SPY Trends And Influencers March 2, 2019

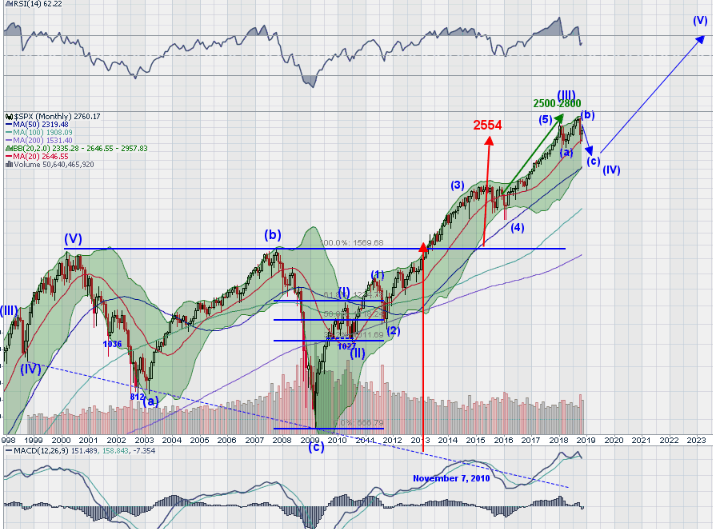

Last week’s review of the macro market indicators noted heading into the last week of February that equity markets continued to look strong but also continued to remain below an all-clear level. Elsewhere looked for Gold ($GLD) to pause in its uptrend while Crude Oil ($USO) resumed the path higher. The U.S. Dollar Index ($DXY) looked to continue to move sideways while U.S. Treasuries ($TLT) were consolidating at resistance.

The Shanghai Composite ($ASHR) and Emerging Markets ($EEM) were continuing their trends higher. Volatility ($VXXB) looked to remain very low keeping the bias higher for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts were looking a little extended but strong on the shorter timeframe, and remained very strong on the longer timeframe.

The week played out with Gold pausing and then falling back while Crude Oil took a header Monday and then recovered before another stumble Friday. The U.S. Dollar found support at a higher low in consolidation while Treasuries saw distribution midweek accelerate into Friday. The Shanghai Composite held at the big round number 3000 while Emerging Markets pulled back from a higher high.

Volatility held in a tight range in the low teens, keeping the bias higher for equities. The Equity Index ETF’s all met short term resistance Monday and made shallow pull backs. The IWM and QQQ held around their 200 day SMA’s while the SPY remained at the top of the October through December range. What does this mean for the coming week? Let’s look at some charts.

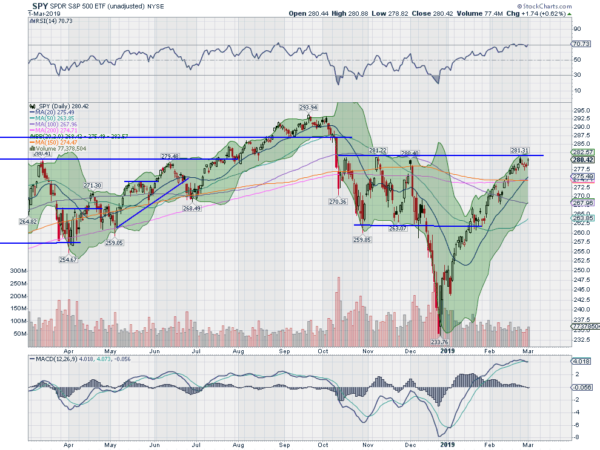

SPY Daily, $SPY

The SPY was just short of the top of the consolidation range that held from October through to early December when the week started. It jumped up to touch it Monday and then pulled back slightly and consolidated the rest of the week. It has spent more than two full weeks back above the 200-day SMA now. But it also is yet to make a higher high and confirm a reversal.

The daily chart shows that the RSI is running sideways along the border between strong bull and overbought. The MACD is flat and looking like it may cross down. The Bollinger Bands® continue to point higher. In all a strong move and chart just missing that final piece of confirmation.

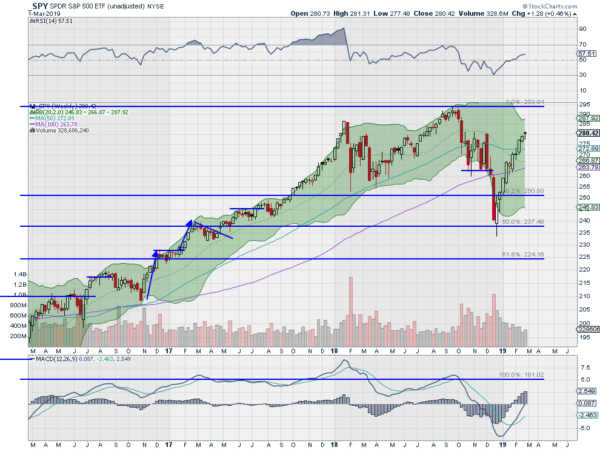

The weekly chart shows a 5th straight week of closing higher, this time with a Hanging Man candle. A drop next week would confirm a top. That is not a given though as we have seen possible reversal candles 2 other times in the move higher from December. The RSI is still shy of a move over 60, my mark of a bullish shift, with the MACD rising and now positive. There is resistance at 282 and 284 then 285 and 287.50. Support lower comes at 280 and 279 then 277.50 and 274.50 before 272.50. Pause in Uptrend.

SPY Weekly, $SPY

As the calendar turns to March the equity markets continue to roar like a lion while market participants continue to look for reasons to sell. Elsewhere look for Gold to continue its recent pullback while Crude Oil stalls in its uptrend. The U.S. Dollar Index remains in broad consolidation while U.S. Treasuries are trending lower in the short term. The Shanghai Composite and Emerging Markets remain in uptrends, but with Emerging Markets consolidating the move.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all experienced consolidation this week at key levels on the short time frame, a healthy pause. On the longer timeframe, possible reversal candles will look to next week to see if confirmation of long term uptrends is given or reversal confirmation at a lower high. Use this information as you prepare for the coming week and trade them well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.