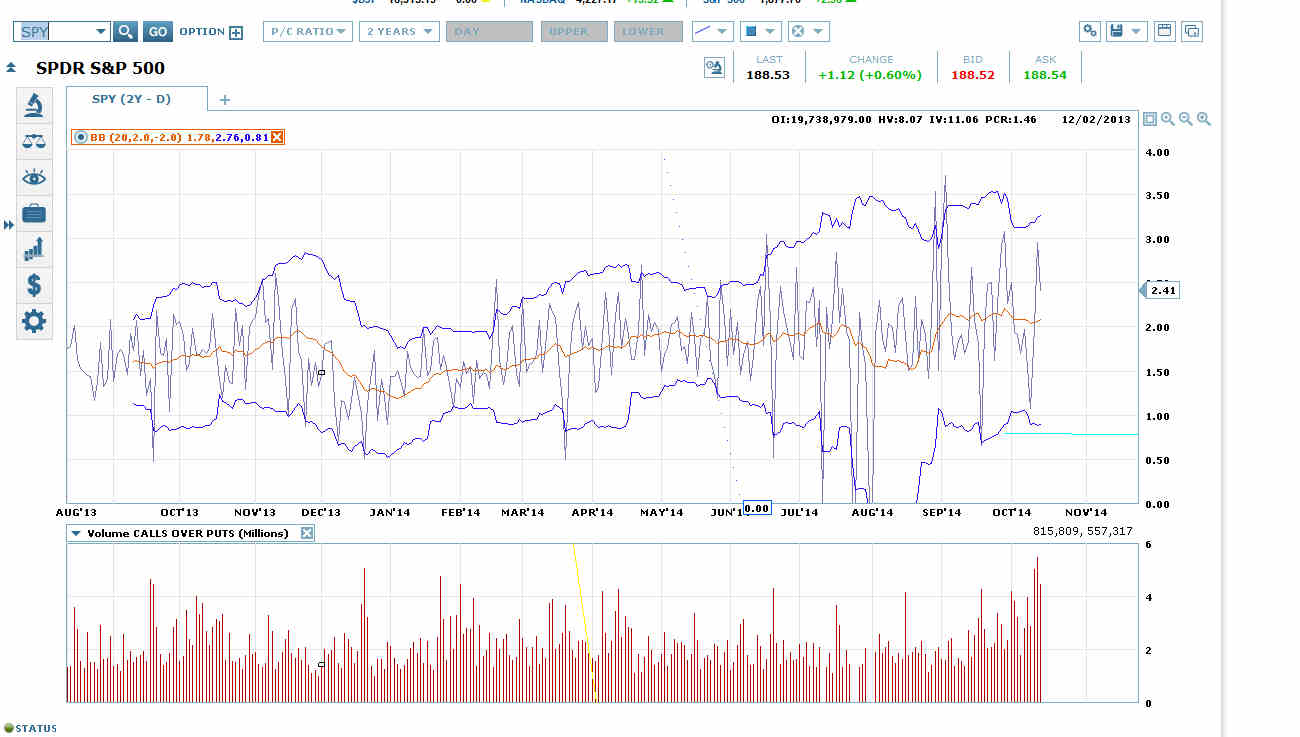

The SPDR S&P 500 (ARCA:SPY) Put-Call Ratio Fell to 2.41 yesterday – That’s Still Very High for Opex Week

