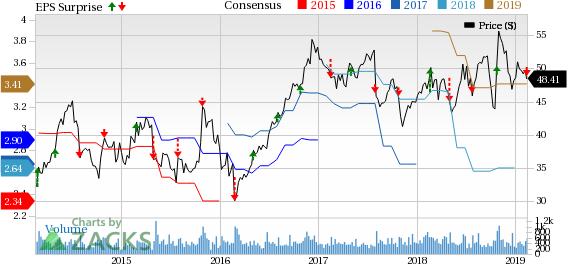

Standard Motor Products Inc. (NYSE:SMP) reported adjusted earnings of 52 cents per share for fourth-quarter 2018, missing the Zacks Consensus Estimate of 61 cents. Further, the bottom line was lower than the prior-year quarter figure of 54 cents per share.

During the quarter under review, earnings from continuing operations were $12.2 million against loss of $8.1 million in the prior-year quarter.

During the reported quarter, total revenues increased to $247 million from $240 million a year ago. The top line was almost in line with the Zacks Consensus Estimate.

Gross profit increased to $71.6 million from $69.3 million in the year-ago quarter. Operating income also increased to $18.4 million from $15.9 million in the year-ago quarter.

2018 Results

For 2018, earnings were $2.55 per share, down from the 2017 figure of $2.83.

For 2018, revenues were $1.1 billion, almost the same as the 2017 figure.

Segmental Results

During the reported quarter, revenues from the Engine Management segment increased to $203 million from $198 million a year ago.

Operating income was $23.9 million (11.8% of sales) compared with $22.8 million (11.5% of sales) in the prior-year quarter.

Revenues at the Temperature Control segment increased to $41.8 million from $40.3 million a year ago. The segment recorded operating loss of $3.5 million (negative 8.3% of sales) against operating income of $50,000 (0.1% of sales) in the fourth quarter of 2017.

Revenues at the All Other segment increased to $2.2 million from $1.7 million a year ago. The segment registered operating loss of $4.6 million, lower than loss of $5 million recorded in the fourth quarter of 2017.

Financial Position

Standard Motor had cash and cash equivalents of $11.1 million as of Dec 31, 2018, compared with $17.3 million as of Dec 31, 2017. Other long-term debt was $153,000 as of Dec 31, 2018, compared with $79,000 as of Dec 31, 2017.

Dividend Update

The company’s board of directors approved an increase in quarterly dividend from 21 cents to 23 cents per common share. The dividend will be paid on Mar 1, 2019.

Zacks Rank & Stocks to Consider

Currently, Standard Motor carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the auto space are General Motors Company (NYSE:GM) , Oshkosh Corp. (NYSE:OSK) , and American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) , each presently carrying a Zacks Rank #2 (Buy). You can see tthe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

General Motors has an expected long-term growth rate of 8.5%. Over the past three months, shares of the company have risen 9.4%.

Oshkosh has an expected long-term growth rate of 11.3%. Over the past three months, shares of the company have surged 15%.

American Axle & Manufacturing has an expected long-term growth rate of 8.1%. Over the past three months, shares of the company have risen 16.8%.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

General Motors Company (GM): Free Stock Analysis Report

American Axle & Manufacturing Holdings, Inc. (AXL): Free Stock Analysis Report

Oshkosh Corporation (OSK): Free Stock Analysis Report

Standard Motor Products, Inc. (SMP): Free Stock Analysis Report

Original post

Zacks Investment Research