Last week’s review of the macro market indicators suggested, heading into the new Quarter look for Gold ($GLD) to consolidate or pullback in its neutral channel while Crude Oil ($USO) continues to March higher. The U.S. Dollar Index ($UUP) seems content to move sideways, while U.S. Treasuries ($TLT) consolidate and are biased lower. The Shanghai Composite ($SSEC) looks sick, while Emerging Markets ($EEM) are biased to the upside in the short run at support. Volatility ($VIX) looks to remain subdued keeping the bias higher for the equity index ETF’s $SPY, $IWM and $QQQ, despite the new highs created recently. The QQQ looks the best on a longer scale while the SPY is better very short term.

The week played out with Gold continuing lower and finding long term support, while Crude Oil put in a short term top and pulled back. The U.S. Dollar did continue sideways with a downward drift ,while Treasuries broke their consolidation, but to the upside. The Shanghai Composite consolidated the move lower while Emerging Markets gave up their gains rolling over. Volatility bounced off of the lows, but remained subdued and near resistance. In the Equity Index ETF’s the SPY made new multi-year highs, and the QQQ 6 month highs before giving back some ground late in the week. The IWM continued its pullback.

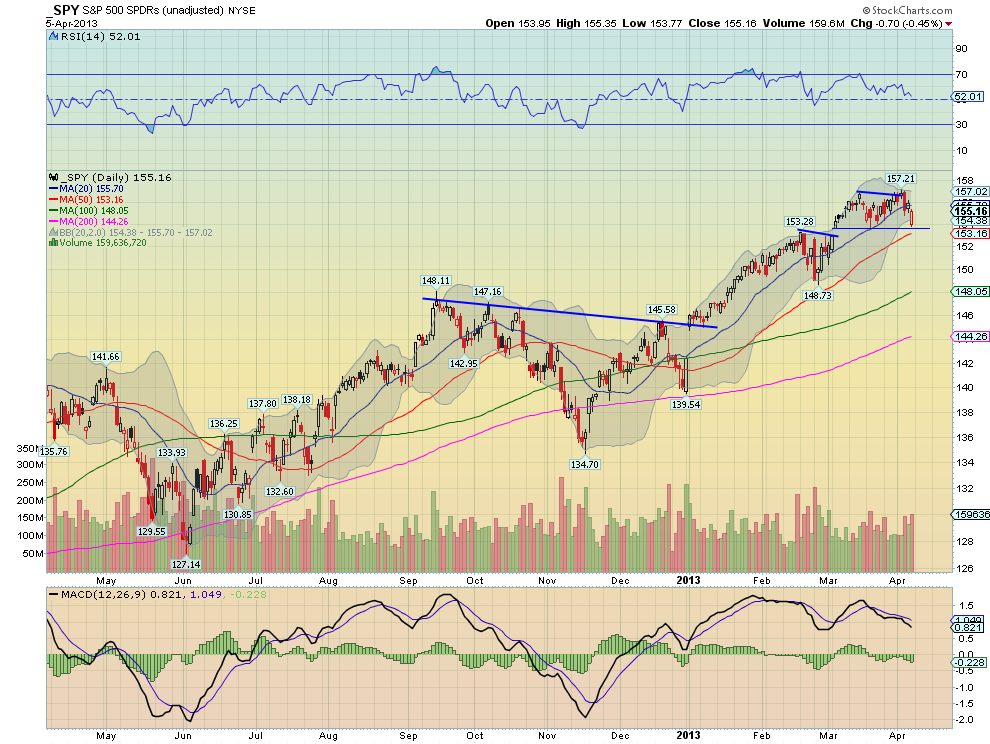

SPY Daily, SPY

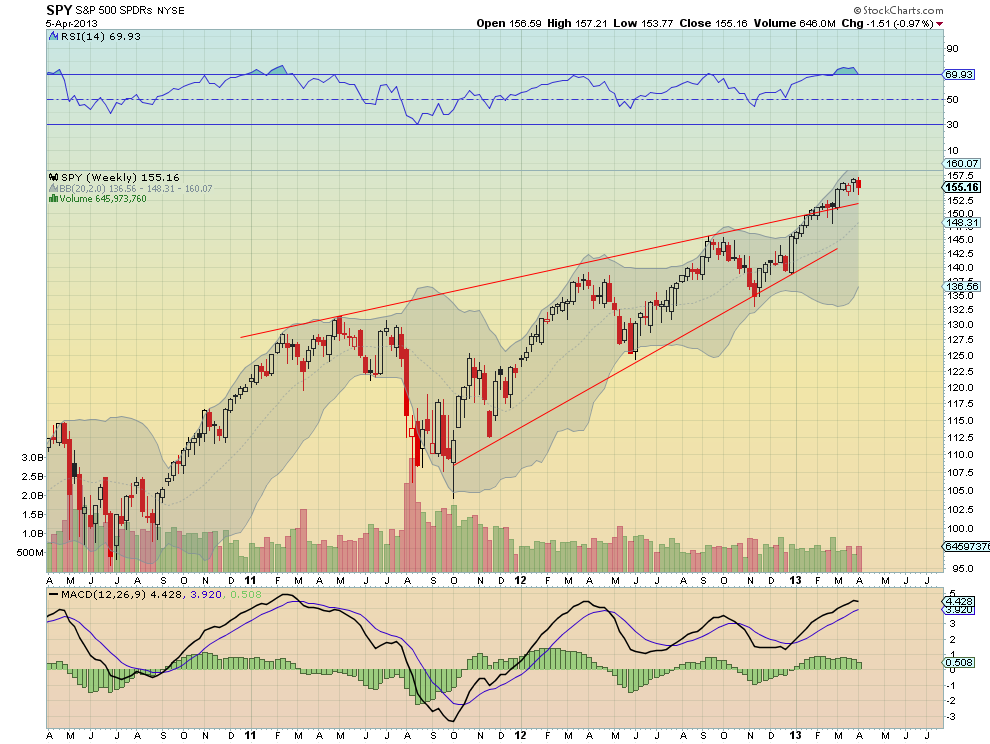

SPY Weekly, SPY

The SPY made a new intraday high Tuesday, just below the all time high at 157.52, before pulling back to support Friday at 153.50. The Hollow Red candle Friday shows a strong intraday trend higher, that closed the gap down to start the day. The Relative Strength index (RSI) on the daily chart is trending lower, but remains in bullish territory. The Moving Average convergence Divergence indicator (MACD) is continuing to move lower on the signal line and histogram on the daily chart. Downside risk remains. The weekly picture shows continued consolidation after the move higher off of the wedge break out, allowing the RSI to work off a technically overbought condition. The MACD is leveling on this timeframe, suggesting that any rollover in it may bring the price down. Support comes at 150 below, and resistance is found higher at 156.80 and 157.52. Continued Broad Consolidation with a Chance of a Pullback.

Heading into next week, the markets are decidedly weaker but not giving up . Look for Gold to continue to bounce toward 1600 while Crude Oil moves higher in its triangle consolidation. The U.S. Dollar Index looks to pullback in the uptrend, while U.S. Treasuries are back in the consolidation zone and biased higher. The Shanghai Composite and Emerging Markets remain biased to the downside. Volatility looks to remain contained, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. They all look better to the downside on a very short term basis, with the QQQ is the strongest on the weekly timeframe. Use this information as you prepare for the coming week and trad’em well.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

SPY Trends And Influencers: April 6, 2013

Published 04/06/2013, 03:29 AM

Updated 05/14/2017, 06:45 AM

SPY Trends And Influencers: April 6, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.