Squeeze Story:

Yesterday’s FOMC Minutes, today’s Fed speeches from Fischer/Lockhart and the USD price action in relation to how much of the hike has been priced in, are all coming together to shout December.

Data out of the US including last night’s Philly Fed Manufacturing Index and Unemployment Claims both continued to highlight the strength of the US economic recovery and markets are now sure that the time has come.

We got this from the Fed’s Fischer early this morning:

“The Fed has done everything it can not to surprise markets.”

But as Lockhart continues to make clear, it now comes down to how fast and up to what level the Fed goes to:

“The pace of increases may be somewhat slow and possibly more halting than historic episodes of rising rates.”

This is why forex markets are seeing the US dollar squeeze that we have been. You look at what’s priced in already and any technical USD weakness is going to be sold in the short term as big longs start to take off some of their size.

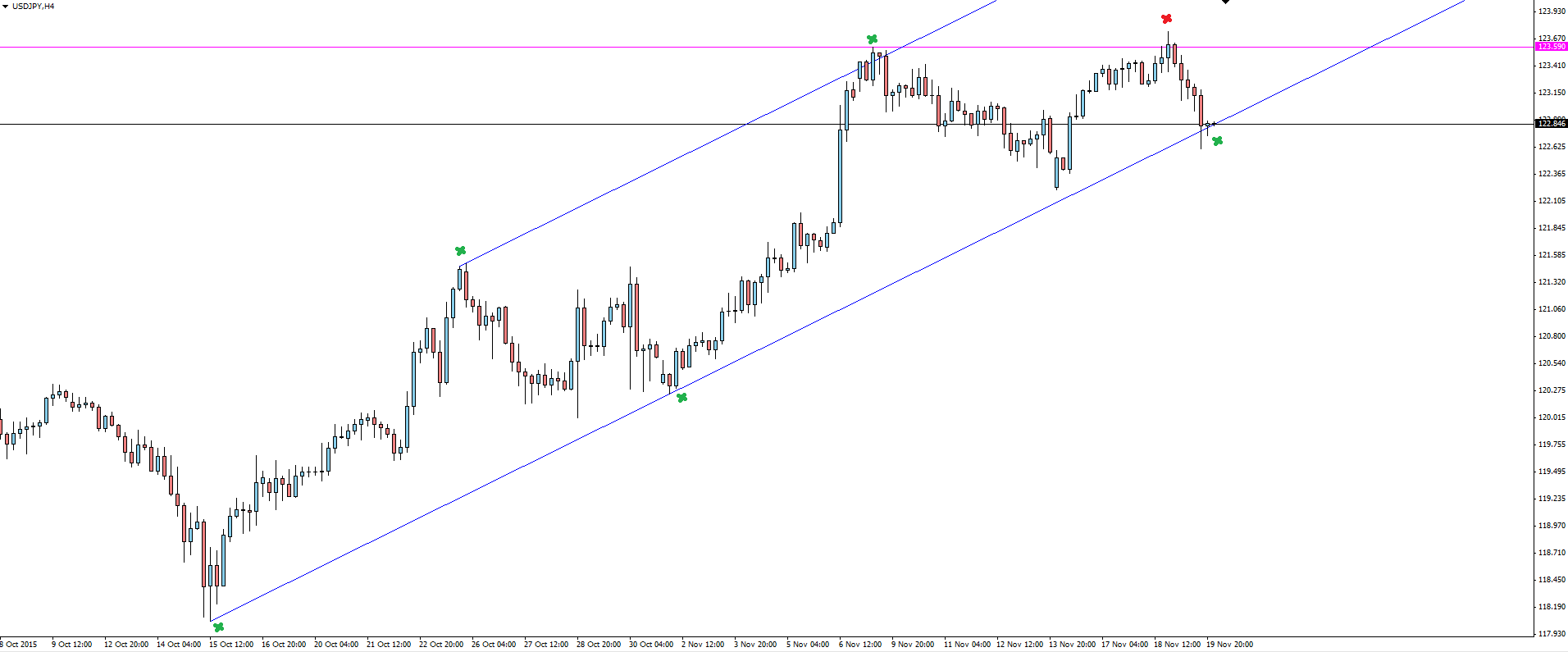

USD/JPY 4 Hourly:

Click on chart to see a larger view.

