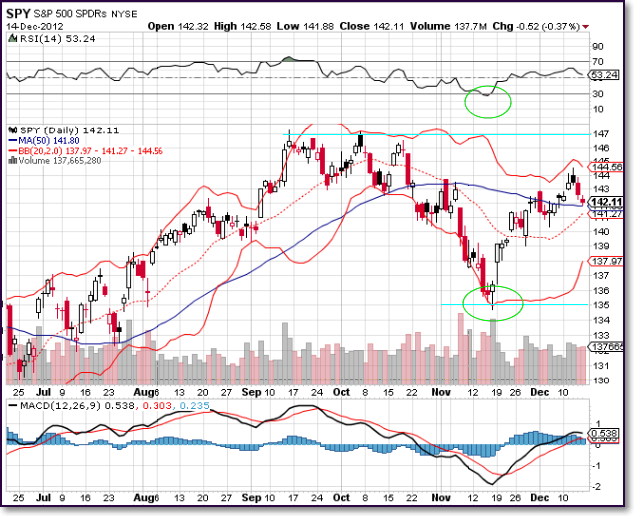

RSI- for the last three weeks, the SPY has gone up in value and as I observe the recent lows, I am noticing the lows have stayed above the '50' marker. This suggested strength in the move up and a possible continuation longer term. The present peak has plenty of room to move up.

Bollinger Bands- it looks like the stock is moving between the upper and lower Bollinger Bands in what may be the beginning of a longer term trading channel that could move from (135-147) or anywhere in between. That is one outlook. The present low at the middle band could also signify a stronger move up.

MACD- The MACD MA's look like the present peak and the pullback may not signal a long term pullback. The SPY dropped stepper than the MA's. It looks like the stock wants to move higher. The stock is still in the bullish range like the RSI is.

Current Events

"A lot of firms are saying to their trading desks, 'You can take days off for Christmas, but you are on standby to come in if anything happens.' This is certainly different from previous years, especially around this time of the year when things are supposed to be slowing down," said J.J. Kinahan, chief derivatives strategist at TD Ameritrade in Chicago.

"Next week is going to be a Capitol Hill-driven market."

Higher tax rates on capital gains and dividends are part of the automatic tax increases that will go into effect next year, if Congress and the White House don't come up with a solution to avert the fiscal cliff. That possibility could give investors an incentive to unload certain stocks in some tax-related selling by December 31.

The source said Obama sees the offer made on Friday by U.S. House Speaker John Boehner as a sign of progress, but simply believes it is not enough and there is much more to be worked out before Obama can reciprocate.

Tax rates and entitlements are the two most difficult issues in the so-far unproductive negotiations to avert the "fiscal cliff" of steep tax hikes and spending cuts set for the new year unless Congress and the president reach a deal to avoid them.

Boehner's shift did not come as a complete surprise. Recent polls have suggested little public support for his position and he has been getting pressure from Senate Republicans to be more flexible.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

SPY: Congress Will Influence The Markets This Week

Published 12/17/2012, 02:43 AM

Updated 07/09/2023, 06:31 AM

SPY: Congress Will Influence The Markets This Week

Technically Speaking

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.