SPY Trends And Influencers March 9, 2019

As the calendar turned to March, the equity markets continued to roar like a lion and market participants continued to look for reasons to sell. Elsewhere looked for Gold ($GLD) to continue its recent pullback while Crude Oil ($USO) stalled in its uptrend. The US Dollar Index ($DXY) remained in broad consolidation while US Treasuries ($TLT) were trending lower in the short term. The Shanghai Composite ($ASHR) and Emerging Markets ($EEM) remained in uptrends, but with Emerging Markets consolidating the move.

Volatility ($VXXB) looked to remain very low keeping the bias higher for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts all experienced consolidation during the week at key levels on the short time frame, a healthy pause. On the longer timeframe possible reversal candles looked to the week to see if confirmation of long term uptrends would be given or rather a reversal confirmation at a lower high.

The week played out with Gold continuing lower Monday to support and holding there with a spurt higher Friday while Crude Oil Also fell Monday and settled but ended the week with a V dip. The US Dollar rose all week and Treasuries followed it higher. The Shanghai Composite soared all week until a massive pullback Friday reversed it all while Emerging Markets fell after an early move to the upside.

Volatility slowly walked higher all week, ending at a 1 month high, and changing the bias to lower for equities along the way. The Equity Index ETF’s reacted by pulling back from resistance after a long streak to the upside. What does this mean for the coming week? Let’s look at some charts.

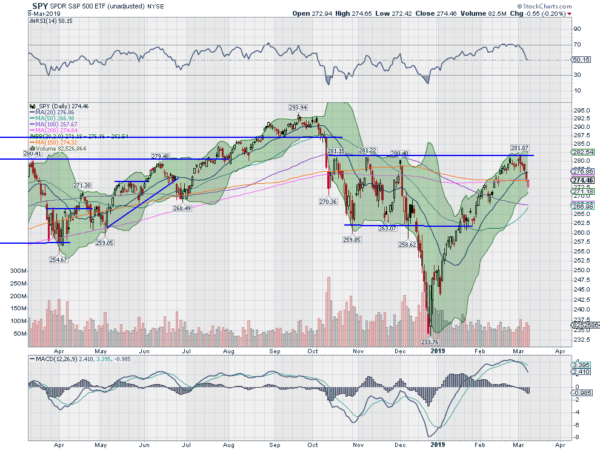

SPY Daily, $SPY

The SPY came into the week at the top of the channel that held it from October to December and waning momentum. And after the long ride higher from the late December low it reversed lower, dropping all 5 days this week. The silver lining might be the intraday price action on Friday which saw buyers come in to close at the high and print a bullish Hollow Red candle.

The daily chart shows it closing just below the 200-day SMA and continuation up Monday would create a higher low from the February low. The RSI has pulled back to the midline from overbought and the MACD is crossed down and falling, but positive. There is also some room still to the lower Bollinger Band®. A touch there would close the February 12 gap.

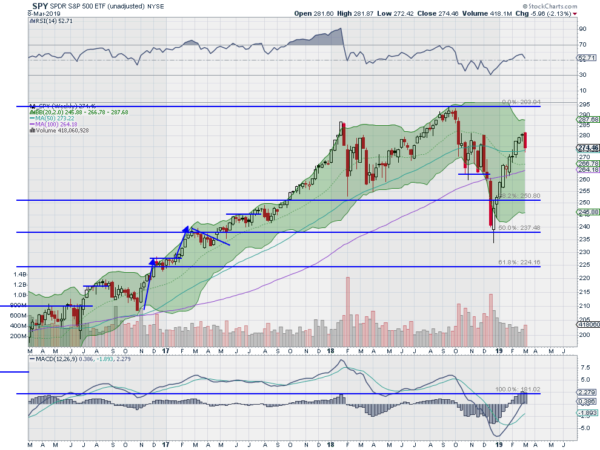

The weekly chart shows the pullback finding support at the 50 week SMA. The RSI is turning back to the midline with the MACD rising and now positive. There is support at 272.50 and 271.40 then 269 and 265. Resistance above 274.50 comes at 277.50 and 279 then 280 and 282 before 284. Pullback in Uptrend.

SPY Weekly, $SPY

Heading into March Options Expiration week the equity markets have finally taken a rest, and are digesting the strong moves from the Christmas Eve low. Elsewhere look for Gold to pull back in its uptrend while Crude Oil marks time moving sideways. The US Dollar Index continues in broad consolidation but with a possible bullish reversal building while US Treasuries move higher in broad consolidation. The Shanghai Composite is making a digestive move in its uptrend while Emerging Markets are pulling back and possibly reversing lower.

Volatility looks to remain low but rising from extremes shifting the bias to lower for the equity index ETF’s SPY, IWM and QQQ. Their charts all confirmed reversal patterns on the weekly timeframe and their first 5 day moves lower on the daily timeframe. No major damage to the uptrend has been done at this point. Use this information as you prepare for the coming week and trad’em well.

Disclaimer:

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.