This was highlighted no better than in yesterday’s USD/JPY price action, as price pushed into resistance.

———

On the Calendar Friday

EUR: ECB President Draghi Speaks

CAD: Core CPI m/m

CAD: Core Retail Sales m/m

———-

Chart of the Day:

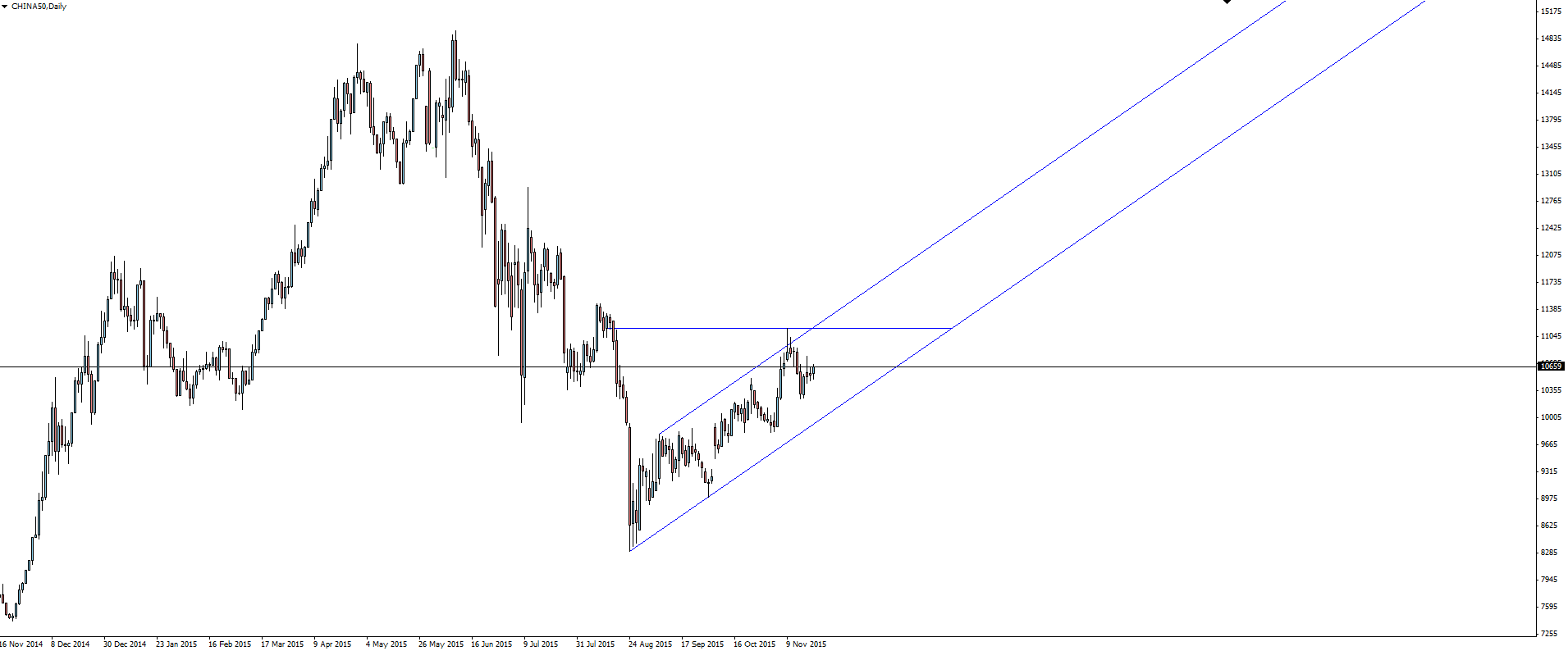

Today we take a look at the roller-coaster that is the China A50 Index.

CHINA50 Daily:

Click on chart to see a larger view.

After rallying into vertical bubble territory, the CHINA50’s burst has been nothing short of spectacular.

The last few weeks has seen a steady, short term channel form against the overall trend that looks like a flag pattern back into previous support now acting as resistance.

Is that a short?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by the winner of Forex awards Vantage FX Pty Ltd does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, Forex news, research, analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.