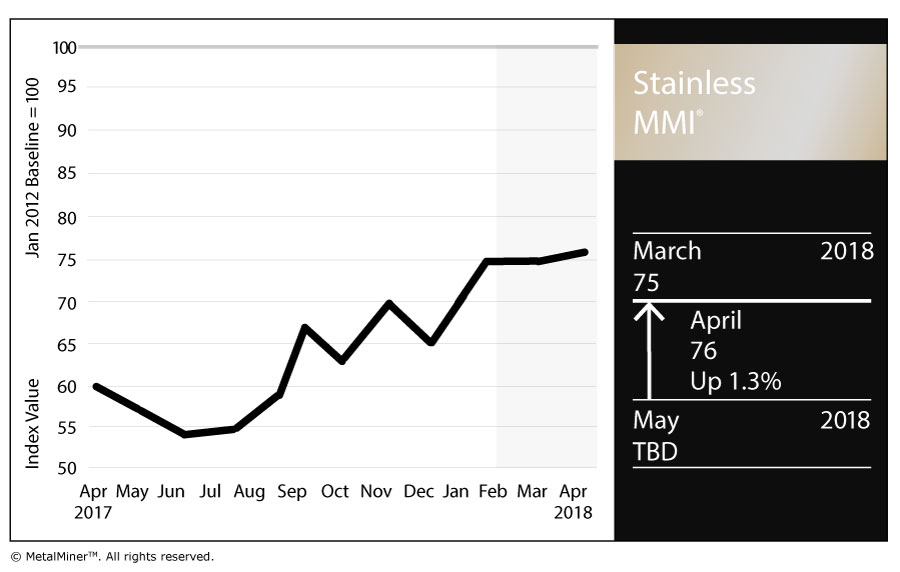

The Stainless Steel MMI (Monthly Metals Index) inched one point higher in April. The current reading is 76 points.

The index’s increase was driven by the rise in stainless steel surcharges, despite slightly falling LME nickel prices this month. Other related metals in the stainless steel basket increased.

LME Nickel

In April, nickel price momentum appears to have recovered from its previous pace.

LME nickel prices dropped in March, along with other base metals. However, the drop appears less sharp than for aluminum or copper.

Source: MetalMiner analysis of FastMarkets

LME nickel prices remain high and far away from 2017 lows back in May or June, when MetalMiner recommended buying organizations buy some volume forward. Prices back at that time were around $8,800/mt versus the current $13,200/mt price level.

Domestic Stainless Steel Market

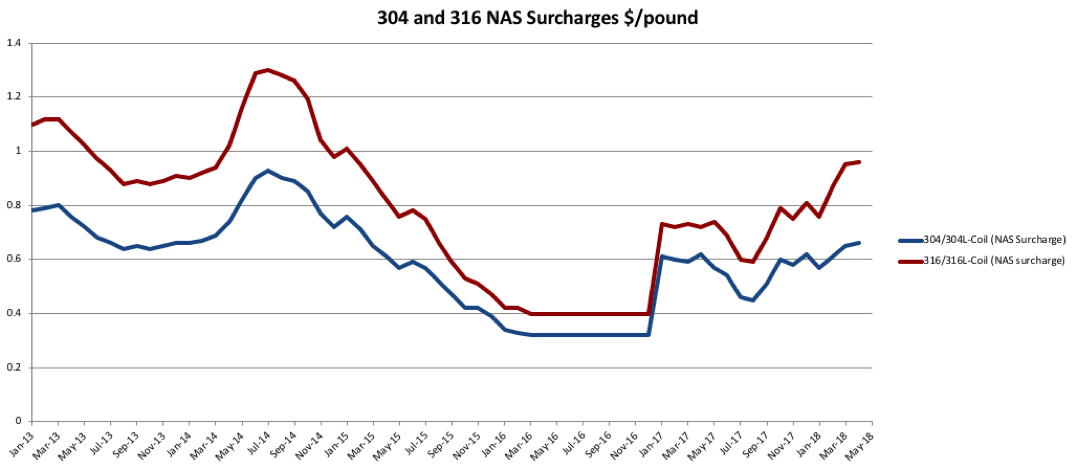

Following the recovery in stainless steel momentum, domestic stainless steel surcharges increased this month.

The 316/316L-coil NAS surcharge reached $0.96/pound. Therefore, buying organizations may want to look at surcharges to identify opportunities to reduce price risk either via forward buys or hedging.

Source: Source: MetalMiner data from MetalMiner IndX(™)

The pace of stainless steel surcharge increases appears to have slowed this month. However, surcharges have increased from 2017. The 316/316L-coil NAS surcharge is closer to $0.96/pound.

What This Means for Industrial Buyers

Stainless steel momentum appears stronger this month, with steel prices skyrocketing.

As both steel and nickel remain in a bull market, buying organizations may want to follow the market closely for opportunities to buy on the dips.

by Irene Martinez Canorea