SPY Trends And Influencers February 16, 2019

Heading into February Options Expiration, the equity markets saw their first signs of weakness this year. They did recover to post positive weeks, but the fatigue was evident. Elsewhere looked for Gold (NYSE:GLD) to resume its uptrend while Crude Oil (NYSE:USO) might be reversing lower. The U.S. Dollar Index (DXY) continued to mark time moving sideways in broad consolidation while U.S. Treasuries (NASDAQ:TLT) were at resistance as they move higher.

The Shanghai Composite (NYSE:ASHR) reopened with a positive outlook and Emerging Markets (NYSE:EEM) were pausing in their move higher. Volatility (NYSE:VXXB) looked to remain at low levels making it easier for equities to advance. Their charts showed digestion of the 6-week move higher in the shorter timeframe as the SPY, IWM and QQQ all held over their 20 day SMA’s. The longer timeframe saw the uptrend intact but with some indecision in the short run.

The week played out with Gold holding over the round number in a tight range while Crude Oil faked out and reversed to the upside. The U.S. dollar probed higher while remaining in consolidation as Treasuries were smacked lower but recovered most of the drop late in the week. The Shanghai Composite pushed to the upside but saw some profit taking Friday while Emerging Markets pulled back to retest the breakout area.

Volatility held at last week’s lows until a bigger move lower Friday, keeping the bias higher for equities. The Equity Index ETF’s reacted by moving higher, slowly Monday and then gapped and ran the rest of the week. This put the SPY solidly back over the 200-day SMA with the QQQ tangled up in its 200 day SMA and the IWM running hard but lagging them. What does this mean for the coming week? Let’s look at some charts.

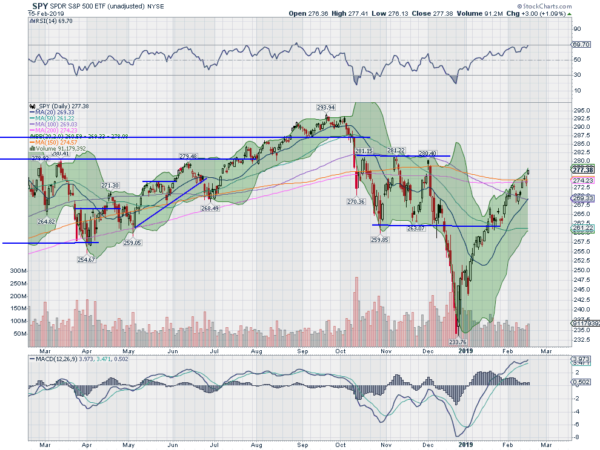

SPY Daily, $SPY

The SPY was attempting to find support after a rejection at the 200-day SMA when the week began. It made a marginal move higher Monday and then gapped up Tuesday, ending back at the 200-day SMA. It jumped over it Wednesday and then fell back Thursday. But a strong move Friday had it close the week over the 200-day SMA for the first time since the end of November.

The daily chart shows the RSI is strong and moving higher in the bullish zone, near a technically overbought condition. The MACD is rising and positive, avoiding a cross. The Bollinger Bands® are running higher with the price moving along. A very strong uptrend on this timeframe.

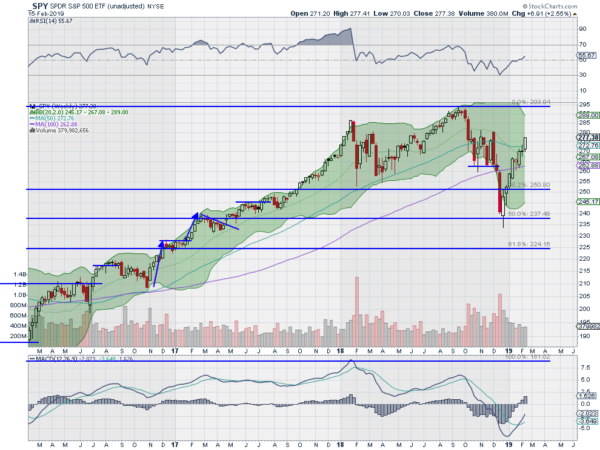

The weekly chart shows last week’s doji resolving to the upside, showing indecision can resolve either way. Price is closing in on the October and November consolidation highs, with the RSI only just now breaking above the midline and the MACD crossed up but still negative. There is resistance above 277.50 at 279 and 280 then 282 and 284. Support lower comes at 274.50 and 272.50 then 271.40 and 269. Uptrend.

SPY Weekly, $SPY

With February Options Expiration in the books and heading into the President’s Day weekend, equities look very strong. Elsewhere look for Gold to bounce continue higher in its uptrend while Crude Oil joins it with a renewed push higher. The U.S. Dollar Index looks to continue to mark time sideways while U.S. Treasuries are stalled at resistance in their move higher. The Shanghai Composite is driving higher and Emerging Markets are basing after a digestive pullback.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts showed strong weekly moves with momentum for more as the SPY breaks firmly over the 200-day SMA and the QQQ joining it. Only the IWM is left to join the club and it is driving higher fast. Use this information as you prepare for the coming week and trade them well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.