Labor Day Weekend Special details at bottom.

Last month in this space my Monthly Macro Review/Preview had the monthly outlook suggesting that Gold (SPDR Gold Trust (ARCA:GLD)) and Copper (iPath DJ-UBS Copper Subindex TR (NYSE:JJC)) would continue to consolidate but with Copper biased higher and Gold possibly ready for the next leg down. US Treasuries (iShares Barclays 20+ Year Treasury (ARCA:TLT)) continued to look better to the upside as they consolidated and the US Dollar Index (PowerShares db USD Index Bullish (NYSE:UUP)) continued to underwhelm moving sideways. Crude Oil (United States Oil Fund (NYSE:USO)) was testing support so we were watching lower while Natural Gas (US Natural Gas Fund (ARCA:UNG)) continued to look better to the downside. The Shanghai Composite (iShares FTSE/Xinhua China 25 Index (ARCA:FXI)) was getting antsy in its recent consolidation with a short term upward bias while Emerging Markets looked like they might be tiring at resistance and the German DAX (iShare MSCI Germany (ARCA:EWG)) consolidated it moves higher. Volatility (Volatility S&P 500) looked like it may be ready to move up and up off of the long bottom but had yet to test upper levels and looked to remain relatively calm. With that backdrop the Equity Index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ) were mixed. The iShares Russell 2000 Index (ARCA:IWM) was the worst and was biased lower while the SPDR S&P 500 (ARCA:SPY) looked to consolidate the long run higher at best and possibly pullback a bit, while the QQQ looked strong like a freight train climbing a mountain. Use this information to understand the long term trends in Equities and their influencers as you prepare for the coming months. How does an additional month impact the longer term picture? Let’s look at some charts.

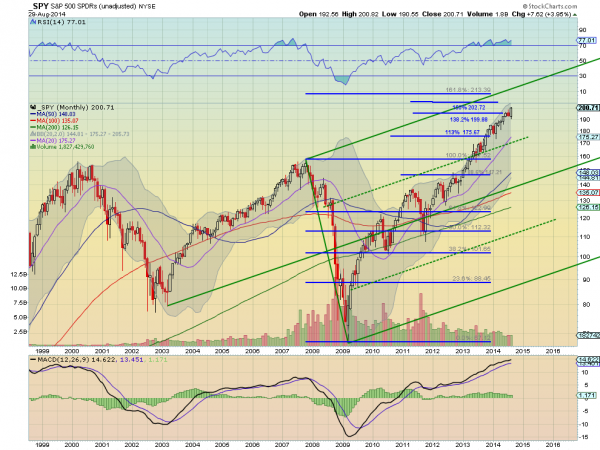

SPY, SPY

The SPY continued its march higher closing near the high of the month on the longest candle since February. The move puts the Upper Median Line of the Andrews’ Pitchfork firmly in the crosshairs. The MACD continues to run higher and the RSI is technically overbought, but has been moving sideways in a tight range since getting into that condition at the start of 2013. The round number at 200 may still hold on to the price for a while or act as a place to pullback to in the future, but the next Fibonacci extension at 202.72 and then 213.39 are upside targets. Support under 200 may come at 192.50 and 185. Continued Upward Price Action.

The monthly outlook going into September seems bright for equities. Elsewhere it suggests that Gold and Copper may see more sideways action in September. U.S. Treasuries look to continue higher and the US Dollar Index is showing short term signs higher looking to join them. Crude Oil is at risk of losing support lower while Natural Gas looks to have bounced and staved off any further downside for a while. The Shanghai Composite is heating up in its consolidation with an upward bias and Emerging Markets look to continue the move higher as the German DAX looks ready to rebound higher. Volatility of volatility is picking up but still looks to remain at low levels. With that backdrop, the Equity Index ETF’s SPY, IWM and QQQ are set up to continue higher in the coming months. The charts of the SPY and QQQ are showing it and look strong while the IWM continues to be in a range, but not giving up any ground. Use this information to understand the long term trends in Equities and their influencers as you prepare for the coming months.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.