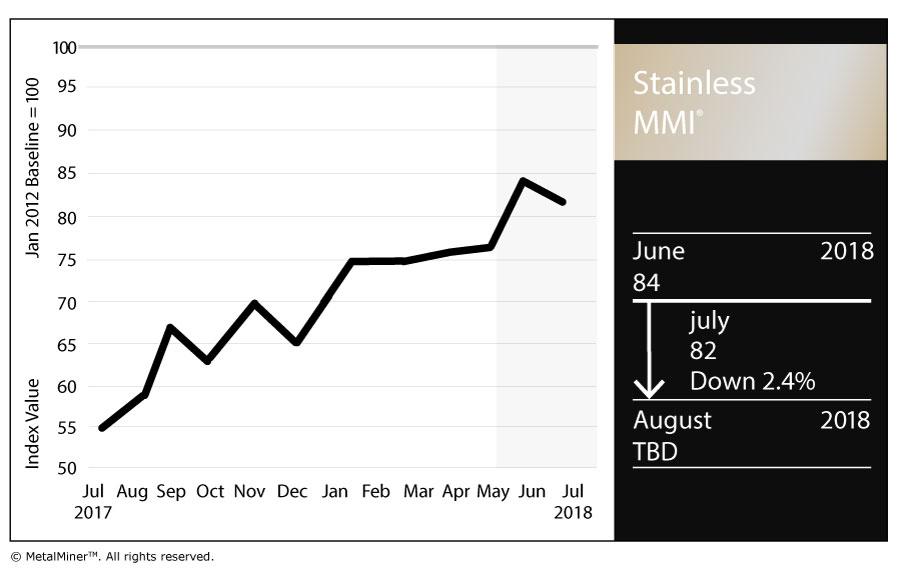

The Stainless Steel Monthly Metals Index (MMI) fell slightly this month, down to 82 from 84.

Despite the fall in the Stainless Steel MMI, the index remains at February 2015 highs.

The index dropped due to a slight decrease in LME nickel prices in June. However, stainless steel surcharges inched higher again this month, remaining in a strong uptrend.

LME Nickel

In June, nickel price momentum slowed down slightly. However, the short-term slide in June came as a result of a general downtrend in base metals. LME nickel prices remain in a long-term uptrend since June 2017.

Nickel long-term prices. Source: MetalMiner analysis of FastMarkets

Buying organizations can expect higher prices in the coming months.

MetalMiner previously recommended buying some volume forward. Given the current uncertainty in the steel and stainless industries, nickel prices remain supported for the short term.

A fundamental tightness in the nickel market has also added support to the latest nickel price increases.

President Rodrigo Duterte of the Philippines announced a possible halt to mining in the country due to environmental damage. In June, 23 out of 27 mines passed an environmental review easing the uncertainty of supply. However, nickel supply uncertainty still remains as a result of environmental measures.

Domestic Stainless Steel Market

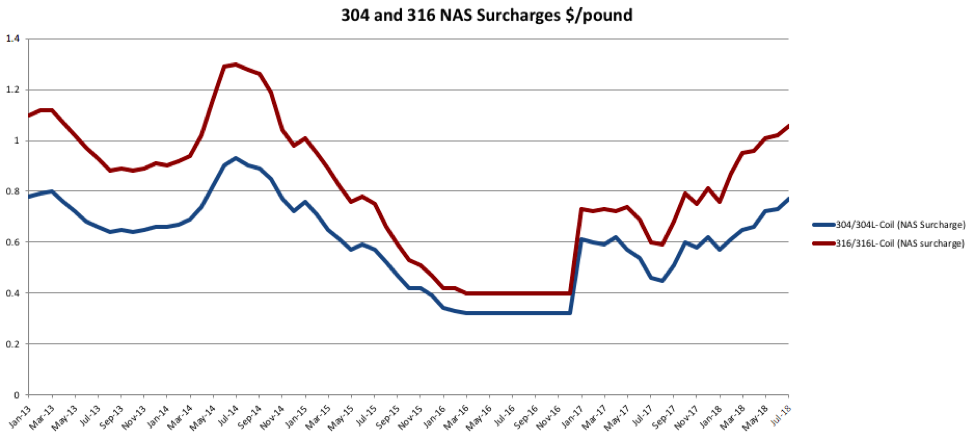

Following the recovery in stainless steel momentum, domestic stainless steel surcharges increased again this month.

The 316/316L-coil NAS surcharge reached $1.06/pound, while the 304/304L went up to $0.7698.

Source: MetalMiner data from MetalMiner IndX(™)

The pace of stainless steel surcharge increases appears to have recovered its previous level again this month. Stainless steel surcharges remain in a clear uptrend and appear well above 2015-2017 lows.

What This Means for Industrial Buyers

Stainless steel momentum slowed down slightly this month. However, both steel and nickel remain in a bull market. Therefore, buying organizations may want to follow the market closely for opportunities to buy on the dips.

To understand how to adapt buying strategies to your specific needs on a monthly basis, take a free trial to our Monthly Outlook now.

Actual Stainless Steel Prices and Trends

Chinese 304 stainless steel coil prices fell this month by 5.91%, while Chinese 316 stainless steel coil prices fell by 4.98%.

Chinese Ferrochrome prices decreased this month by 1% to $1,970/mt. Nickel prices fell 1.38% to $15,000/mt.

by Irene Martinez Canorea