Heading into the last week of January, equities took a pause but remained in their uptrends. The also remained short of declaring that the correction was over. Elsewhere looked for Gold (GLD) to pause in its uptrend while Crude Oil ($USO) paused in its move higher. The U.S. Dollar Index ($DXY) was back in broad consolidation while U.S. Treasuries ($TLT) paused in their uptrend.

The Shanghai Composite ($ASHR) was building the case for a possible reversal higher while Emerging Markets ($EEM) were building a reversal as well. Volatility ($VXXB) looked to remain muted keeping the bias higher for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts remained strong in the short timeframe and just short of full bullish on the longer timeframe.

The week played out with Gold refusing to pause and continuing higher while Crude Oil started lower but reversed to finish up on the week. The U.S. dollar pulled back to the January lows while Treasuries were steady after a blip fell back Friday. The Shanghai Composite held over its moving average and breakout levels while Emerging Markets continued their move higher.

Volatility held in a tight range in the teens, and drifting lower keeping the bias higher for equities. The Equity Index ETF’s all moved higher on the week with the QQQ leading the way but the SPY and IWM also with sizable gains. All three are still yet to make a higher high though. What does this mean for the coming week? Let’s look at some charts.

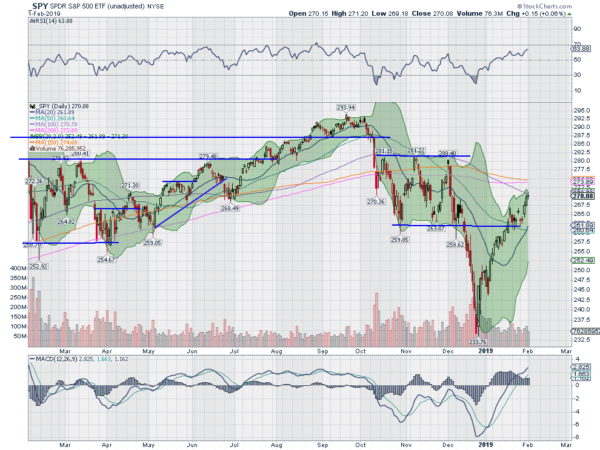

SPY Daily

The SPY came into the week pausing and consolidating the secondary move off of the December low. It held there early in the week and then started moving higher Wednesday. The move continued the rest of the week, ending the week in the middle of the channel that held it from October to December.

The daily chart shows it at the 100-day SMA, with a near doji to end the week. The RSI is rising and in the bullish zone with the MACD rising and positive. It is still short of the 281 level to make a first higher high though. Another good week but not at the all clear level yet.

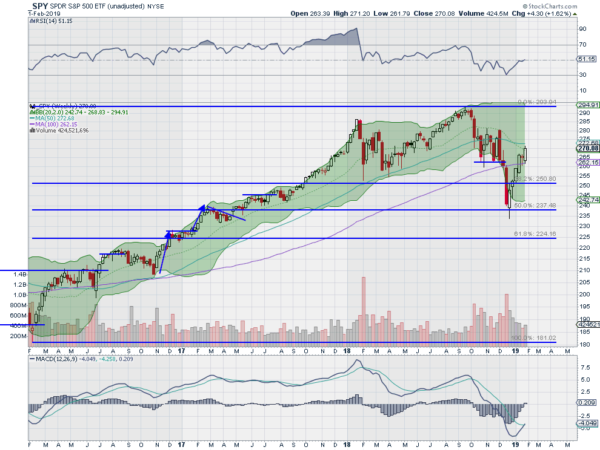

The weekly chart shows a resumption of the uptrend and to the 50-week SMA. The RSI is poking over the mid-line with the MACD crossing up. There is resistance at 271.40 and 272.50 then 274.50 and 277.50. Support lower comes at 269 and 265 then 263 and 261. Uptrend.

SPY Weekly

With January in the books as the best in 30 years and the first week of February ahead, equity markets continue to look strong as they push higher. Elsewhere look for Gold to continue in its uptrend while Crude Oil looks to break higher as well. The U.S. Dollar Index continues to mark time moving sideways while US Treasuries are at resistance. The Shanghai Composite is building a reversal and Emerging Markets have confirmed a reversal higher.

Volatility looks to remain low and falling keeping the breeze at the backs of the equity index ETF’s SPY, IWM and QQQ. Their charts show a possible pause in the short term but the longer picture continues to look strong, as they close in on printing the first higher high since the drop. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.