This week we are looking at another of the Investor’s Business Daily (IBD) Top 50 List companies. We use this list in one of our options portfolios to spot outperforming stocks and place option spreads that take advantage of the momentum.

While equity markets fell sharply in the past week, Square’s stock price enjoyed a boost from its positive earnings report. Check out what these analysts have to say about the stock – Square (NYSE:SQ) earnings net stock an upgrade as analyst sees huge market for Cash App and Better Buy: PayPal Holdings vs. Square.

Technicals

SQ has shown strength as a major horizontal level has come into play near $83 and the stock managed to close above it while the rest of the equity markets mostly posted notable losses in the past week. The upward momentum remains intact, mostly due to a strong earnings report. While above the $83 price point, this stock looks poised to make another run for all-time highs near the psychological $100 mark. SQ has traded in a range since 2019 and the bullish breach above $83 appears to be signaling a bullish breakout.

This price was $0.02 less than the mid-point of the option spread when SQ was trading near $83. Unless the stock rallies quickly from here, you should be able to get close to this amount.

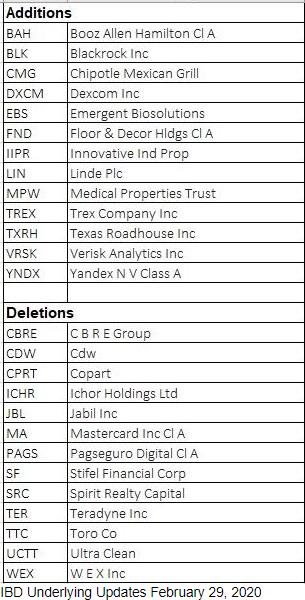

IBD Underlying Updates February 29, 2020

We have found that the Investor’s Business Daily Top 50 List has been a reliable source of stocks that are likely to move higher in the short run. Recent additions to the list might be particularly good choices for this strategy, and deletions might be good indicators for exiting a position that you might already have on that stock.

As with all investments, you should only make option trades with money that you can truly afford to lose.

Note: This article was written by Jignesh Davda for Terry’s Tips options newsletter. Terry’s Tips is an options newsletter which has run actual options portfolios for subscribers for 19 years. It is managed by Dr. Terry F. Allen, Harvard MBA and former seat-holder on the CBOE.