Last week’s review of the macro market indicators saw heading into the unofficial start of Summer, equity markets got kicked in the teeth again but continued to hang on. Elsewhere looked for Gold (NYSE:$GLD) to consolidate in the downtrend while Crude Oil (NYSE:$USO) pulled back. The US Dollar Index ($DXY) was changing to a short term downtrend while US Treasuries (NASDAQ:$TLT) continued to march higher.

The Shanghai Composite (NYSE:$ASHR) and Emerging Markets (NYSE:$EEM) looked to continue to move lower. Volatility ($VXXB) looked to remain stable at moderate levels keeping the pressure off of for the equity index ETF’s $SPY, $IWM and $QQQ. This allowed sentiment driven by headlines to play a bigger roll. In response, the QQQ was looking the weakest with the SPY and IWM finding support at prior levels.

The week played out with Gold slowing the drop early and then exploding higher at the end of the week while Crude Oil paused before another drop Friday. The US Dollar made a higher high before giving back some Friday while Treasuries continued higher. The Shanghai Composite consolidated in a tighter range while Emerging Markets found support and moved slightly higher.

Volatility moved slightly higher, putting pressure on equities. The Equity Index ETF’s pulled back in reaction as trade wars heated up. The SPY, IWM and QQQ all dropped Tuesday and then gapped down Wednesday and held. Then they ended the week and month with another gap down Friday that saw some buying. What does this mean for the coming week? Let’s look at some charts.

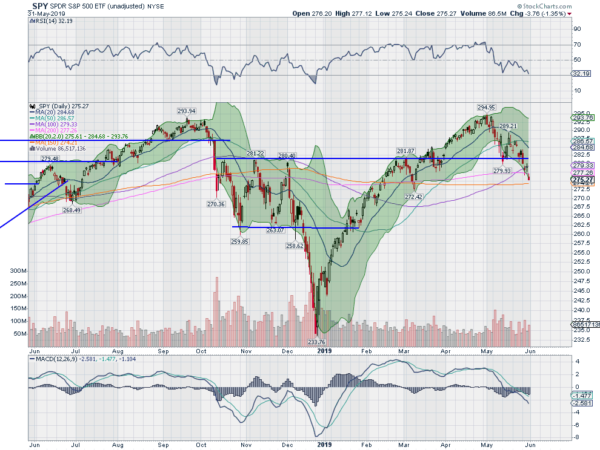

SPY Daily, $SPY

The SPY came into the week retesting the prior May low and top of the consolidation range from last fall. It broke down through that Tuesday and continued lower Wednesday to the 100 day SMA. It held there Thursday before another move lower Friday. The SPY closed the week approaching the 200 day SMA.

The daily chart shows the price making a lower low after a lower high. The Bollinger Bands® are opening to the downside as price falls out. The RSI is back at oversold levels with the MACD falling and now negative. The March low is now a key area to hold.

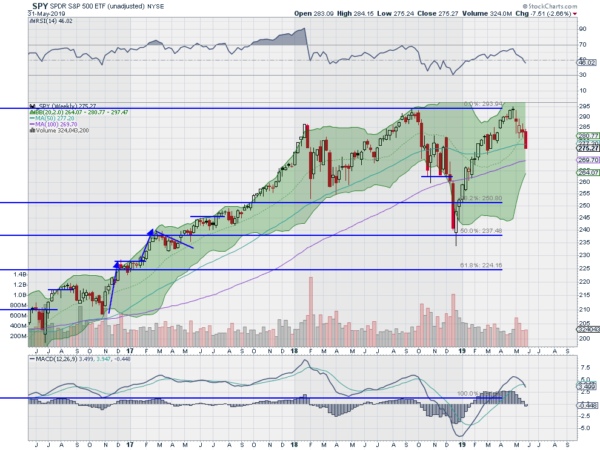

On the weekly chart it printed a near Marubozu candlestick, closing on the low. The RSI is falling through the mid line, but still in the bullish zone, with the MACD crossed down and falling. There is support lower at 274.50 and 272.50 then 271 and 268.50 before 266.75 and 265. Resistance comes at 277.50 and 278 then 280 and 282 before 284 and 285. Downtrend.

SPY Weekly, $SPY

Five months of 2019 are in the books and equity markets have given back half of their gains from the peak at the end of April. Elsewhere look for Gold to continue in its uptrend while Crude Oil continues lower. The US Dollar Index continues to drift higher while US Treasuries are very strong but overbought. The Shanghai Composite continues to consolidate in its downtrend while Emerging Markets may be reversing back higher.

Volatility looks to drift up putting downward pressure on the equity index ETF’s SPY, IWM and QQQ. Their charts are showing the pain in the short run and that is now moving into the weekly timeframe as well. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.