A Larger Company Circling Square For a Buyout?

Square Inc (NYSE:SQ).

As we have seen in the social media and social networking companies of late, rumors of buyouts and consolidation in the area are running rampant- seemingly almost every few days.

From Twitter Inc (NYSE:TWTR), Yelp Inc (NYSE:YELP), and of course the famous LinkedIn(NYSE:LNKD)-which was successfully acquired in a buyout recently, rumors have abounded. Most have not come to fruition, with the exception being Linked-in. Today added a new face in the mix. The name of the company is Square Inc.(SQ).

The company trades on the New York Stock Exchange under the ticker ticker symbol SQ. The company allows merchants, from a mobile setting application, to accept payments for products and services.

Recently they have branched out into making small business loans to qualified customers that they deal with.

The original idea for Square arose when a friend of Jack Dorsey (CEO of Square) named (Jim Mckelvey) was unable to accept a credit card payment for products and services he was selling to a customer in a mobile setting.

The reason why many traders and analysts feel Square may be being circled by a larger, better financed company arose today, April 12th, 2017 when some unusual options trades began to hit the tape in the reporting of options trades at the CBOE (Chicago Board Of Options).

Unusual Options Activity

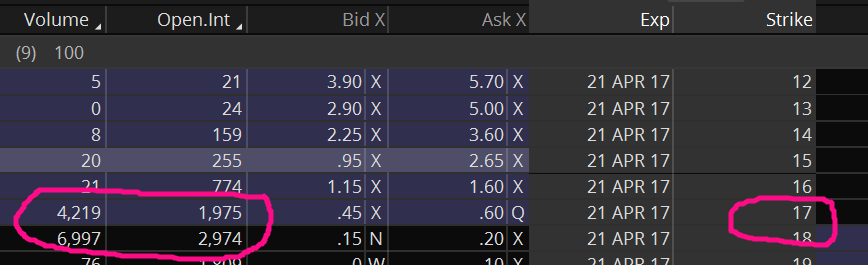

Below you will see some of these trades circled. Of note were the April 21 line $17 and $18 strikes. The volume was massive, Especially when compared to the open interest already existing.

It is trades and activity like this that usually occurs prior to some sort of major activity in the stock price. It does not always work out well for the traders and investors who follow along, but when it does it is a very lucrative trade or investment.

One of the companies cited as a possible suitor for a possible takeover is Visa Inc (NYSE:V). Visa has seen its own recent unusual option activity and when you consider today’s action in the options in Square it does seem that something may be brewing under the surface.

Other possible suitors of course are other companies in the credit card and mobile payment arenas-namely PayPal Holdings Inc (NASDAQ:PYPL), Verifone Systems Inc (NYSE:PAY), American Express, Inc.(NYSE:AXP).

Source For Options Data- ThinkorSwim Trading Platform

SQ Technicals

A look at the price chart below for Square Inc also shows some promising signs of a stock under accumulation and a possible imminent break out to the upside. Note the nearly solid green candle formed from today’s price action with the increased daily trading volume.

A solid green Japanese Candlestick usually indicates strong buying and bullish behavior going forward. It is what many technical analysts and stock traders look for when they are going to long a stock for a trade or an investment.

Also please see the red resistance line which the price has begun to attack and which will serve as some form of resistance as the stock price tries to get through that area.

However, the stock has the green support trend line just below, which some traders may use as an entry point if the price should come back a little bit from today’s move.

Company Profile

Square Inc. develops and provides payment processing, point-of-sale (POS), financial, and marketing services worldwide.

It provides Square Point of Sale, a POS application software that offers managed payments solutions and advanced software products, including Square Dashboard, a cloud-based reporting and analytics tool that provides sellers with real-time data and insights about sales, items, customers, and employees; Square Payroll, which empowers sellers to hire, onboard, and pay employees and the associated taxes; and customer engagement tools that help sellers to enhance their business through digital customer feedback, marketing, and loyalty programs.

The company also offers in-person/card present payments solutions, such as magstripe readers, contactless and chip readers, and chip card readers; and Square Stand that transforms an iPad into a POS terminal.

In addition, it provides online/card not present payments services through the Square Point of Sale mobile apps or Square Virtual Terminals; Square Invoices and Square Online Store for processing payments; Square Cash, a peer-to-peer payments service; Square Capital that facilitates loans to pre-qualified sellers based on real-time payment and POS data; and Caviar, a courier order management app that provides food delivery services for restaurants.

Further, the company offers gift cards, Square Appointments, Instant Deposit, employee management, and other subscription and services-based products. Its customers include retail, services, and food-related industries of various sizes ranging from a single vendor at a farmers’ market to multi-location businesses. Square, Inc. was founded in 2009 and is headquartered in San Francisco, California.