Coffee giant Starbucks Corporation (NASDAQ:SBUX) late Thursday posted better-than-expected fiscal Q4 earnings results and offered a solid 2017 sales outlook.

The Seattle-based company reported fiscal Q4 EPS of $0.56, edging out Wall Street’s $0.55 estimate. Revenue rose 16.2% from last year to $5.71 billion, also narrowly beating estimates.Starbucks said that comparable store sales in the United States rose 4% in the latest period. That gain was driven entirely by a 6% increase in average ticket size, which offset a 1% decrease in store traffic. Minus estimated Starbucks Rewards loyalty program impacts, average ticket size grew 4%, with traffic growing 1%.Looking ahead, the company forecast weaker-than-expected full-year 2017 EPS of $2.12 to $2.14, which would miss Wall Street’s view of $2.16 per share. Starbucks expects consolidated revenue growth in the double digits, however, which is higher than analyst expectations for 8% higher sales.SBUX also sees mid-single digit comparable store sales growth globally for 2017, and about 2,100 net new stores globally.

The company commented via press release:

Starbucks record Q4 and fiscal 2016 financial and operating results in the face of ongoing economic, consumer and geopolitical headwinds, and the significant investments we continue to make in our people and our business, once again demonstrate the power, relevance and resilience of the Starbucks business and brand,” said Howard Schultz, Starbucks chairman and ceo. “The trust and confidence our customers have in the Starbucks brand – and in our store partners – is propelling our business forward in markets and channels around the world as never before.

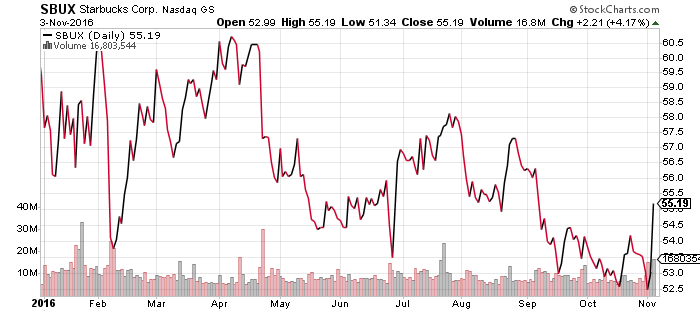

Starbucks shares rose $1.01 (+1.95%) to $52.78 in after-hours trading Thursday. Prior to today’s report, SBUX had fallen 13.76% year-to-date.