SPY (NYSE:SPY) Trends And Influencers October 27, 2019

Last week’s review of the macro market indicators saw, with October options expiration complete, equity markets had a solid week holding near recent highs with good moves higher. Elsewhere looked for Gold ($GLD) to continue to build its bull flag around 1500 while Crude Oil ($USO) consolidated. The US Dollar Index ($DXY) continued to move lower while US Treasuries ($TLT) pulled back in their uptrend. The Shanghai Composite ($ASHR) looked to pullback in consolidation while Emerging Markets ($EEM) pulled back in their short term move higher.

Volatility ($VXXB) had eased and looked to remain low keeping the bias higher for the equity index ETF’s $SPY, $IWM and $QQQ. The SPY and QQQ both broke higher to retest near the highs and looked to continue to have an easier path higher. The IWM continued to churn in a wide consolidation though but put in the strongest week of the 3, perhaps finally ready to lead.

The week played out with Gold holding at 1500 until breaking to the upside at the end of the week while Crude Oil broke consolidation higher midweek as well. The US Dollar found support and bounced but in what looks like a bear flag while Treasuries held in place after an early week dip recovered. The Shanghai Composite found support and turned sideways while Emerging Markets held at the recent top.

Volatility retreated slightly late week, continuing to allow equities to move higher and putting a wind at their back. The Equity Index ETF’s all started the week moving higher. The SPY and QQQ gave some back midweek but then reversed to finish strong. The IWM held the Monday move the rest of the week. What does this mean for the coming week? Let’s look at some charts.

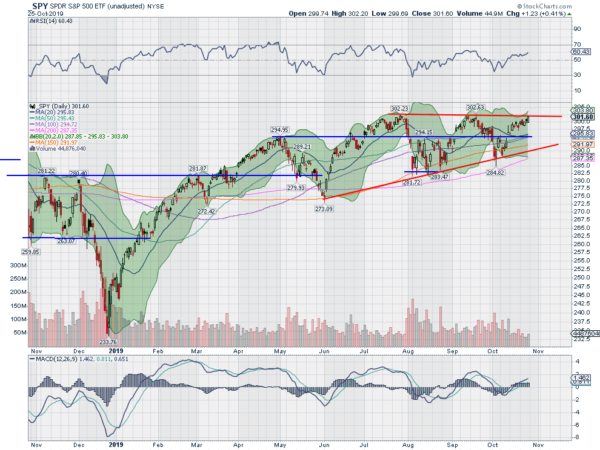

SPY Daily, $SPY

The SPY was moving higher towards a retest of the all-time highs as the week started. It continued higher all week, ending just below the prior highs. The daily chart shows the price at the top of an ascending triangle that has been building for 5 months. The RSI is rising in the bullish zone with the MACD rising and positive. Neither are anywhere near overbought territory. Also, the Bollinger Bands® are opening higher.

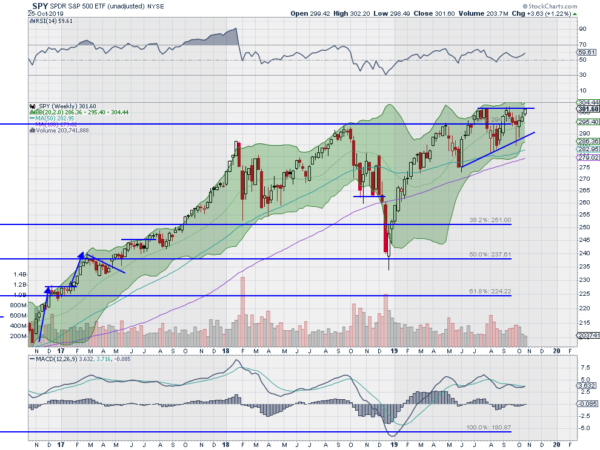

The weekly chart shows the triangle as well. It gives a target to 330 on a break higher. The Bollinger Bands on this timeframe are also opening with the RSI rising and bullish and the MACD trying to cross up after a reset lower. There is no resistance above 302.50. Support lower comes at 301 and 300 then 298.80 and 296.50 before 294 and 292. Uptrend in Consolidation.

SPY Weekly, $SPY

The run up week to the October FOMC meeting saw equity markets make a strong move, led by the small caps and punctuated by a new alltime high in the Nasdaq 100. Elsewhere look for Gold to continue to build its bull flag while Crude Oil moves higher in broad consolidation. The US Dollar Index looks to continue to drift to the upside while US Treasuries resume their pullback. The Shanghai Composite looks to continue to churn in consolidation while Emerging Markets rise in broad consolidation.

Volatility looks to continue to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The QQQ looks to continue higher after making a new all time high and the SPY appears to be following right behind it. The IWM continues to churn in a wide consolidation but with movement to the upside. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.