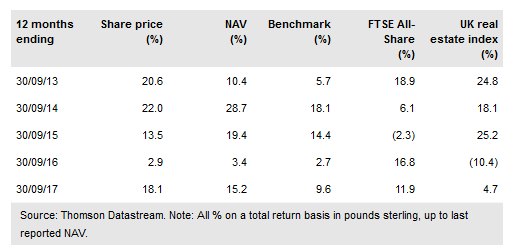

Standard Life (LON:SLA) Investments Property Income Trust Ltd (LON:SLI) holds an actively managed portfolio of UK commercial property. Since September 2006, the trust has been managed by Jason Baggaley, who aims to generate an attractive level of income with the potential for income and capital growth. SLI has a strong performance track record – its NAV total return has outperformed its benchmark IPD Monthly Index Funds (quarterly version) over one, three, and five years, while its share price total return has also outperformed over 10 years. SLI regularly trades at a premium, which the board aims to manage via share issuance.

Investment strategy: Active portfolio management

Baggaley invests in a diversified portfolio of UK commercial property across the three main sectors of industrial, office and retail. He actively manages the portfolio by signing new leases with existing or new tenants on improved terms, and completing refurbishments to enhance rental income or capital appreciation potential. SLI collects its own rent, enabling closer relationships with its tenants and currently has a 100% record of rent collection within 21 days. SLI has announced an above-average level of purchases and sales in recent months, with the manager aiming to reposition the portfolio as much as possible to provide resilience to any slowdown in the UK commercial property market. At end-September 2017, SLI’s loan-to-value was 21.6%, which is towards the low end of the historical range.

To read the entire report Please click on the pdf File Below: