Square Inc. (NYSE:SQ) was upgraded by research analysts at Vetr from a "hold" rating to a "buy" rating in a research note issued to investors on Wednesday, MarketBeat.com reports. The firm presently has a $11.55 price objective on the stock. Vetr's price target would suggest a potential upside of 4.34% from the stock's current price.

Other analysts also recently issued reports about the stock. Goldman Sachs restated a "buy" rating and set a $15.00 price target on shares of Square in a research report on Thursday, August 4th. Compass Point boosted their price target on shares of Square from $13.00 to $14.00 and gave the stock a "buy" rating in a research report on Thursday, August 4th. BTIG Research set a $12.00 price target on shares of Square and gave the stock a "buy" rating in a research report on Wednesday, July 27th.

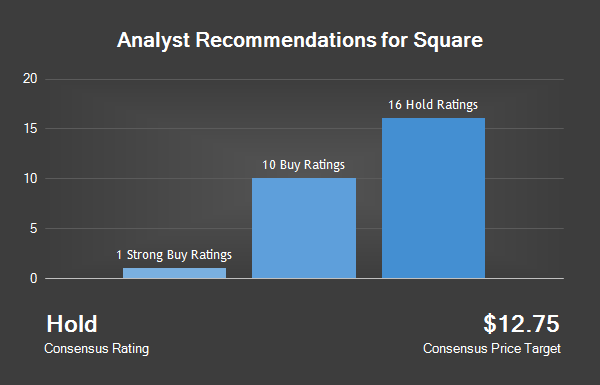

Mizuho reiterated a "buy" rating and issued a $16.00 target price on shares of Square in a report on Thursday, August 4th. Finally, RBC Capital Markets reiterated a "buy" rating on shares of Square in a report on Friday, August 5th. Sixteen equities research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has given a strong buy rating to the stock. The company presently has a consensus rating of "Hold" and a consensus target price of $12.71.

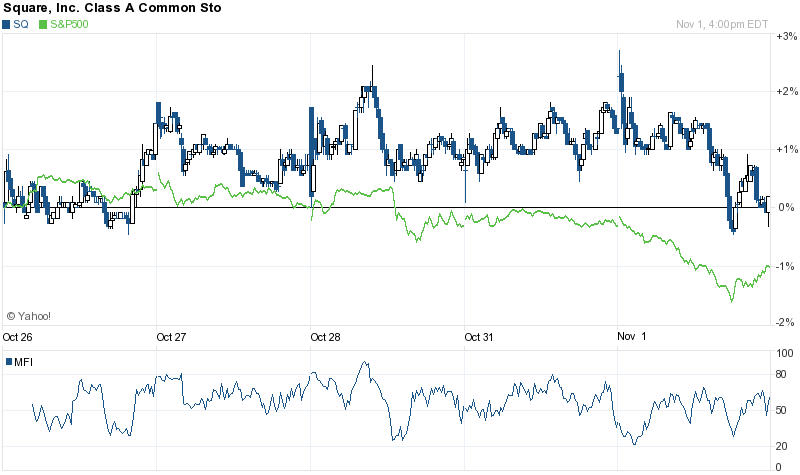

Square opened at 11.07 on Wednesday, MarketBeat.com reports. The stock's market capitalization is $3.78 billion. Square has a 12-month low of $8.06 and a 12-month high of $15.91. The company's 50-day moving average is $11.41 and its 200 day moving average is $10.85.

Square last released its quarterly earnings results on Tuesday, November 1st. The company reported ($0.09) EPS for the quarter, topping analysts' consensus estimates of ($0.11) by $0.02. Square had a negative net margin of 14.85% and a negative return on equity of 37.14%. The company had revenue of $439 million for the quarter, compared to the consensus estimate of $374.36 million. Square's revenue for the quarter was up 50.9% compared to the same quarter last year. On average, analysts predict that Square will post ($0.60) EPS for the current year.

In related news, insider Dana Wagner sold 50,000 shares of the company's stock in a transaction on Friday, August 5th. The shares were sold at an average price of $11.29, for a total transaction of $564,500.00. Following the completion of the transaction, the insider now directly owns 321,315 shares in the company, valued at approximately $3,627,646.35. The transaction was disclosed in a filing with the SEC, which is available through the SEC website.

Also, Director James Morgan Jr. Mckelvey sold 400,000 shares of the company's stock in a transaction on Tuesday, September 13th. The shares were sold at an average price of $11.27, for a total transaction of $4,508,000.00. Following the transaction, the director now owns 424,837 shares of the company's stock, valued at $4,787,912.99. The disclosure for this sale can be found here. Corporate insiders own 42.60% of the company's stock.

A number of institutional investors have recently added to or reduced their stakes in SQ. American Century Companies Inc. bought a new position in Square during the second quarter valued at approximately $183,000. Investment House LLC boosted its position in Square by 486.1% in the second quarter. Investment House LLC now owns 88,855 shares of the company's stock valued at $804,000 after buying an additional 73,695 shares during the last quarter.

Westwood Management Corp IL bought a new position in Square during the second quarter valued at approximately $362,000. Bollard Group LLC bought a new position in Square during the second quarter valued at approximately $1,810,000. Finally, Creative Planning boosted its position in Square by 76.2% in the second quarter. Creative Planning now owns 14,719 shares of the company's stock valued at $133,000 after buying an additional 6,365 shares during the last quarter. Hedge funds and other institutional investors own 16.97% of the company's stock.

About Square

Square, Inc enables payment processing, and also offers financial and marketing services. The Company provides sellers various tools to start, run, manage and grow their businesses. It serves sellers of all sizes, ranging from a single vendor at a farmers' market to multinational businesses. It serves as a payment service provider, acting as the touch point for the seller to the rest of the payment chain.