Last week’s review of the macro market indicators saw, heading into September Options Expiration and the FOMC meeting, that the equity markets were showing strength, but building that wall of worry as they sat at prior highs, not breaking through them. Elsewhere looked for Gold ($GLD) to pullback in its uptrend while Crude Oil ($USO) consolidated in the drift lower. The US Dollar Index ($DXY) continued to drift to the upside while ($TLT) continued lower.

The Shanghai Composite ($ASHR) was pausing in its new move higher while Emerging Markets ($EEM) looked to continue higher. Volatility ($VXXB) continued to remain very low keeping the bias to the upside for the equity index ETF’s $SPY, $IWM and $QQQ. The SPY and QQQ both sat on the cusp of new all-time highs after touching their tops but recoiling. The IWM also showed promise at the top of its long consolidation range.

The week played out with Gold bouncing around in a $10 range around 1500 while Crude Oil gapped higher and then settled into support, also holding a tight range. The US Dollar held in a tight range as well slightly higher in the drift while Treasuries found support and bounced. The Shanghai Composite fell back to the round number, 3000, and found support while Emerging Markets digested the recent move up.

Volatility took an uptick early but fell back, all within a tight range at low levels, keeping the wind at the back of equities. The Equity Index ETF’s were split with the SPY and QQQ starting the week gapping lower but then recovering Wednesday. The IWM held on for one more day before it too gapped down and recovered. They all moved higher Thursday and then gave it back Friday to end the week slightly lower. What does this mean for the coming week? Let’s look at some charts.

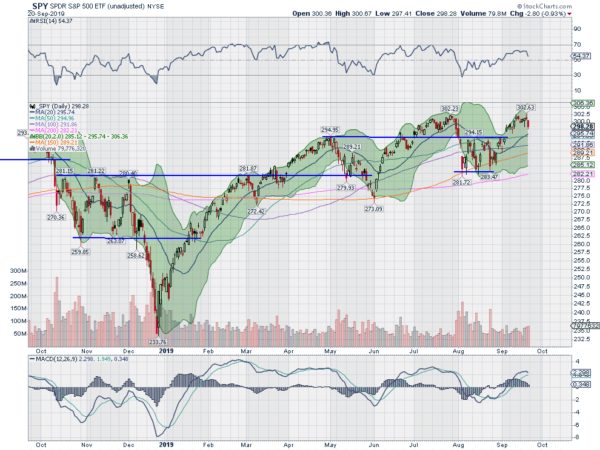

SPY Daily, $SPY

The SPY came into the week retesting the July highs. Monday saw a small pullback that closed a gap and it held up through Wednesday and the September FOMC meeting. Thursday saw a slight move lower with follow-through Friday. It ended the week down a little over 1% from the all-time highs.

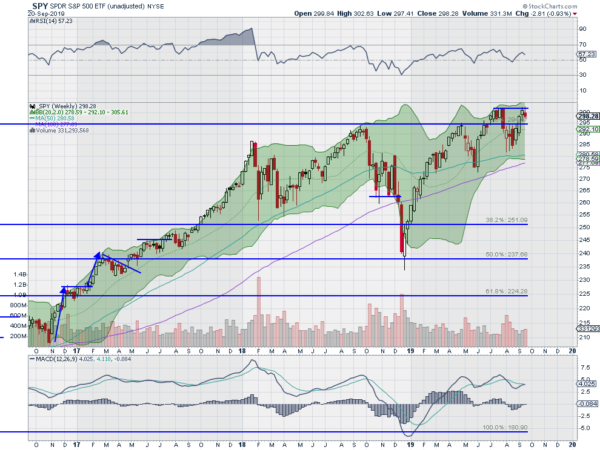

The daily chart shows the bull flag building at the highs. The Bollinger Bands® continue to point higher. The RSI is pulling back slightly in the bullish zone with the MACD rolling to cross down. Note there is an open gap not far below to 294. The weekly chart shows the price holding over the April and September 2018 highs and stalling at the retest of the all-time high.

The RSI is kinking down in the bullish zone with the MACD trying to cross up. There is resistance at 298.80 and 300 then 301 and 302 before 302.50. Support lower comes at 296.50 and 294 then 292 and 290. Consolidation in Uptrend.

SPY Weekly, $SPY

With the September FOMC and Quadruple Witching behind, equity markets held up well until more trade issues Friday. Even so, the declines were minor as the index ETF’s hold near their all-time highs. Elsewhere look for Gold to stall at 1500 while Crude Oil consolidates. The US Dollar Index is still drifting to the upside while US Treasuries bounced in their downtrend. The Shanghai Composite is consolidating the short term move higher with Emerging Markets stalling in their short term rise.

Volatility looks to remain very low but has stopped dropping changing the bias to neutral for the equity index ETF’s SPY, IWM and QQQ. The SPY and QQQ both continue to hold near their all-time highs with strong longer-term charts while the IWM is holding at the top of the 2019 wide consolidation zone. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.