Last week’s review of the macro market indicators saw with five months of 2019 in the books that equity markets had given back half of their gains from the peak at the end of April. Elsewhere looked for Gold ($GLD) to continue in its uptrend while Crude Oil ($USO) continued lower. The US Dollar Index ($DXY) continued to drift higher while US Treasuries (:$TLT) were very strong but overbought.

The Shanghai Composite ($ASHR) continued to consolidate in its downtrend while Emerging Markets ($EEM) might reverse back higher. Volatility ($VXXB) looked to drift up putting downward pressure on the equity index ETF’s $SPY, $IWM and $QQQ. Their charts were showing the pain in the short run and that was now moving into the weekly timeframe as well.

The week played out with Gold driving higher while Crude Oil found support mid-week and bounced Friday. The US dollar pulled back and through the long drift higher while Treasuries digested their gains holding at the highs. The Shanghai Composite fell back from resistance and made a new 3 month low while Emerging Markets continued to move higher.

Volatility met resistance and fell back, removing the pressure on equities. The Equity Index ETF’s reacted by moving higher, with the SPY exploding to the upside and the QQQ not far behind. The IWM started out fast but then lost energy and consolidated. What does this mean for the coming week? Let’s look at some charts.

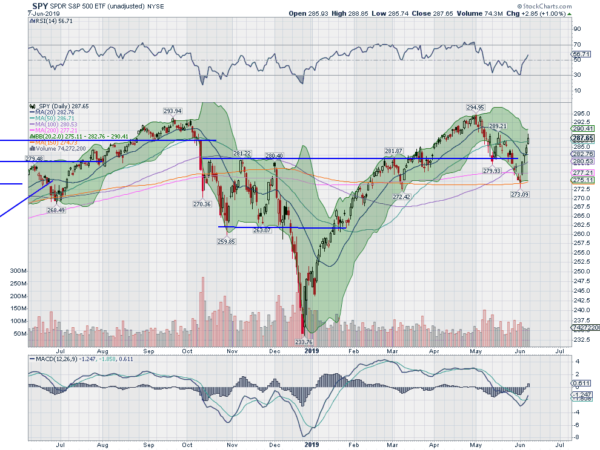

SPY Daily, $SPY

The SPY came into the week falling and through the 20-day SMA. Monday it continued to move lower but with a hammer candle, Then Tuesday began a turn around with a strong move higher. It continued Wednesday and through the rest of the week to close a strong week higher. It ended the week at the may bounce level.

The daily chart shows a strong rise with a small upper shadow showing up on the Friday candle. The RSI is rising through the midline with the MACD crossed up and rising, but still negative. The price is now approaching the upper Bollinger Band.

The weekly chart shows a bullish engulfing candle taking out the last 3 weeks. The RSI on this timeframe is rising and bullish with the MACD turning to cross back up and positive. There is resistance from 289.50 to 290.50 then 292 and 294. Support lower comes at 287 and 285 then 284 and 282 before 280. Reversal Higher.

SPY Weekly, $SPY

With the May employment report behind and heading into a light economic news week, the equity markets are looking strong after a fast and hard reversal higher. Elsewhere look for Gold to continue higher while Crude Oil continues to move lower. The US Dollar Index looks to continue lower in the updrift while US Treasuries consolidate their move higher. The Shanghai Composite has renewed the downtrend while the bounce in Emerging Markets continues to move them higher.

Volatility looks to continue to ease making it easier for equity index ETF’s SPY, IWM and QQQ, to move up. Their charts all show a strong move higher on the week, and firm reversals on the weekly chart. The daily charts show the SPY and QQQ with strong moves up all week, while the IWM stalled midweek and consolidated. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.