Staples Inc (NASDAQ:SPLS) was upgraded by BidaskClub from a "strong sell" rating to a "sell" rating in a research note issued on Wednesday, MarketBeat.com reports.

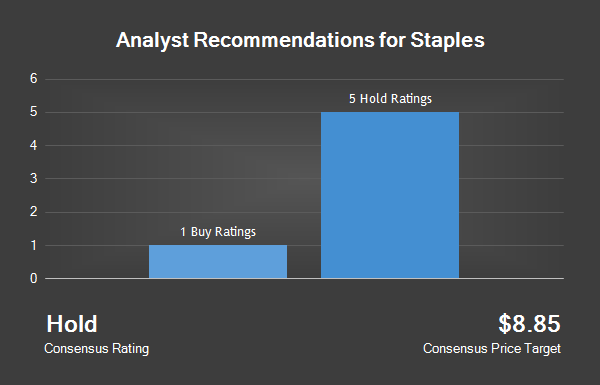

A number of other research analysts also recently issued reports on SPLS. Zacks Investment Research upgraded shares of Staples from a "sell" rating to a "hold" rating in a research report on Monday, May 15th. Oppenheimer Holdings, Inc. restated a "hold" rating on shares of Staples in a research report on Tuesday, May 16th. Telsey Advisory Group raised their price target on shares of Staples from $9.00 to $10.25 and gave the stock a "market perform" rating in a research report on Thursday, June 29th. Jefferies Group LLC restated a "hold" rating and issued a $9.00 price target on shares of Staples in a research report on Wednesday, August 9th. Finally, Loop Capital restated a "hold" rating and issued a $5.00 price target on shares of Staples in a research report on Friday, May 19th. Two equities research analysts have rated the stock with a sell rating, six have given a hold rating and one has issued a buy rating to the stock. The company currently has an average rating of "Hold" and an average price target of $9.04.

Staples (NASDAQ SPLS) opened at 10.20 on Wednesday, MarketBeat.com reports. Staples has a 1-year low of $7.24 and a 1-year high of $10.25. The firm's market capitalization is $6.66 billion. The firm has a 50-day moving average of $10.14 and a 200-day moving average of $9.43.

COPYRIGHT VIOLATION WARNING: "[[title]]" was first posted by [[site]] and is owned by of [[site]]. If you are accessing this news story on another site, it was illegally copied and republished in violation of U.S. & international copyright & trademark legislation. The correct version of this news story can be read at [[permalink]].

Hedge funds have recently added to or reduced their stakes in the company. BlackRock Inc boosted its stake in Staples by 3,241.4% in the first quarter. BlackRock Inc now owns 47,899,430 shares of the specialty retailer's stock worth $420,078,000 after buying an additional 46,465,935 shares during the period. Oldfield Partners LLP purchased a new stake in Staples during the first quarter worth $124,653,000. CNH Partners LLC purchased a new stake in Staples during the second quarter worth $63,079,000. Quinn Opportunity Partners LLC boosted its stake in Staples by 3,854.3% in the second quarter. Quinn Opportunity Partners LLC now owns 5,528,766 shares of the specialty retailer's stock worth $55,675,000 after buying an additional 5,388,948 shares during the period. Finally, Dimensional Fund Advisors LP boosted its stake in Staples by 48.6% in the first quarter. Dimensional Fund Advisors LP now owns 15,070,240 shares of the specialty retailer's stock worth $132,163,000 after buying an additional 4,930,604 shares during the period. 90.62% of the stock is currently owned by institutional investors and hedge funds.

About Staples

Staples, Inc (Staples) is a provider of products and services that serve the needs of business customers and consumers. The Company offers a range of print and marketing and technology services. The Company's segments include North American Delivery, North American Retail and Other. The North American Delivery segment consists of the United States and Canadian businesses, including Staples Business Advantage, staples.com, staples.ca, and quill.com, that sell and deliver products and services primarily to businesses.