SPY Trends And Influencers March 16, 2019

Last week’s review of the macro market indicators noted heading into March Options Expiration week the equity markets had finally taken a rest and were digesting the strong moves from the Christmas Eve low. Elsewhere looked for Gold ($GLD) to pullback in its uptrend while Crude Oil ($USO) marked time moving sideways. The US Dollar Index ($DXY) continued in broad consolidation but with a possible bullish reversal building while US Treasuries ($TLT) moved higher in broad consolidation.

The Shanghai Composite ($ASHR) was making a digestive move in its uptrend while Emerging Markets ($EEM) were pulling back and possibly reversing lower. Volatility ($VXXB) looked to remain low but rising from extremes, shifting the bias to lower for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts all confirmed reversal patterns on the weekly timeframe and their first 5 day moves lower on the daily timeframe. Still, no major damage to the uptrend had been done at this point.

The week played out with Gold trying to move higher and then falling back but ending with a bounce while Crude Oil turned to the upside and ran to resistance. The US Dollar pulled back from recent highs while Treasuries held in a tight range under resistance. The Shanghai Composite continues to struggle to create separation from the 3000 level while Emerging Markets found support and moved higher.

Volatility moved back into the low teens, shifting the bias higher for equities. The Equity Index ETF’s reacted by moving higher early in the week and then consolidated the gain. The SPY (NYSE:SPY) and QQQ are now at 5 month highs. The IWM remains off of its recent high but is now rising again. What does this mean for the coming week? Let’s look at some charts.

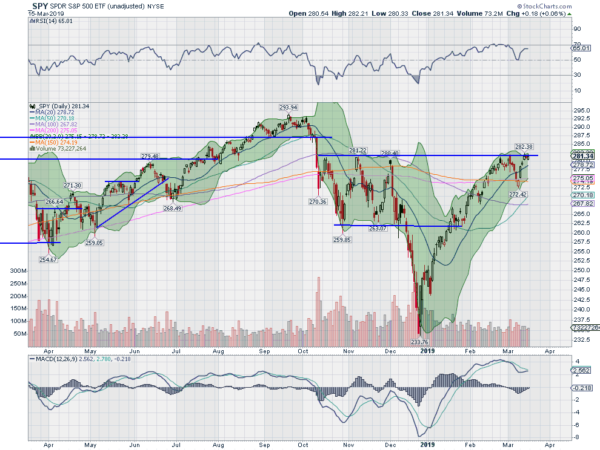

SPY Daily, $SPY

The SPY had found support in a pullback, on its first attempt to move over the October through December consolidation, as the week began. It continued higher through Wednesday, when it closed at a new 5 month high, and then stalled the rest of the week.

The daily chart shows the Bollinger Bands® have squeezed during this 3 day consolidation. The RSI is holding in the bullish zone at a slightly lower high with the MACD level after resetting lower. A quick move back to the prior high with good support for more, but with some topping upper shadows.

The weekly chart shows an inside real body holding over the 50 week SMA. The RSI is holding under 60 with the MACD crossed up and now positive. There is resistance at 282 and 284 then 285 and 287. Support lower comes at 280 and 279 then 277.50 and 274.50. Consolidation in Uptrend.

SPY Weekly, $SPY

As the market moves through March Options Expiration the equity markets have shifted gears into consolidation with the exception of the QQQ. Elsewhere look for Gold to continue to pullback in its uptrend while Crude Oil moves higher. The US Dollar Index looks to move lower in broad consolidation while US Treasuries stall under resistance. The Shanghai Composite and Emerging Markets are back in consolidation mode, moving sideways.

Volatility looks to sit at very low levels, giving support to equities to continue higher. Their charts show the SPY and IWM taking a pause in the shorter timeframe while the QQQ continues to blast higher. On the longer timeframe all 3 have recovered from their 1 week pullback and continue to show strong uptrends. Use this information as you prepare for the coming week and trad’em well.

Disclaimer:

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.