Last week’s review of the macro market indicators saw, with 1 trading day left in the 3rd Quarter, equities were continuing to give no strong preference for direction but were continuing to weather the headlines. Elsewhere looked for Gold ($GLD) to consolidate around 1500 while Crude Oil ($USO) pulled back in consolidation. The US Dollar Index ($DXY) was rising in a channel while US Treasuries ($TLT) paused in their bounce.

The Shanghai Composite ($ASHR) and Emerging Markets ($EEM) both looked to continue lower. Volatility ($VXXB) had built up and looked poised to continue changing the bias to lower for the equity index ETF’s $SPY, $IWM and $QQQ. The SPY and QQQ looked to continue to consolidate near all-time highs while the IWM continued to churn in a wide consolidation as well, but further from its highs.

The week played out with Gold starting lower but then recovering to end back near 1500 while Crude Oil finally found support and bounced at the end of the week. The US Dollar found resistance at a higher high and pulled back while Treasuries moved higher. The Shanghai Composite dropped Monday and then was closed for the rest of the week while Emerging Markets found support mid-week and bounced.

Volatility ticked up early and then reversed much of the gain late in the week, mimicking the chop in equities. The Equity Index ETF’s took a nose dive Tuesday through Thursday after a small uptick to start the week. With a recovery Thursday and follow through Friday they remained lower on the week but significantly off the bottom. What does this mean for the coming week? Let’s look at some charts.

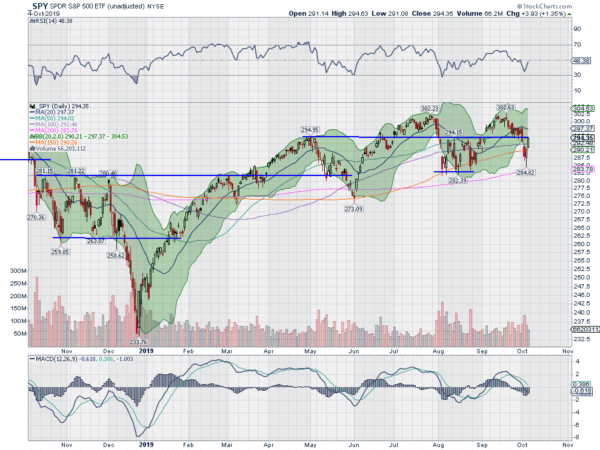

SPY Daily, $SPY

The SPY was holding over the 50 day SMA after a pullback from the all-time high as the week began. It held there Monday but dropped further Tuesday and added to the downside Wednesday. Thursday started lower and then had a strong turn around with good follow through Friday. It ended the week back at the 50 day SMA and at what has been important resistance and support since April, down slightly.

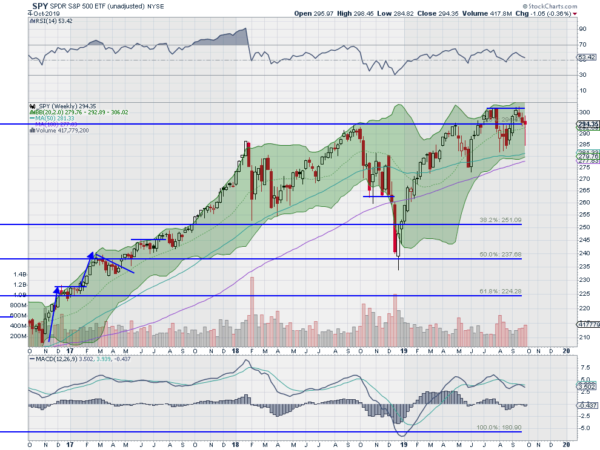

The daily chart shows the gaps created in August and September filled as well as the one created this week. The RSI is moving back higher and the MACD leveling and slightly negative. Price is also back inside the Bollinger Bands®. On the weekly chart a Hammer with a long lower shadow holds at the prior support.

Confirmation with a move higher next week would signal a push back to the highs at least. The RSI is drawing toward the mid line with the MACD moving lower but positive. There is resistance above at 296.50 and 298.80 then 300 and 301 before 302 and 302.50. Support lower comes at 294 and 292 then 290 and 287 before 285 and 284. Short Term Reversal Higher.

SPY Weekly, $SPY

With the third quarter in the books equity markets saw a rocky start to October but a strong finish on the week. Elsewhere look for Gold to consolidate around 1500 while Crude Oil bounces in the downtrend. The US Dollar Index continues the drift to the upside while US Treasuries drive back towards their all-time highs. The Shanghai Composite looks to come back from holiday biased lower and Emerging Markets have reversed to the upside in the short term.

A Volatility spike has eased and looks to continue lower, shifting the bias to higher for the equity index ETF’s SPY, IWM and QQQ. The SPY and QQQ reversed drops to close with strong momentum over support while the IWM held and bounced at the bottom of its wide consolidation range. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.