Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Looking toward deal execution

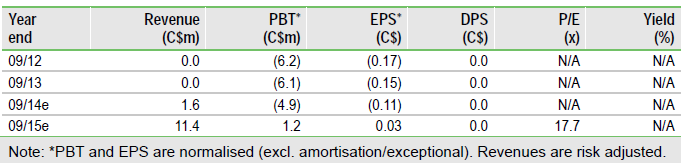

SQI designs and develops highly efficient and accurate immunological diagnostics. There are two main customers for these tests, pharma companies/CROs to analyse clinical trial data, and centralised diagnostics laboratories. Ongoing collaborations with Bristol-Myers Squibb (BMS) and Isis Pharmaceuticals, with multiple discussions in the pipeline, underscore the pharma customer opportunity. Delivering on existing contracts and securing new customers are key to SQI’s investment case. We value SQI at C$70m, or C$1.55/share, but a ~C$4m funding requirement is an overhang.

Demand for greater efficiency and accuracy

SQI’s Ig_PLEX technology is able to determine the fine detail of any immune response, particularly anti-drug antibodies (ADA), cytokines and antibodies associated with autoimmune diseases. A comprehensive diagnostic data set is of increasing importance to the FDA in its review of new drug applications, which is driving demand for more efficient (time/cost saving) and accurate diagnostic tools.

Focus on pharma customers

The BMS collaboration has provided important validation of SQI’s technology, with data showing that Ig_PLEX is twice as sensitive as current single-well assays and eight times more sensitive than its closest multiplex competitor. The Isis deal to develop a multiplexed assay, and further agreements with two (undisclosed) large pharma customers, highlight the commercial potential. SQI is primarily focused on delivering on its existing contracts and converting the sales pipeline (such as a scoped project with a biotech company) into fresh contracts.

To Read the Entire Report Please Click on the pdf File Below.