Investing.com’s stocks of the week

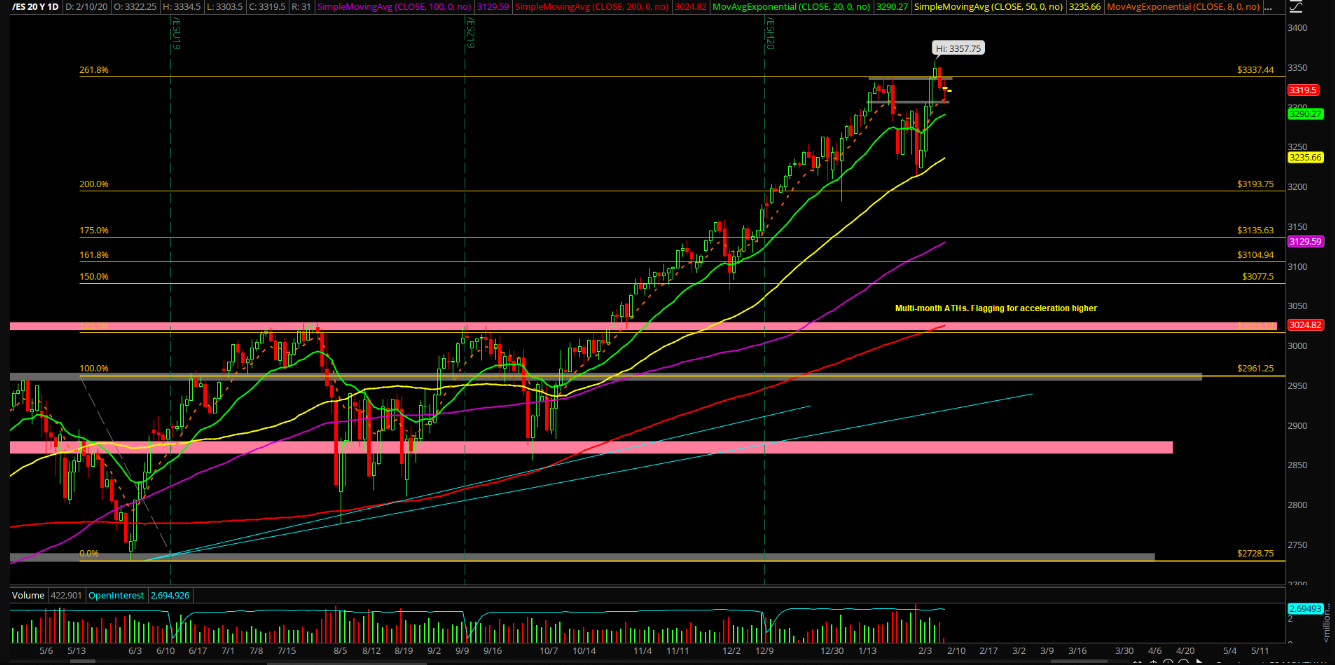

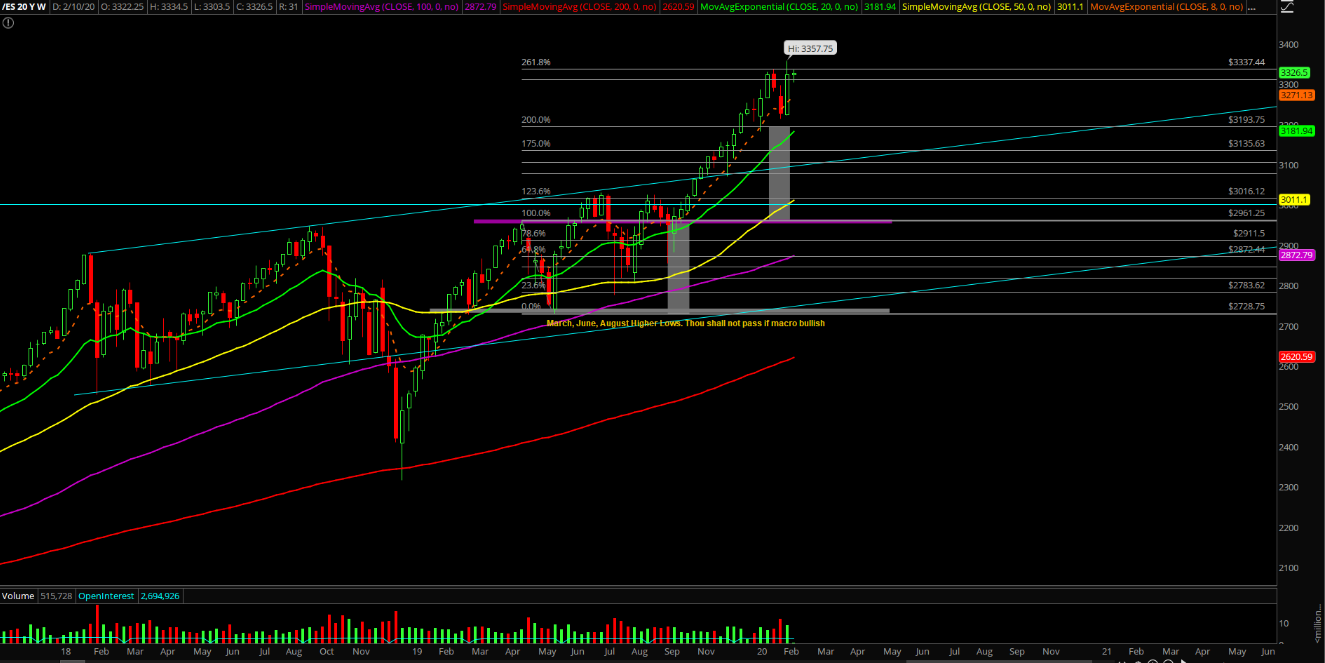

The first week of February played out as a large bull engulf breakout candle that negated all the losses of the final two weeks of January. If you recall, it became a feedback loop squeeze/daily W-shaped bottom where the bears tried their best to break below the key trending supports, but they failed miserably. The only thing worth noting is that it was the first time the market closed below the trending daily 20-EMA for a couple sessions since the October 2019 acceleration. Other than that, it was the same outcome: higher lows and higher highs.

