The threat of centralized staking services poses existential risks to all Proof of Stake networks, including Etheruem.

Key Takeaways

- Events in 2020 have revealed the dangers of centralized staking services, like exchanges.

- Threats include governance mishaps and a poor use of capital.

- In a new report, the Chorus One team has outlined a handful of alternative designs.

After DeFi, Ethereum users are stocking up on Ether in hopes of earning passive returns via staking. But as exchanges and staking services emerge, these easy payoffs come with a serious cost.

Major Risks to Staking Ethereum

Ethereum’s most promising upgrade has been delayed once again despite promises of a summer release. But even after Phase 0 takes flight, enthusiasts will likely need to wait a few more years before earning passive income on their holdings.

In the meantime, Brian Crain, a founder of Chorus One, a blockchain-as-a-service that runs validators for roughly ten staking networks, has a few words of caution.

“Proof of stake networks were not designed with the idea that exchanges would start offering staking services,” said Crain in an interview with Crypto Briefing. “Their inclusion in such networks poses serious challenges.”

Crain and the Chorus One team released an 81-page report last month outlining these serious challenges. However, for anyone who lives and breathes crypto, events in 2020 have already revealed the bulk of the danger.

When big exchanges like Binance, Coinbase, KuCoin, and others began offering staking services, users were relieved. Instead of setting up sophisticated blockchain hardware and ensuring nodes are operating correctly, they could hand off this responsibility to exchanges.

Unfortunately, this convenience comes with a cost, evidenced by a battle for control between Steemit’s community and the founder of Tron, Justin Sun.

After purchasing Steemit, Sun attempted to take over all block producers in the network. Various exchanges aided this attack as they held large amounts of stakeable assets. The takeover was ultimately unsuccessful, but the outsized role of exchanges revealed the flaws in the current PoS design environment.

After governance mishaps, Crain also indicated that it could take a lot of time to exit a staked position. He argues that this lost time equates to lost profits, resulting in an inefficient use of capital.

And with the excitement around ETH 2.0 mounting, this design poses a significant threat to the number two blockchain.

Staking on Ethereum May Need Revision

Exchanges, like users, are well aware of the coveted 32 ETH needed to stake on the Ethereum network. But as enthusiasts learn about the risks that exchanges pose, how can the community ensure adequate decentralization?

It is technically challenging for the average user to effectively set up a validator and risk roughly $8,400 of ETH in a brand new technology. “Though many in the Ethereum community have been vocal about users running their own validators, this likely won’t happen,” said Crain.

Custodial stakers, like exchanges, will thus bear the brunt of this responsibility, for better or worse. Still, some are optimistic that this arrangement will succeed.

The founder and CEO of MyEtherWallet, Kosala Hemachandra, told Crypto Briefing in an interview:

“I don’t think that the concern is too high here. I don’t expect it to be in the exchange’s favor to do this, at least initially. Once you lock your ETH for staking, there is no way to get it back, at least for now. Exchanges need liquid ETH unless they start supporting bETH, which will be 1:1 with ETH. Even in this case, they’ll be taking a huge risk, as no one knows when bETH can be converted to ETH on-chain.”

bETH, or Beacon Ether, refers to the ETH that will be staked on Ethereum’s Beacon Chain. This chain is Phase 0 of Ethereum’s transition from a PoW to a PoS consensus mechanism.

As Hemachandra mentioned above, staking on the beacon chain is a one-way bridge. It’s unclear when this will change, and in the meantime, users are currently enjoying hefty returns in the way of DeFi’s yield farming craze.

So, why would they make this jump?

According to Anthony Sassano, the marketing lead at Set Protocol and co-founder of EthHub, the risk profile is much different for each activity.

If one assumes that ETH staking will operate as advertised, more conservative Ethereans will make a safe bet that Ethereum will continue operating longer than any up and coming DeFi project.

Still, Crain and even Hemachandra are bullish on a redesign of staking.

Proposing Alternative Staking Models

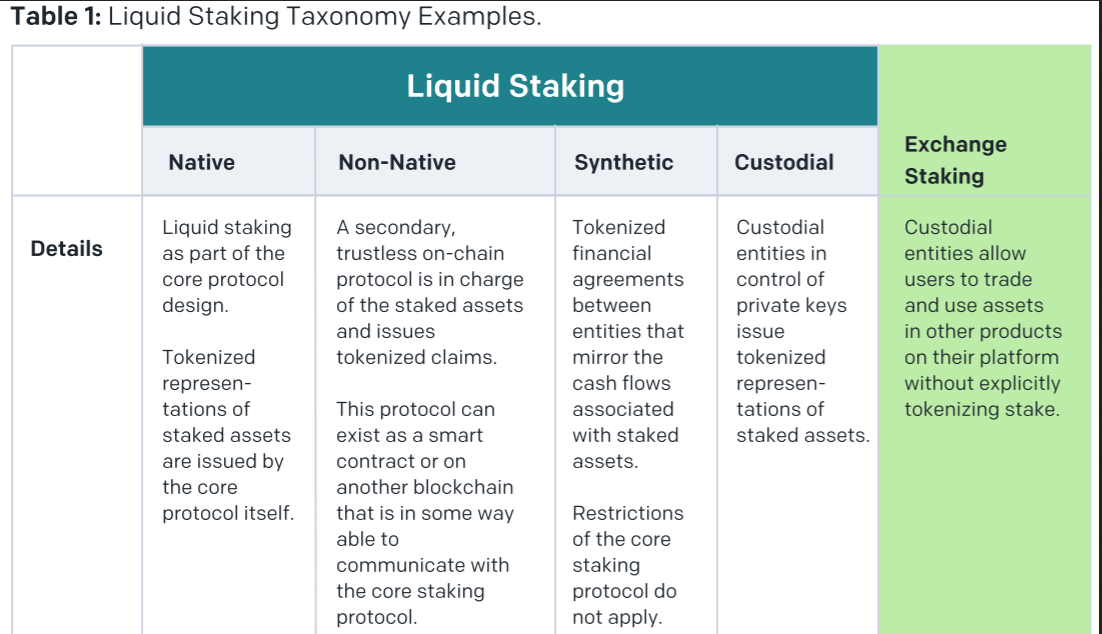

Liquid staking is one alternative that Crain and the Chorus One team have proposed in their report. It implies the tokenization of the asset holder’s stake and essentially creates a much larger market that these staked assets can inhabit.

Instead of tokens being locked in, holders could continue to use representations of these tokens for many other purposes. Hemachandra said:

“The beauty of Ethereum is that it can facilitate these kinds of new systems, and yes tokenizing the returns will let users/stakers immediately take advantage of their staking returns. However, this is just one solution, and there are likely many more that haven’t been discovered yet.”

Examples of this include projects like RocketPool and StakerDAO. Each team has attempted to implement some form of liquid staking.

RocketPool, for instance, allows users to deposit as little as 0.01 ETH as soon as the Beacon chain is live. Instead of needing to wait until Phase 2, stakers would also get rETH tokens representing their staked holdings. The ETH deposited is then assigned to any number of so-called “smart node” operators.

The additional token isn’t ideal, says Crain, but RocketPool is just one example of how staking on Ethereum could be improved. It resembles the current design space, except it makes a trade-off to omit any grave centralization concerns.

Understanding these trade-offs is perhaps all that matters for now. Though Ethereum’s network would be the most extensive PoS system after it transitions, it isn’t the only one. Other examples, like Cosmos and Tezos, have offered even further insight into the successes and failures of staking.

Whether it be DeFi or staking, centralization risk cannot be overlooked, no matter how profitable the returns may be.