Starbucks Corp. (NASDAQ:SBUX) just released its third quarter fiscal 2017 financial results, posting non-GAAP earnings of 55 cents per share and revenues of $5.7 billion. Currently, SBUX is a #3 (Hold), and is down a slight 0.59% to $59.14 per share in trading shortly after its earnings report was released.

Starbucks:

Matched earnings estimates. The coffee giant reported earnings of 55 cents per share, matching the Zacks Consensus Estimate of 55 cents per share. This number excludes 8 cents from non-recurring items.

Matched revenue estimate. The company saw consolidated net revenue figures of $5.7 billion, coming in-line with our consensus estimate of $5.74 billion and grew 8% year-over-year.

Starbucks reported that global comparable store sales increased 4%, with U.S. comp store sales increased 5% thanks to a 5% growth in average ticket. China comp store sales increased 7%, driven by a 5% increase in transactions.

Starbucks Rewards membership gained 8% year-over-year, to 13.3 million active members. The program represented 36% of U.S. company-operated sales.

Mobile Payment increased to 30% of transactions in U.S. company-operated stores, while Mobile Order and Pay increased to 9% of transactions in U.S. company-operated stores.

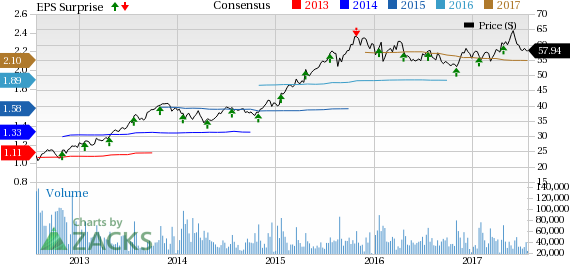

Here’s a graph that looks at Starbucks’ price, consensus, and EPS surprise:

Starbucks purchases and roasts high-quality whole bean coffees and sells them along with fresh, rich-brewed, Italian style espresso beverages, a variety of pastries and confections, and coffee-related equipment primarily through its company-operated retail stores. In addition to sales through its company-operated retail stores, Starbucks sells whole bean coffees through a specialty sales group and supermarkets. Additionally, Starbucks produces and sells bottled Frappuccino coffee drinks and a line of premium ice creams through its joint venture partnerships.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Starbucks Corporation (SBUX): Free Stock Analysis Report

Original post

Zacks Investment Research