Last week’s review of the macro market indicators suggested, coming out of the Thanksgiving holiday the markets looked set up for a run higher into the end of the year. Gold (GLD) looked higher in its neutral trend while Crude Oil (USO) was set to head higher. The US Dollar Index (UUP) appeared biased lower while US Treasurys (TLT) also looked better lower. The Shanghai Composite (SSEC) was biased lower but mindful of a possible double bottom, while Emerging Markets (EEM) resumed their consolidation under long-term resistance.

Volatility (VIX) looked to remain subdued keeping the bias higher for the equity index ETF’s (SPY), (IWM), and (QQQ) and their charts seemed to agree, with the lone caution being the recent move higher was on decreasing holiday week volume. Let price guide not volume.

The week played out with Gold getting hit instead while Crude Oil stayed in its narrow range. The US dollar did move lower finding a floor near 80 while Treasurys consolidated at a slightly higher level. The Shanghai Composite took the next step lower while Emerging Markets moved toward the top of their range and the Volatility Index tested the floor again. The Equity Index ETF’s all moved higher before leveling and giving back a little on Friday. What does this mean for the coming week? Let's look at some charts.

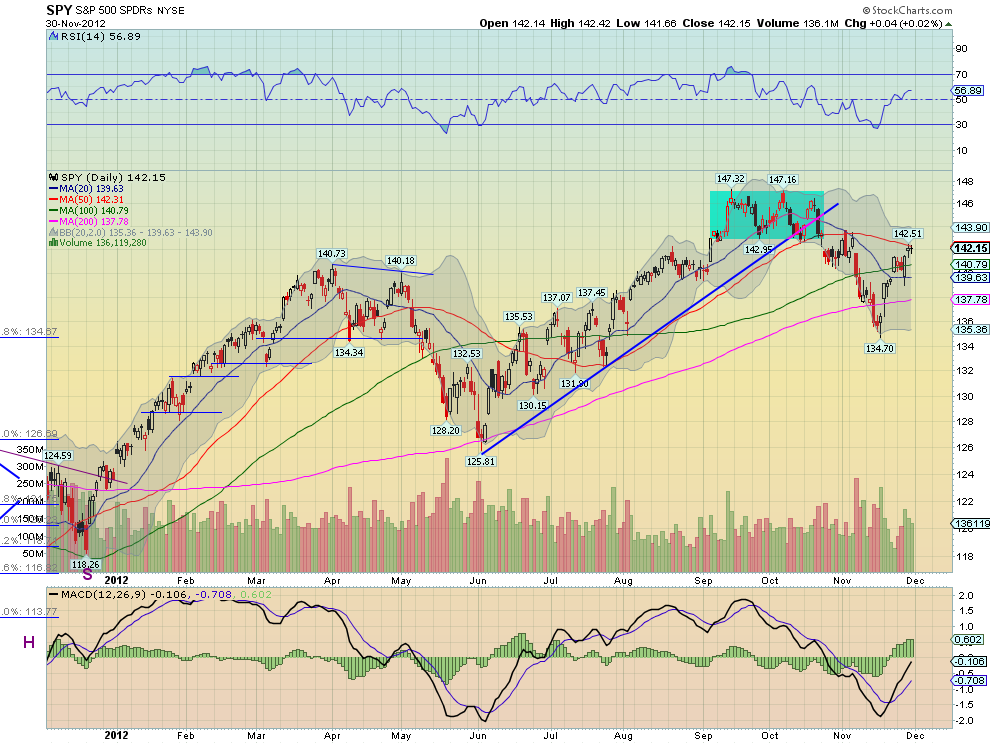

SPY Daily (SPY)

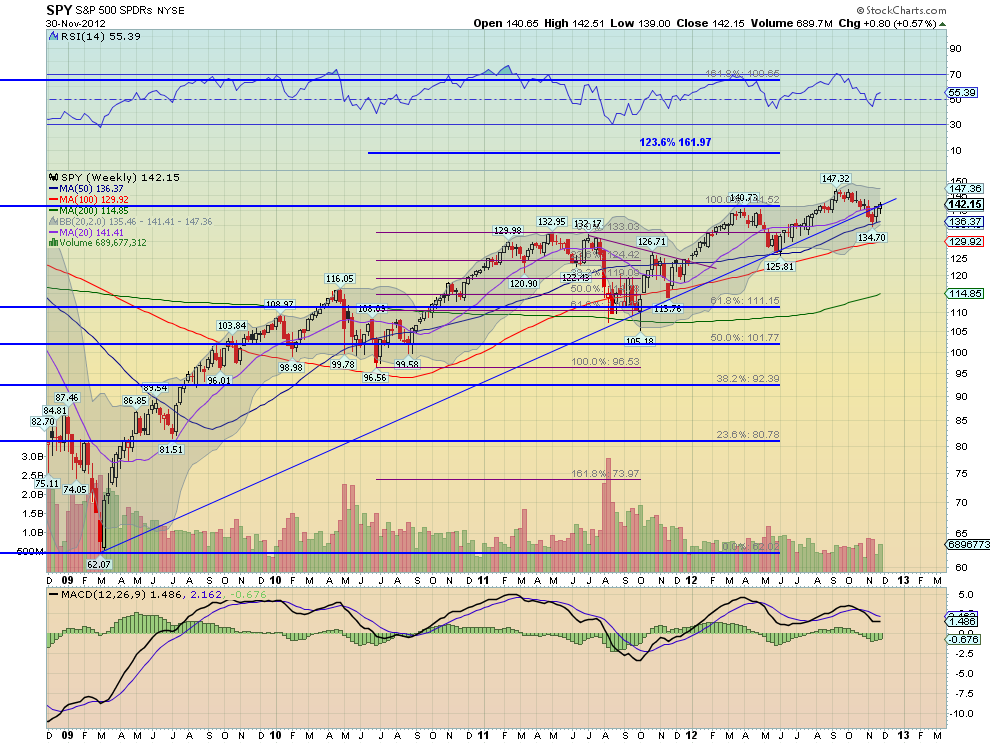

SPY Weekly (SPY)

The SPY moved higher finishing the week at the 50-day SMA printing an Evening Star followed by a tighter Doji. Signs of a reversal IF confirmed lower. The RSI though is moving higher and on the verge of turning into bullish territory with a MACD that is positive and growing. Perhaps a consolidation instead of a reversal.

The weekly view shows a move back over the rising trend resistance with a rising RSI and a MACD that is improving towards a bullish cross. The RSI triple bottom looking more solid. Resistance higher comes at 143.20 and 147.25. Over that the uptrend strengthens with a target of 156.21 on a Measured Move higher. Support lower is found at 139.80 followed by 137.75 and 135.60. Under that and the downtrend continues.

Uptrend with a Chance of Consolidation.

Heading into December the markets are biased higher but cautiously so. Gold looks headed lower in its long term channel while Crude Oil heads higher. The US Dollar Index seems content to move lower while US Treasurys are biased lower but may continue to consolidate. The Shanghai Composite is marching lower while Emerging Markets stagnate in their consolidation zone. Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are starting to show signs of being tired though, so caution is warranted on the long side in the near-term. Use this information as you prepare for the coming week and trade’m well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

SPY Trends And Influencers: December 1, 2012

Published 12/02/2012, 12:58 AM

Updated 05/14/2017, 06:45 AM

SPY Trends And Influencers: December 1, 2012

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.