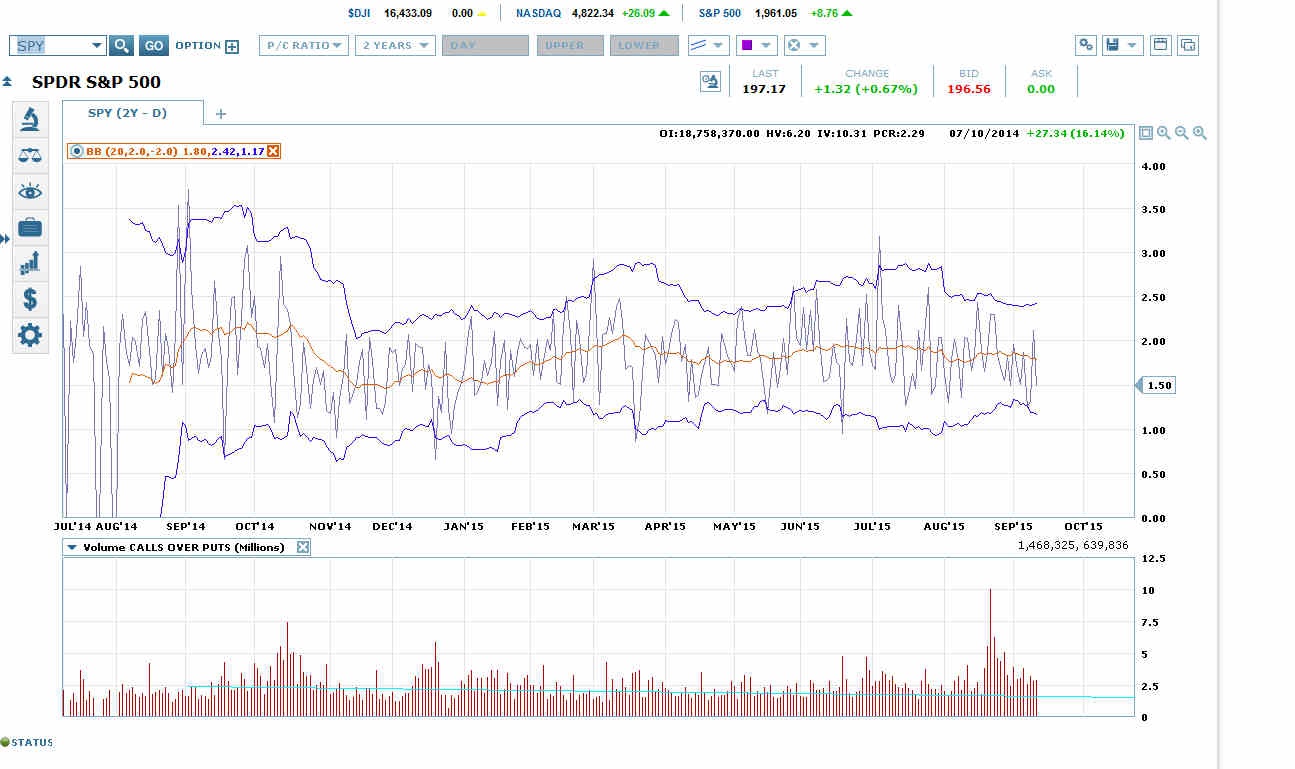

The SPDR S&P 500 (NYSE:SPY) Put-Call Ratio Dropped Hard to Well Below its 20 dma on Friday

The SPY put-call ratio dropped hard on Friday’s short squeeze, falling to 1.50 on a 7% drop in put volume and a 31% rise in call volume.

That 1.50 ratio is well below the ratio’s 20 dma. A drop in the ratio below its 20 dma heading into opex week would tend to be bearish for price on Monday.

One thing to keep in mind is that September is a triple witching month. Triple witching months tend to result in the SPY put-call ratio continuing to drop into Thursday of opex week, with price rising after Monday, typically to the top of a small trading range.

A classic scenario in this spot would be a price drop on Monday, followed by a price rise through Thursday back to the top of the range before Monday’s drop, with the price heading down again on Friday.

You see some great moves (up or down) after triple witching weeks. For a recent example, the October 2014 crash started on Friday of the September 2014 triple witching week. The September 2008 triple witching week started a crash on Friday as well.

The September ’09 triple witching led into a dip. The September ’11 triple witching led into a lower low than the August ’11 crash low. The September ’12 triple witching led into a big dip. The September ’13 triple witching led into a dip.

You aren’t guaranteed to get a price rise out of triple witching weeks. Sometimes the price moves both up and down in a small range all week. And sometimes the price falls hard into triple witching Fridays. That kind of triple witching tends to be followed by a hard move up.

Amazingly, open interest put in another big jump today as both bulls and bears continue to dig in. The level is the highest I can remember heading into opex week in at least the past year, and I believe a lot longer than that.