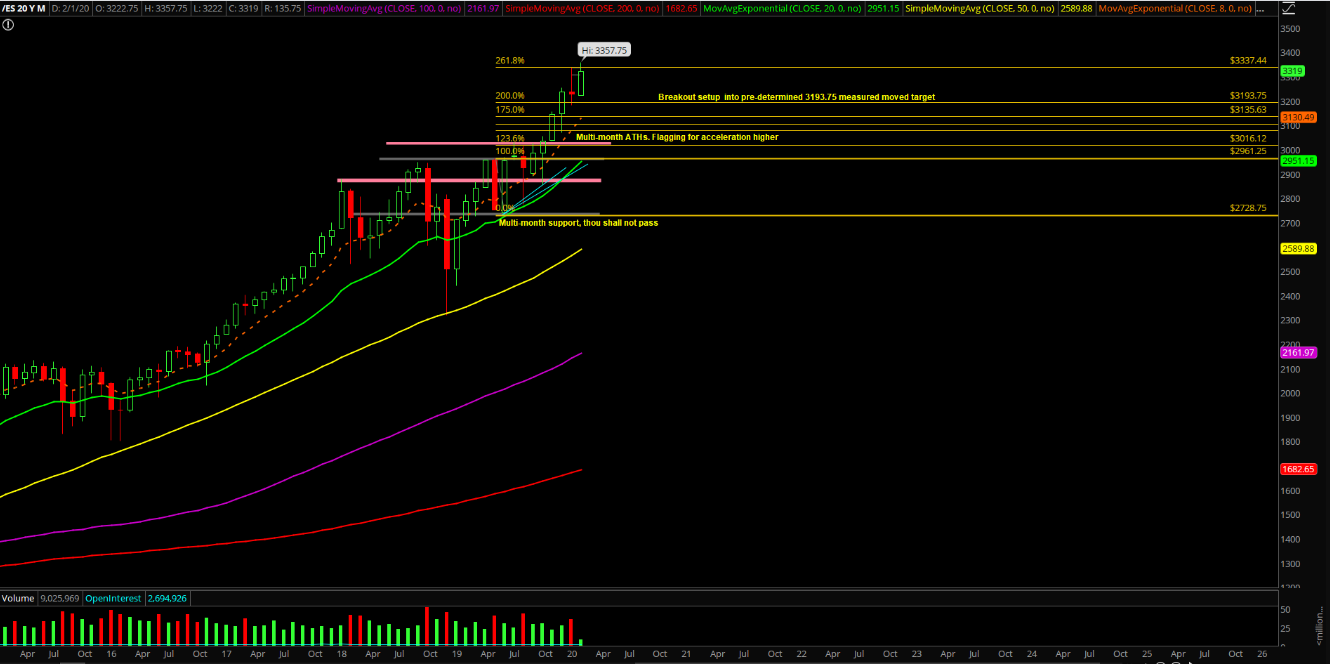

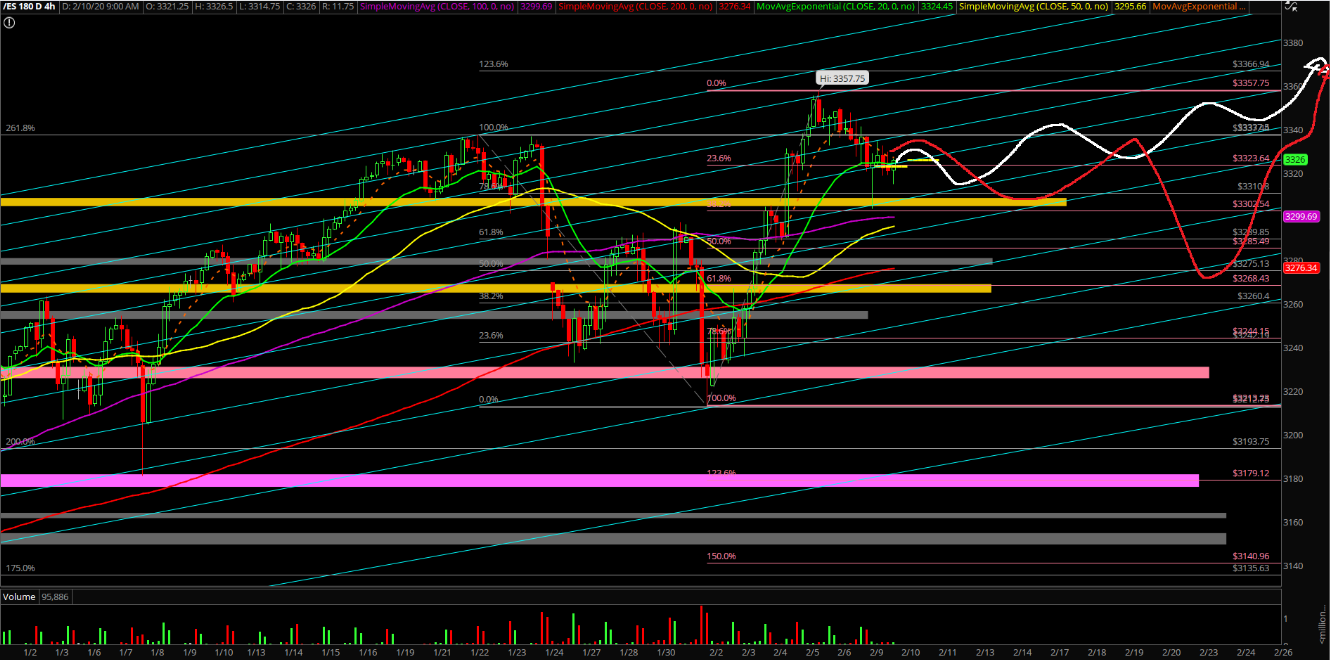

The main takeaway is last week’s expansion into the new all-time high targets alongside the confirmation of another round of trapped bears/weak hands shaken out. This week, in general, will likely be focused on stabilizing the gains made from last week and seeing if the bull train does the usual "hold half and go" setup by holding above the 50-61.8% fib retracement region at all times.

What’s Next?

Friday closed at 3323 at the Emini S&P 500 (ES) and this week is fairly easy given our predetermined key levels in an existing uptrend alongside with the respective goal lines for both sides. Traders should take advantage of the daily 8/20-EMA momentum when applicable due to the nature of leveraging the trend/bull train.Summing Up Our Game Plan