A month has gone by since the last earnings report for Standard Motor Products, Inc. (NYSE:SMP) . Shares have lost about 12.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Standard Motor Q2 Earnings Miss Estimates, Down Y/Y

Standard Motor’s second-quarter 2017 adjusted earnings of $0.81 per share missed the Zacks Consensus Estimate of $0.99. Also, it came lower than the prior-year quarter figure of $0.88 per share.

Earnings from continuing operations, on a reported basis, amounted to $18.3 million or 78 cents per share, declining from $19.9 million or $0.86 in the prior-year quarter.

Total revenue also increased to $312.7 million from $289 million a year ago, surpassing the Zacks Consensus Estimate of $311 million.

Gross profit in the second quarter of 2017 increased to $90.7 million from $87.1 million in the year-ago quarter. Operating income declined to $29.7 million from $31.8 million in the year-ago quarter.

Segment Results

Revenues at the Engine Management segment increased to $223.3 million in the reported quarter from $198.8 million a year ago. Operating profit was $27.4 million (12.3% of sales) compared with $30.6 million (15.4% of sales) in the prior-year quarter.

Revenues at the Temperature Control segment slightly decreased to $87.4 million from $87.5 million a year ago. The segment recorded an operating profit of $8.6 million (9.8% of sales) compared with a profit of $6.3 million (7.2% of sales) in the second quarter of 2016.

Revenues at the All Other segment decreased to $1.99 million from $2.63 million a year ago. The segment registered an operating loss of $5.4 million, wider than $4.6 million in the second quarter of 2016.

Financial Position

Standard Motor had cash and cash equivalent of $16.4 million as of Jun 30, 2017 compared with $12.4 million as of Jun 30, 2016. Long-term debt of the company was $101,000 as of Jun 30, 2017, compared with $120,000 as of Dec 31, 2016.

Business Update

Along with the integration of the General Cable North American ignition wire acquisition, the company has begun transferring the entire production from the acquired plant in Nogales, Mexico to Reynosa, Mexico.

Also, the company started to move its electronics plant in Orlando, Florida, to Independence, Kansas.

Dividend

Standard Motor’s board approved a dividend of $0.19 per share to be paid on Sep 1 to stockholders of record on Aug 15.

How Have Estimates Been Moving Since Then?

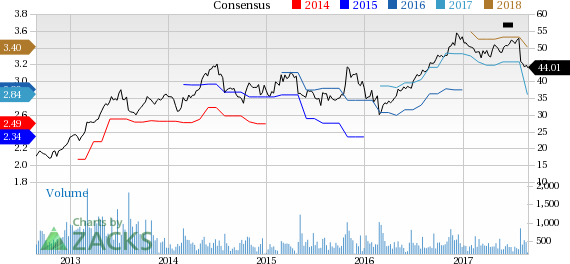

Following the release, investors have witnessed a downward trend in fresh estimates. There have been two revisions lower for the current quarter. In the past month, the consensus estimate has shifted lower by 13% due to these changes.

VGM Scores

At this time, Standard Motor's stock has a poor Growth Score of F, a grade with the same score on the momentum front. However, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for value based on our styles scores.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. The stock has a Zacks Rank #4 (Sell). We are expecting a below average return from the stock in the next few months.

Standard Motor Products, Inc. (SMP): Free Stock Analysis Report

Original post

Zacks Investment Research