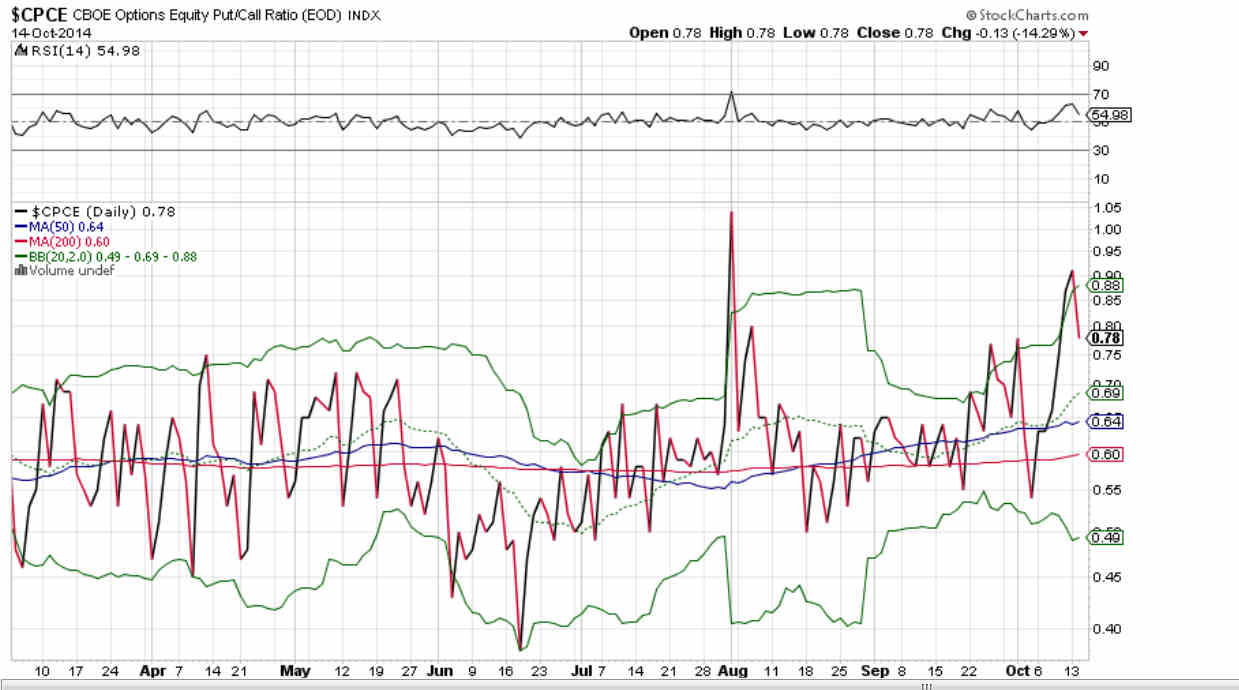

The SPY put-call ratio and CPCE fell a little yesterday.

The CPCE Fell to 0.78 Yesterday – Well Above Its 20 DMA

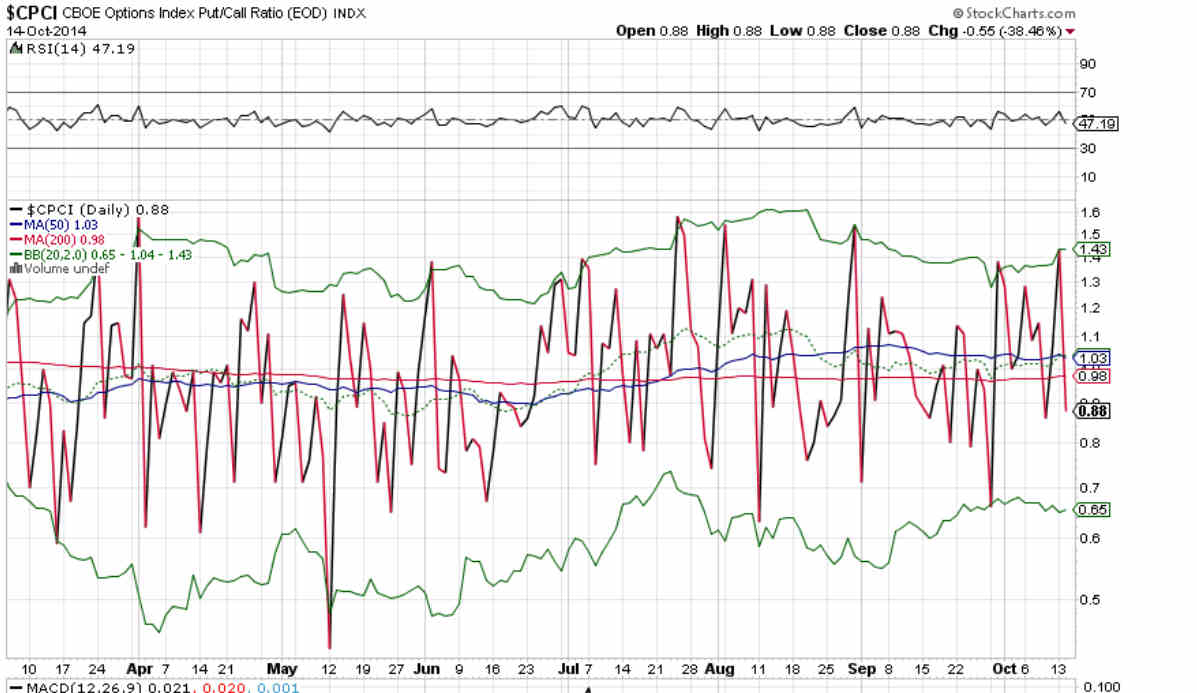

But the CPCI fell a lot.

The CPCI Fell to 0.88 – Well Below its 20 dma

Together the ratios are bullish for today, when the charts indicate we should see a megaphone wave up. The question is whether the short squeeze gets sold into again, as it was yesterday, or whether we can get a big wave up to 1915-1925.

If today’s wave up is small on high volume, it’s bearish, because it implies that sophisticated sellers are taking every opportunity to unload inventory, even all the way down here. If today’s wave up is big and loose, it supports more bullish intermediate-term scenarios.

The SPY put-call ratio fell on a big rise in open interest, meaning both bulls and bears continue to dig in. SPY put volume fell 23% today. SPY call volume fell by only 6%.