SPY Trends And Influencers February 23, 2019

Last week’s review of the macro market indicators noted with February Options Expiration in the books and heading into the President’s Day weekend, equities looked very strong. Elsewhere looked for SPDR Gold Shares (NYSE:GLD) to continue higher in its uptrend while United States Oil (NYSE:USO) joined it with a renewed push higher. The U.S. Dollar Index looked to continue to mark time sideways while U.S. Treasuries (NASDAQ:TLT) were stalled at resistance in their move higher.

The Shanghai Composite (NYSE:ASHR) was driving higher and Emerging Markets (NYSE:EEM) were basing after a digestive pullback. Volatility (NYSE:VXXB) looked to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts showed strong weekly moves with momentum for more as the SPY broke firmly over the 200 day SMA and the QQQ joined it. Only the IWM was left to join the club and it was driving higher fast.

The week played out with Gold starting to the upside but reversing mid-week and then again Friday to finish higher while Crude Oil crept higher mid-week and then held the gain. The U.S. Dollar drifted lower to support while Treasuries took a shot Thursday but recovered Friday to finish little changed. The Shanghai Composite met resistance at the 200 day SMA but then blasted through Friday while Emerging Markets found support and reversed higher.

Volatility drifted down into the low teens, and a more than 4 month low, keeping the bias higher for equities. The Equity Index ETF’s reacted in mixed fashion, with a generally flat week until a positive finish extending the streak higher. The IWM has moved up through the prior consolidation zone while the SPY and QQQ are knocking on the roof of theirs. What does this mean for the coming week? Let’s look at some charts.

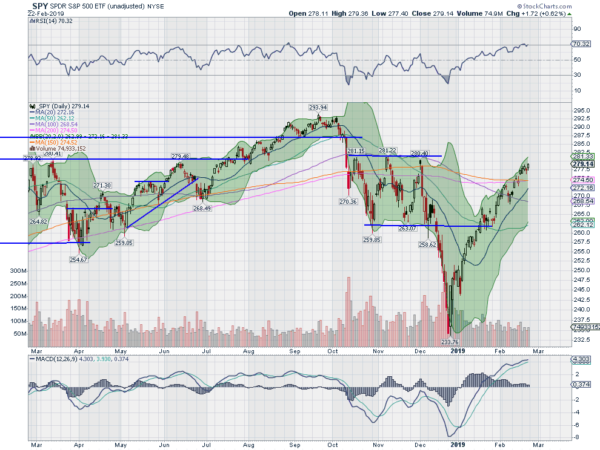

SPY Daily, $SPY

The SPY entered the week solidly over its 200 day SMA and continuing higher. It moved up modestly Tuesday and Wednesday, before giving back some Thursday. Friday it moved back to finish at the high of the week. It was a small move though and price remains below the December 3rd high.

The daily chart shows price moving along near the top of the Bollinger Bands® that are pushing higher. The RSI is also riding along the border of overbought territory within the bullish zone. The MACD has slowed its push to the up side. The trend since Christmas Eve shows no signs of weakness.

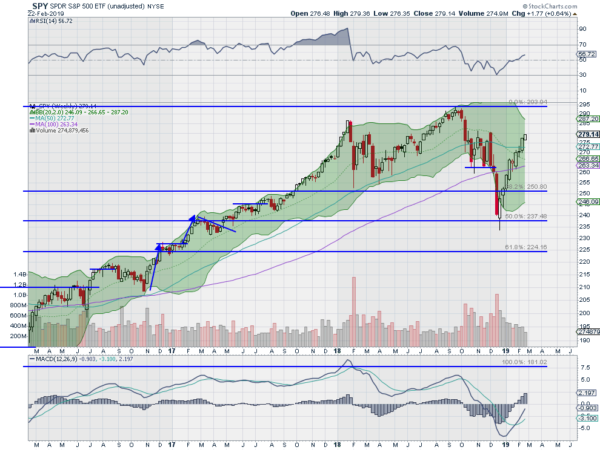

The weekly chart shows the 4th straight week closing higher with a week off and then a string of 4 weeks before that. Price is very near the top of the October through December consolidation range. The RSI is through the mid line but still short of a move into the bullish zone with the MACD rising and near a cross to positive. There is resistance at 280 and 282 followed by 284 and 285 then 287. Support lower comes at 279 and 277.50 then 274.50 and 272.50 before 271.40. Uptrend.

SPY Weekly, $SPY

Heading into the last week of February equity markets continue to look strong but also continue to remain below an all clear level. Elsewhere look for Gold to possibly pause in its uptrend while Crude Oil resumes the path higher. The U.S. Dollar Index looks to continue to move sideways while U.S. Treasuries are consolidating at resistance. The Shanghai Composite and Emerging Markets are continuing their trends higher.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are looking a little extended but strong on the shorter timeframe, but remain very strong on the longer timeframe. Use this information as you prepare for the coming week and trade them well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.