Starbucks Corporation (NASDAQ:SBUX) met analysts’ expectations on earnings, but failed to meet the same on revenues in third-quarter fiscal 2017 results.

Apart from impressive third-quarter earnings, Starbucks made another major announcement. First, Starbucks announced plans of buying the remaining 50% stake in its East China business for $1.3 billion in cash, the company’s largest ever acquisition, as it continues to look to China as one of the main growth area. The addition gives Starbucks full ownership of about 1,300 Starbucks locations in Shanghai as well as Jiangsu and Zhejiang provinces.

However, the premium coffee giant also shared plans of closing its Teavana outlets (379 stores, 3,300 employees) after buying it in 2012.

Despite Starbucks’ expansion plans, its shares fell 5.8% in after-hours trading session on Jul 27. The pessimism was possibly due to the soft guidance for fiscal 2017.

Starbucks Chief Financial Officer Scott Maw, said, “The combination of trends in the quarter and ongoing macro pressures impacting the retail and restaurant sectors has us a bit more cautious.”

Earnings, Sales & Comps Discussion

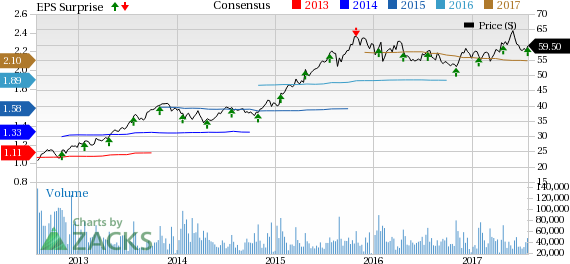

Adjusted earnings per share (EPS) of 55 cents was in line with the Zacks Consensus Estimate, but grew 12.2% year over year.

Total second-quarter sales of $5.66 billion increased 8.1% year over year, driven by higher store openings and global comps growth. The upside was driven by robust sales in the U.S. and the Europe, Middle East, and Africa (EMEA) divisions.

Revenues, however, missed the Zacks Consensus Estimate of $5.74 billion by 1.4%.

Global same-store sales (comps) grew 4%, better than the 3% growth witnessed in the preceding quarter. Global traffic increased 4% in the quarter against 3% decline in traffic in the previous quarter.

Margin Jumps

Operating margin decreased 110 basis points (bps) year over year to 18.4% in the quarter due to goodwill and store asset impairments. On a non-GAAP basis, operating margin advanced 100 bps to 20.8%.

Segment Details

Americas: Net revenue in this flagship segment increased 10% year over year to $3.99 billion.

Comps rise of 5% in the quarter was better than 3% last quarter. U.S. comps grew 5%, comprising 5% increase in average ticket.

The company’s core beverage contributed 2% to comps growth in the U.S. Core coffee and espresso and core beverages contributed 2% of comps. Food sales contributed 2 points and innovation beverages contributed 1% to comps growth in the quarter. Overall, 3% of comps growth came from beverage, while 2% from food.

Membership increased 8% year over year in the My Starbucks Rewards (MSR) program in the quarter. Customers in the U.S. are using the chain’s mobile app to order and pay for their drinks and are joining the company’s rewards program. Mobile payments represented 30% of U.S. transactions, increasing from 9% a year ago.

Operating margin in the segment, however, contracted 20 bps to 24.4% as strong sales leverage were more than offset by higher investments in store partners, the impact of product sales mix and higher commodity costs.

China-Asia-Pacific (CAP): Net revenue increased 9% to $840.6 million on the back of higher revenues from new store opening and comp store sales growth.

Comps grew 1%, softer than 3% growth seen in the previous quarter. Stellar 7% comps growth in China were partly offset by softness in Japan.

Starbucks’ licensed joint venture markets, including East China and South Korea, continue to contribute to CAP's performance in the quarter, as evidenced by a 30% increase in income from joint ventures.

Operating margin at the CAP segment rose 280 bps year over year to 26.6% buoyed by strong sales leverage and higher JV income.

Europe, Middle East and Africa (EMEA): Net revenue declined 9% year over year to $249.9 million due to portfolio shift to licensed stores, including the sale of the Germany outlet as well as due to currency headwind.

That said, comps grew 2% (against 1% decline in the preceding quarter), marking the strongest growth in seven quarters, banking on solid U.K. performance.

Operating margin declined 700 bps to 3.9%, owing to a shift in the portfolio toward more licensed stores and partial impairment of goodwill for its Switzerland market.

Channel Development (CPG): This segment includes roasted whole bean and ground coffees, premium Tazo teas, a variety of ready-to-drink beverages (like Frappuccino and Starbucks Refreshers) and Starbucks and Tazo branded K-Cup packs sold through channels such as grocery, specialty retailers, and foodservice, to name a few.

Channel Development’s net revenues were up 9% to $478.7 million.

Operating margin rose 130 bps to 43.9% driven by higher profits from the North American Coffee Partnership (NCAP) with PepsiCo, Inc, (NYSE:PEP) and lower coffee costs.

All-Other: The segment comprises emerging brands like Teavana (acquired in Dec 2012), Seattle's Best Coffee, Starbucks Reserve and Roastery businesses. Revenues at the segment decreased 9% to $100.4 million.

Q4 Guidance

For the fourth quarter, Starbucks projected global comp growth at 3% to 4%.

GAAP EPS will be in the range of 53–54 cents and non-GAAP EPS will be in the range of 54–55 cents.

Fiscal 2017 Guidance

Given the “choppiness” it witnessed in the fiscal third quarter as well as in the initial fourth quarter, Starbucks now is somewhat bearish for the remainder of fiscal 2017.

The company now expects revenue growth to be at the low end of its prior guidance range of 8–10%. This excludes 1% from Fx and 2% of impact for the extra week in fiscal 2016.

For fiscal 2017, the company cut its non-GAAP earnings target to the range of $1.96???$1.97 from $2.08–$2.12 per share expected earlier. On a non-GAAP basis, EPS is expected in the range of $2.05 to $2.06, representing a growth rate of 12–13%, excluding 1% to 2% of Fx.

Zacks Rank

Starbucks carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Dunkin' Brands Group, Inc. (NASDAQ:DNKN) second-quarter 2017 adjusted earnings of 64 cents per share beat the Zacks Consensus Estimate of 62 cents by 3.2% and increased 12.3% year over year.

Chipotle Mexican Grill, Inc.’s (NYSE:CMG) second-quarter 2017 adjusted earnings were $2.32 per share, which outpaced the Zacks Consensus Estimate of $2.16 by 7.41%. Also, earnings compared favorably with the year-ago quarter figure of 87 cents per share, given a substantial rise in revenues.

In second-quarter 2017, Domino’s Pizza, Inc. (NYSE:DPZ) posted earnings of $1.32 per share which outpaced the Zacks Consensus Estimate of $1.22 by 8.20%. Further, earnings climbed 34.7% year over year on strong sales and a lower share count.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

Starbucks Corporation (SBUX): Free Stock Analysis Report

Dunkin' Brands Group, Inc. (DNKN): Free Stock Analysis Report

Original post