On Wednesday afternoon, Starbucks (NASDAQ:SBUX) held its biennial investor meeting.

There’s a lot to unpack, but we’ll start with the highlight: Starbucks revealed that it plans to have 55,000 locations by 2030. That would make Starbucks the largest restaurant chain in the world by a good margin—assuming that Subway and McDonald’s (NYSE:MCD) don’t grow their footprints at close to a comparable rate.

The plan may sound overly ambitious: isn’t there already a Starbucks on every corner?

But Starbucks Can Do It… And Do It Well

Doubting Starbucks has rarely been a profitable endeavor since its IPO, nearly 30 years ago, and I don’t expect this situation to be any different.

First, let’s consider the actual pace of the expansion:

The plan calls for stores to increase by nearly 70%, but that’s over a period of 10 years. Breaking it down year-by-year, it’s a very reasonable CAGR of under 6%.

Next, let’s consider where that growth is going to come from:

There isn’t exactly a Starbucks on every corner in the US, but it sure feels that way. Nearly half of the company’s 32,000+ locations are in the US. That’s around 300 Starbucks per state. The coffeehouse chain still has room for expansion in the US, but adding 20,000+ stores across the country would likely lead to oversaturation.

But that’s where China comes in. A few weeks ago, I said that China can drive company-wide growth for years to come. So it shouldn’t come as much of a surprise that Starbucks is looking to China to fuel a large percentage of its 20,000+ store expansion.

The company didn’t give a China-specific target for 2030, but Starbucks does plan to add 600 new stores in China next year alone. Starbucks, however, may just be getting started in China: at its current pace, the chain wouldn’t reach 6,000 stores in China until 2022.

It’s anyone’s guess as to how many Chinese locations Starbucks will have in 2030, but the sky is the limit. Even, say, 12,000 stores, feels a little on the conservative side. Which is just what you want to hear if you’re a Starbucks shareholder – or a prospective one.

Finally, let’s look at what type of locations Starbucks plans to open:

As a coffeehouse chain that specializes in beverages, Starbucks enjoys an advantage over the McDonald’s of the world: it doesn’t need to invest in traditional kitchens and lots of seating at all of its locations.

Starbucks is leveraging this advantage, opening up smaller locations with limited seating, known as Starbucks NOW stores. These stores will cater to busy customers that want to pick-up their orders or have them delivered. And, of course, this process will be helped along by Starbucks’ world-class digital infrastructure.

Starbucks Knows Its Customers

Plant milk, you may have heard, is all the rage among young, urban consumers. Oat milk, in particular, is having its day in the sun (or in the pantry?).

Anyhow, Starbucks is on top of the trends. On Wednesday, the company announced it will launch oat milk beverages in all US stores next spring. The Shaken Iced Expresso with brown sugar and, yes, oat milk, is one such beverage.

Besides the oat milk, that beverage should also be a success for another reason: it’s cold. At the investor meeting, Starbucks noted that, “cold has grown by nearly 45% the past four years.” Cold is also resonating with young consumers as, “Millennials and Gen Z’ers under 30 are two times more likely to drink cold coffee.”

Starbucks has always been hip and cool. Which is very necessary for a company that sells $5++ coffee. These moves and statements show that won’t change anytime soon.

Are Shares Too High?

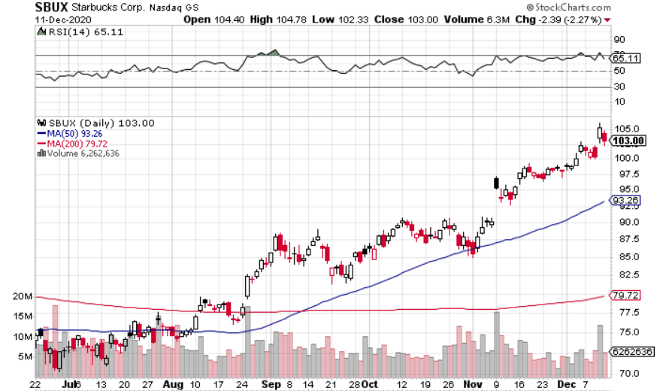

Starbucks shares soared nearly 5% on Thursday, following the investor meeting, setting all-time highs. Shares pulled back on Friday, but still trade a few points higher than they were before the meeting.

So is Starbucks still a buy?

Yes. A resounding yes.

I was very bullish on Starbucks at a little under $98 a share, and I think shares are an even better buy now. Why? Because the company came out with an incredible plan that can take it to the next level, but you only have to pay a small premium in the wake of the announcement.

There might be some profit-taking and volatility in the near-term, but it’s best not to haggle over a few points, and get into SBUX before it truly takes off.