Investing.com’s stocks of the week

The steel (and stainless steel) industry has always been strongly influenced by political issues. Now that the trade cases have largely been decided, the Trump administration’s Section 232 investigation will likely have an impact on domestic steel markets, including the stainless steel sector. Recommendations will likely be released in July.

Steel capacity utilization has increased this past month, according to the American Iron and Steel Institute (AISI). We’ve also seen a healthy manufacturing PMI, indicating positive industrial development.

Notwithstanding, the Chinese Caixin manufacturing PMI index hit an 11-month low. Despite strong growth indicators here in the U.S., steel market participants should carefully monitor the powerful link between the price of steel in China and that in the United States. A rebound in the Chinese economy — and consequently in the steel market — might result in increased steel (and stainless steel) prices. Conversely, the opposite is also true.

Nickel prices have also fallen this month due to Philippine mines reopening, together with increased Indonesian exports.

What This Means for Industrial Buyers

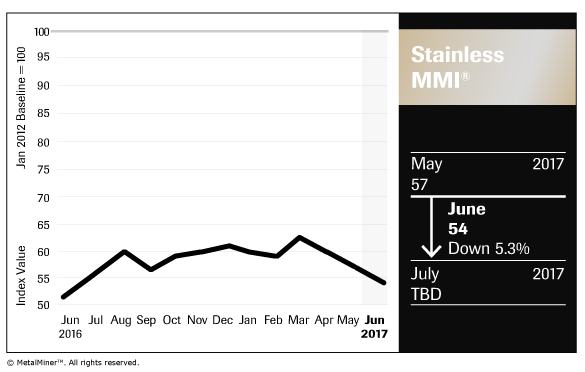

Stainless steel prices usually move drastically in one direction and then hold steady for a little while. While we watch a possible price correction, buying organizations might want to follow the market closely to identify possible buying opportunities should prices continue to decline.