Last week’s review of the macro market indicators suggested, heading into February the equity markets were all moving together and looked better lower. It looked for Gold (GLD) to consolidate and possibly reverse lower while Crude Oil (USO) continued its rise. The US Dollar Index (UUP) looked better to the upside while US Treasuries (TLT) remained biased higher with significant resistance nearby. The Shanghai Composite (SSEC) looked to be consolidating and ready to move higher while Emerging Markets (EEM) were also consolidating but with a downside bias. Volatility (VIX) looked to remain low but creeping up to important levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, but with very little strength. Their charts showed that the SPY was the weakest and looked to continue lower while the IWM was next and then the QQQ the strongest, but only looking at best to consolidate and likely to pullback too.

The week played out with Gold moving higher in the recent range while Crude Oil continued in its range until jumping Friday. The US Dollar held at its highs from last week before dropping to end the week while Treasuries found that resistance and got pushed back down. The Shanghai Composite was closed except for Friday and should have stayed closed then while Emerging Markets made a new low Monday and bounced from there. Volatility ended its move higher Monday and dropped throughout the week. The Equity Index ETF’s took their time finding a bottom after the VIX pop and all turned back higher Thursday and Friday, with the IWM lagging the SPY and QQQ. What does this mean for the coming week? Lets look at some charts.

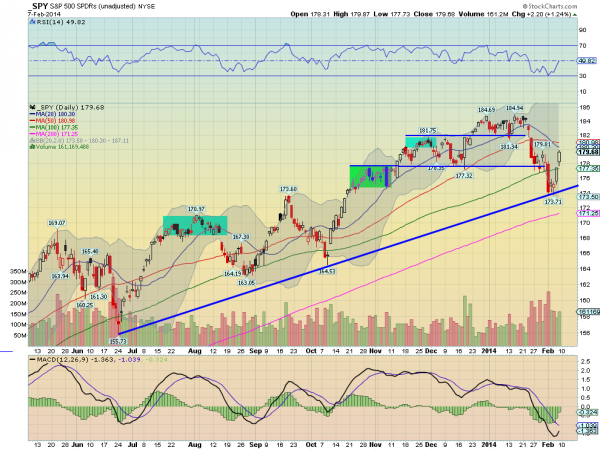

SPY Daily, SPY

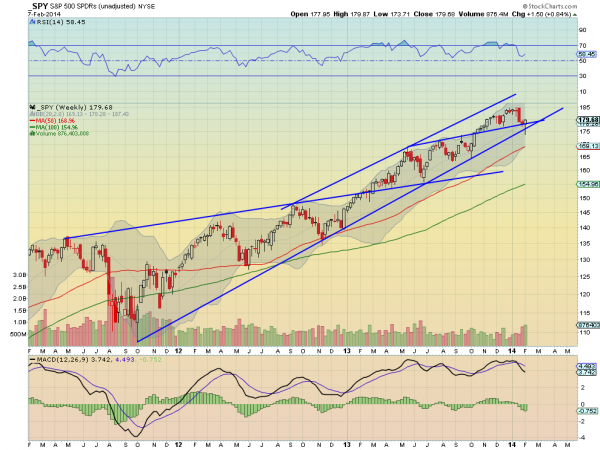

SPY Weekly, SPY

The SPY moved hard to the downside with a bearish Marubozu candle Monday, stopping right at the rising trend support line. The Marubozu did not pan out as the price consolidated with two doji candles, signaling indecision, and in this case a reversal that ended the week higher. The gaps give a little caution, a sign of chasing, as does the failure at this point to retake the 50 day SMA. This caution does not mean to avoid the market. Broadly the SPY made a higher low and has a Measured Move higher now to 193.75. It looks better to the upside in this timeframe with a RSI that is pushing on the mid line and a MACD that is curling up, near a cross. It will give a lot more confidence to the bulls if it can close over 181.80 again. On the weekly chart the Hammer is a potential reversal candle, and held over the rising trendline support. The RSI on this timeframe is also turned back higher leaving only the MACD pointing lower. There is resistance nearby and then 180.50 and 181.80 followed by 183 and 185. Support lower comes at 177.60 and 175 followed by 173.60-173.75. Continued Upward Price Action with Caution.

Heading into next week the markets are giving a sigh of relief but not as strong as they could be. Look for Gold to continue to consolidate with a slight upward bias while Crude Oil continues higher. The US Dollar Index seems content to continue to move sideways while US Treasuries are biased higher in the very short term in their broad consolidation. The Shanghai Composite and Emerging Markets are biased to the upside with the Emerging Markets warranting some caution initially. Volatility looks to remain subdued and biased lower adding a breeze to the backs of the equity index ETF’s SPY, IWM and QQQ. Their charts show a desire for some short term caution to prove the recent moves hold, although the tone is bullish. The QQQ looks the strongest followed by the SPY and then the IWM. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.