal 2018 financial results, posting non-GAAP earnings of 65 cents per share and revenues of $6 billion. Currently, SBUX is a #3 (Hold), and is down 3.3% to $58.55 per share in trading shortly after its earnings report was released.

Starbucks:

Beat earnings estimates. The coffee giant reported non-GAAP earnings of 65 cents per share, topping the Zacks Consensus Estimate of 57 cents per share (this includes a $0.07 benefit from the U.S. tax law change).

Missed revenue estimate. The company saw consolidated net revenue figures of $6 billion, which just missed our consensus estimate of $6.14 billion but grew 6% to hit a new record.

Starbucks said that global comparable store sales increased 2% thanks to a 2% increase in average ticket. In the Americas and the U.S., comp store sales grew 2%, while China comp store sales increased 6% thanks to a 6% increase in transactions.

In the U.S., active membership in Starbucks Rewards grew 11% to 14.2 million, with member spending representing 37% of U.S. company-operated sales.

Mobile Order and Pay represented 11% of the company’s U.S. company-operated transactions.

“Starbucks delivered solid revenue and profit growth and our first ever $6 billion revenue quarter in Q1,” said Scott Maw, CFO. “We are laser-focused on accelerating growth in China and driving improvement across the U.S.business as we move into and through the back half of the year, and remain committed to delivering on the long-term targets we announced last quarter.”

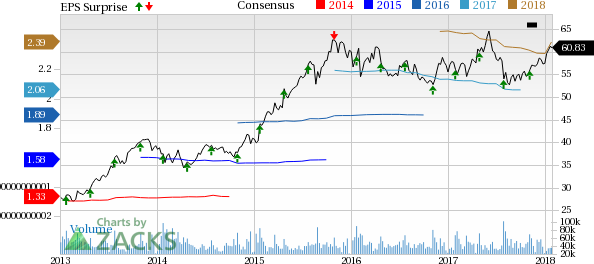

Here’s a graph that looks at Starbucks’ price, consensus, and EPS surprise:

Starbucks purchases and roasts high-quality whole bean coffees and sells them along with fresh, rich-brewed, Italian style espresso beverages, a variety of pastries and confections, and coffee-related equipment primarily through its company-operated retail stores. In addition to sales through its company-operated retail stores, Starbucks sells whole bean coffees through a specialty sales group and supermarkets. Additionally, Starbucks produces and sells bottled Frappuccino coffee drinks and a line of premium ice creams through its joint venture partnerships.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Starbucks Corporation (SBUX): Free Stock Analysis Report

Original post

Zacks Investment Research