Last week’s review of the macro market indicators suggested, as the calendar prepared to turn into April the equity markets were looking weak. Elsewhere looked for Gold to continue lower while Crude Oil continued to move higher. The US Dollar Index looked better to the upside as did US Treasuries, but both with big resistance areas nearby. The Shanghai Composite (SSEC) looked back to its downward price action but Emerging Markets were biased to the upside with some caution after a big week with short term topping signs. Volatility S&P 500 looked to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM), and PowerShares QQQ (NASDAQ:QQQ), despite the moves lower. Their charts were not so optimistic though with the IWM and QQQ in pullbacks that looked to continue while the SPY tried to hold on in consolidation.

The week played out with Gold probing lower before rebounding to end the week up while Crude Oil started lower but also rebounded late in the week. The US Dollar moved slightly higher while Treasuries found trouble at that overhead resistance and pulled back. The Shanghai Composite muddled along sideways while Emerging Markets finally met some resistance and consolidated. Volatility made a new two month low before rebounding slightly. The Equity Index ETF’s halted started the week well but ended worse, with the SPY giving back most of the gains, the IWM virtually all of them and the QQQ the worst, giving all the gains and some more making a lower low in the process. What does this mean for the coming week? Lets look at some charts.

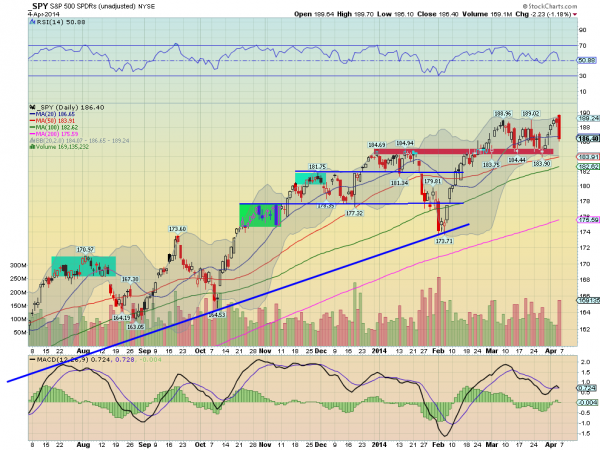

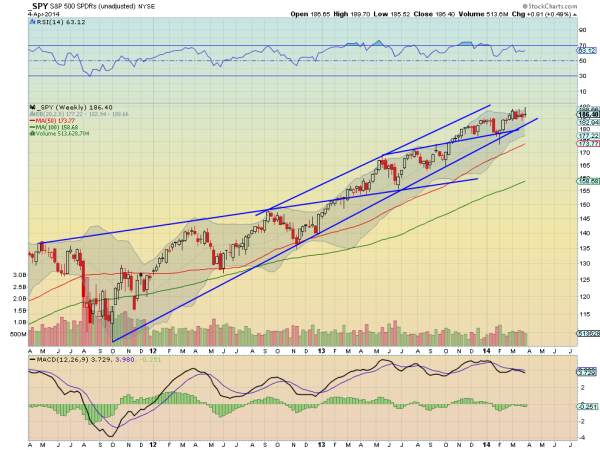

The SPY started the week moving higher, continuing the bounce off of support from the prior week. On Friday it made a new intraday high near the open and then proceeded to sell off the rest of the day, finishing with a strong red candle lower below the 20 day SMA. Volume was solid but not extreme on the sell off, and you will note on the daily chart has been running higher on down days than up days consistently now since mid March. But with that negative backdrop it has yet to break the consolidation range lower, below 184. The RSI on the daily chart is moving back lower, at the mid line, with a MACD that may cross lower Monday. The short term looks lower in the range. On the weekly chart the consolidation of the last 6 weeks is clear as it moves sideways towards the rising trend support line. The RSI on this timeframe is in the bullish zone and flat while the MACD failed to signal higher and is in a soft slope lower. A mixed bag. There is resistance higher at 188.96-189.70, and then a break higher would see a Measured Move target 200. Support lower comes at 184 and 181.80 with 177.50 and 174 following that. A move under 174 turns the trend bearish. Pulling Back in Consolidation Zone in the Uptrend.

Moving into next week the equity markets continue to look weak. Elsewhere look for Gold to move higher with Crude Oil in the short term. The US Dollar Index and US Treasuries are also biased to the upside with a chance that treasuries just churn their wheels sideways. The Shanghai Composite is poised to consolidate in the downtrend while Emerging Markets are biased to the downside in the short run after a strong move higher. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the moves lower last week. Their charts do not share the upside optimism in the short run with the SPY the strongest pulling back near support, the IWM next at support but weak and the QQQ looking lower in the short run. The longer view is similar with the SPY the strongest and consolidating while the IWM is at support and the QQQ moving lower. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.