Last week’s review of the macro market indicators saw with the May employment report behind and heading into a light economic news week, the equity markets were looking strong after a fast and hard reversal higher. Elsewhere looked for Gold ($GLD) to continue higher while Crude Oil ($USO) continued to move lower. The US Dollar Index ($DXY) looked to continue lower in the updrift while US Treasuries ($TLT) consolidated their move higher.

The Shanghai Composite ($ASHR) had renewed the downtrend while the bounce in Emerging Markets (NYSE:$EEM) continued to move them higher. Volatility ($VXXB) looked to continue to ease making it easier for equity index ETF’s $SPY, $IWM and $QQQ, to move up. Their charts all showed a strong move higher on the week, and firm reversals on the weekly chart. The daily charts showed the SPY and QQQ with strong moves up all week, while the IWM stalled mid-week and consolidated.

The week played out with Gold pausing before moving higher at the end of the week while Crude Oil fell back to retest the recent lows and consolidated. The US Dollar moved lower while Treasuries fell back to support early then rallied again. The Shanghai Composite bounced to the top of its range then stalled while Emerging Markets stalled in their rally and reversed

Volatility held in a tight range in the mid-teens, keeping the bias higher for equities. The Equity Index ETF’s however stalled in their rallies, digesting the recent fast moves The SPY remains within a few points of its highs with the QQQ slightly off its highs and over support. The IWM remains in the middle of what has been long term consolidation. What does this mean for the coming week? Let’s look at some charts.

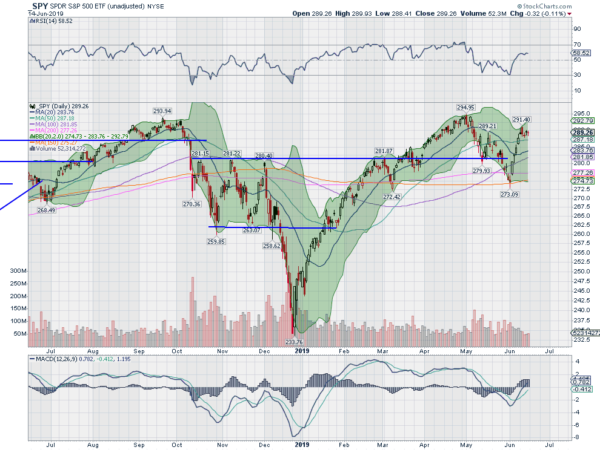

SPY Daily, $SPY

The SPY came into the week following a very strong 4 day move higher. Monday it moved slightly higher, just enough to negate an Inverse Head and Shoulders pattern by rising over the right Shoulder. And that was about all it did all week. It consolidated the rest of the week, marking time sideways.

The daily chart shows this led to the RSI turning flat right at the level where it would turn bullish. The MACD, however, continued to move higher and went positive. The Bollinger Bands are also opening higher. A digestive week.

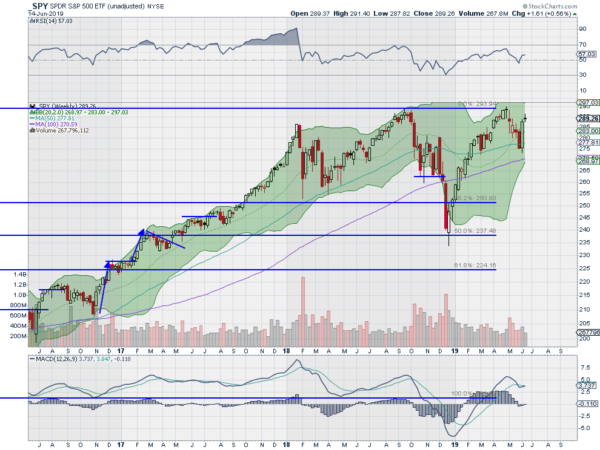

The weekly chart shows a doji with a tight range, signaling indecision. This can resolve either direction, The RSI remains in the bullish range with the MACD trying to cross back up. There is resistance from 289.50 to 290.50 and then at 292 and 294. Support lower sits at 287 and 285 then 284 and 282. Pause in Uptrend.

SPY Weekly, $SPY

Heading into June options expiration equity markets took a digestive breather after a strong move higher but remain looking healthy on the longer timeframe. Elsewhere look for Gold to continue in its uptrend while Crude Oil continues to move lower. The US Dollar Index is now in a short term downtrend while US Treasuries continue to be biased higher.

The Shanghai Composite and Emerging Markets are pulling back lower. Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show a loss of power and momentum in the short run but continued strength in the longer timeframe. Use this information as you prepare for the coming week and trad’em well.

Dislclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.