SPY Trends And Influencers June 29, 2019

Last week’s review of the macro market indicators saw with June options expiration complete, equity markets were looking strong with 1 week left in the first half of the year. Elsewhere looked for Gold ($GLD) to continue in its uptrend while Crude Oil ($USO) joined it moving higher. The US Dollar Index ($DXY) looked to continue to retrench lower while US Treasuries ($TLT) paused in their uptrend.

The Shanghai Composite ($ASHR) looked to continue its reversal higher while Emerging Markets ($EEM) continued their short term uptrend. Volatility ($VXXB) looked to remain low keeping the bias higher for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts all showed strength on the longer timeframe. On the shorter timeframe, the small caps appeared to be weaker than the others though.

The week played out with Gold probing higher but failing to hold the move while Crude Oil mover higher mid-week and consolidated. The US dollar found support and held at lower lows while Treasuries continued to bounce off of resistance in a tightening range. The Shanghai Composite met resistance and consolidated around the big round number while Emerging Markets also stalled in their move higher.

Volatility moved slightly higher but continued in the low teens, jolting equities early then removing the drag on equities mid-week. The Equity Index ETF’s reacted by pulling back early in the week. All found support by Wednesday and the IWM led them higher with the SPY following in slower fashion but the QQQ consolidating in a tightening range. What does this mean for the coming week? Let’s look at some charts.

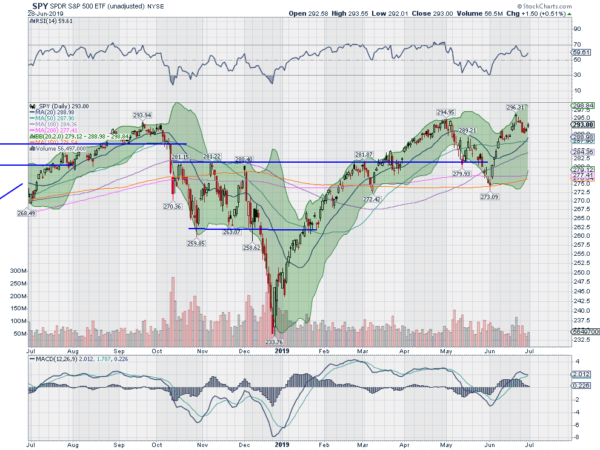

SPY Daily, $SPY

The SPY was pulling back from a new all-time high as it came into the week. It made a small move lower Monday and then accelerated down Tuesday. Top callers were everywhere. It found support Wednesday and then lifted Thursday and Friday to end the week slightly lower. This reversal also made for a higher low following a higher high, a short term uptrend.

The daily chart shows the Bollinger Bands® turning up with the RSI also rising in the bullish zone. The MACD is level but is also avoiding a cross down. On this timeframe, the price action looks positive with room to continue.

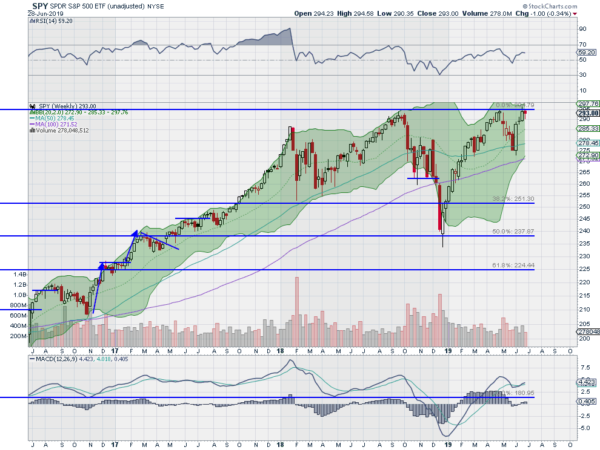

On the weekly chart, it printed an inside candle near the highs. The RSI is holding in the bullish zone with the MACD crossed up, rising and positive. The Bollinger Bands are also opening higher. There is resistance at 294 and 295 followed by 296.25. Support lower comes at 292 and then from 289.50 to 290.50 followed by 287 and 285 then 284. Uptrend.

SPY Weekly, $SPY

As the second Quarter closed equity markets regained some of their swagger with a couple of positive days. Elsewhere look for Gold to possibly pause in its uptrend while Crude Oil continues higher. The US Dollar Index continues in the short term downtrend while US Treasuries remain in their uptrend. The Shanghai Composite looks to break consolidation around the round number 3000 and resume the uptrend while Emerging Markets remain in a short term uptrend.

Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show renewed strength from the IWM with the SPY trying to follow, but a bit less confidence from the QQQ. Perhaps a shift in leadership is coming. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.