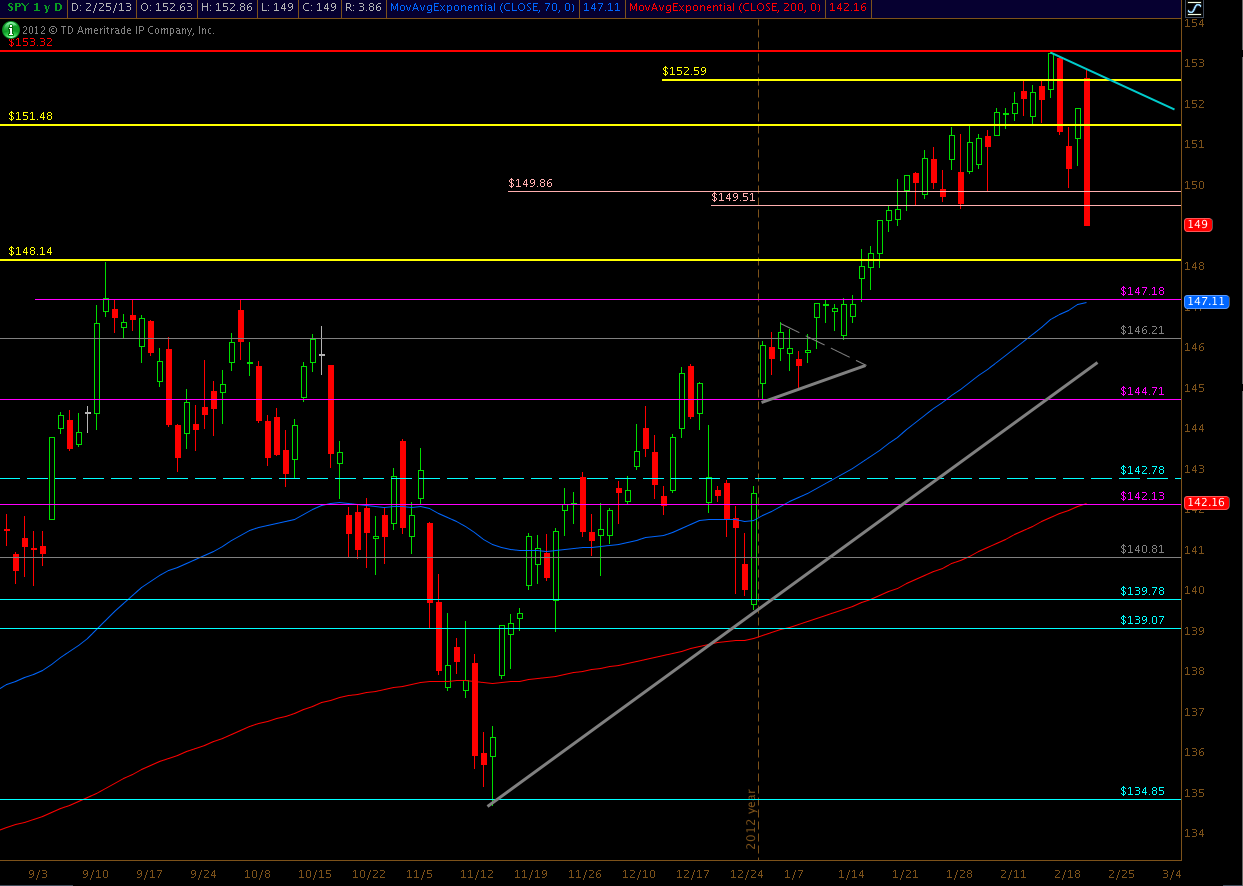

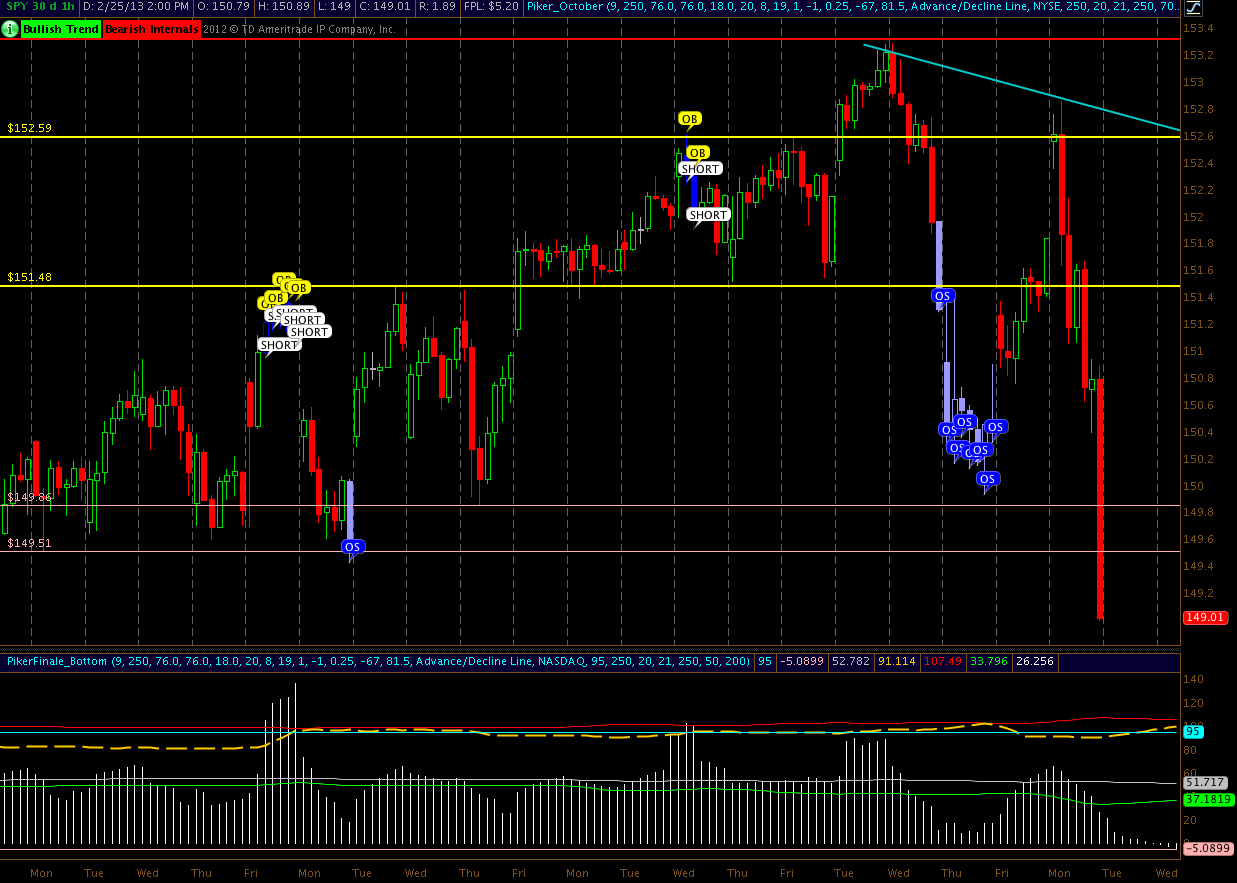

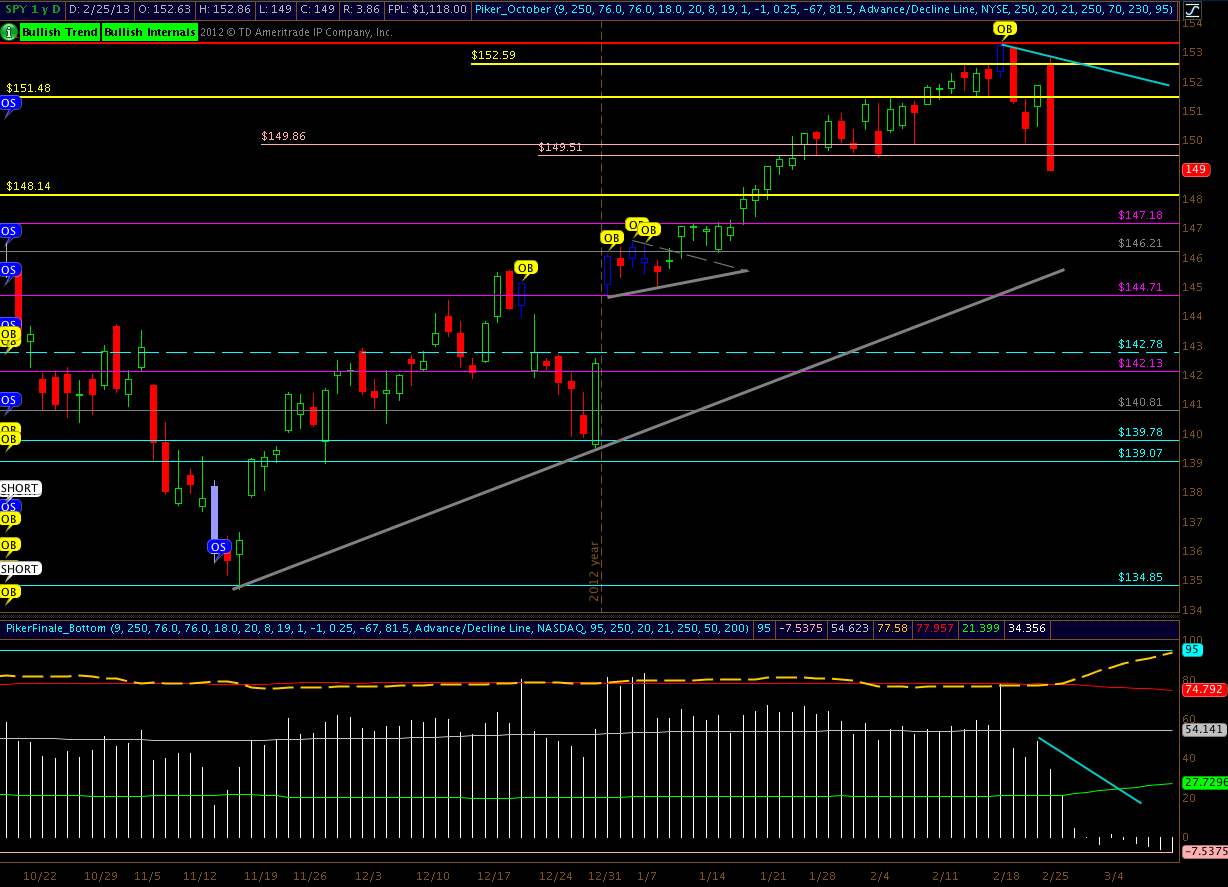

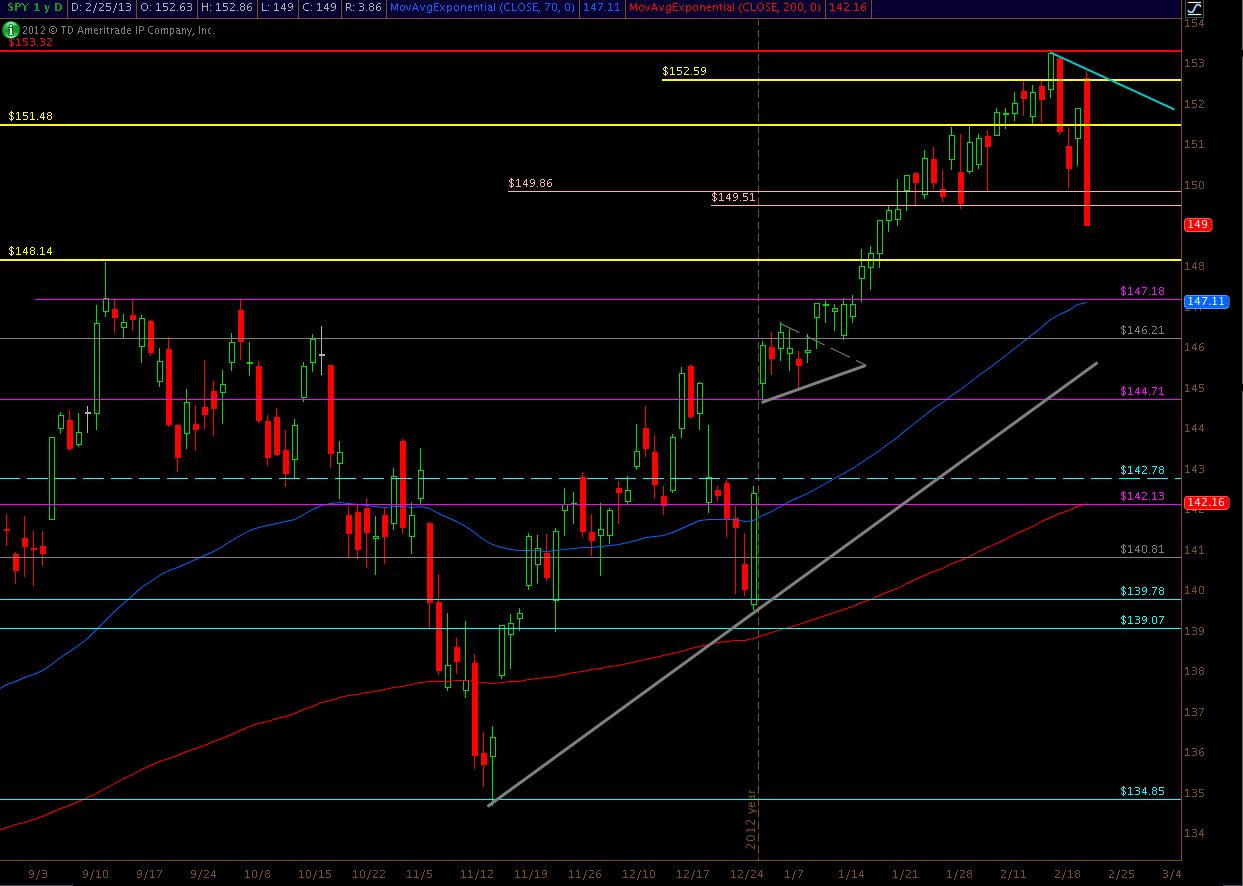

Talk about a Bearish engulfing candlestick. Yesterday price action was very interesting, in that the market declined significantly after looking like it would rally. The decline didn’t come from a gap down and a grind lower like we have seen. As we noted yesterday, SPY needed to get above the 152.61 level in which it did not as it failed at 152.86 and moved lower. More importantly it was noted to watch 151.48 as if this level fails, the market will move much lower and be bearish.

SPY broke below multiple support levels and closed in no man's land from a technical perspective. SPY broke below 151.48 sending it lower and broke below additional support at 149.86 and 149.51. These levels will now act as resistance with the first being test today at 149.51. The only real next support level exist at 148.24 and and 147.18.

The selling more than likely does not stop at 149.00, as we know from looking at the 90% down days and when VIX jumped 34%. Because of this we can expect to see some more selling at least another 1% which puts SPY at 147.18. If SPY can get above 149.86, it is possible the selling could stop but right now the bulls have an up hill battle to climb.

Also we still don’t have an oversold condition on the Piker Signal on the daily chart or the Hourly. The Daily Chart shows that SPY still about 2 more days before its oversold, where the hourly the hourly could hit oversold at 10:00 today.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

SPY Support And Resistance Levels To Watch

Published 02/27/2013, 01:12 AM

Updated 07/09/2023, 06:31 AM

SPY Support And Resistance Levels To Watch

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.