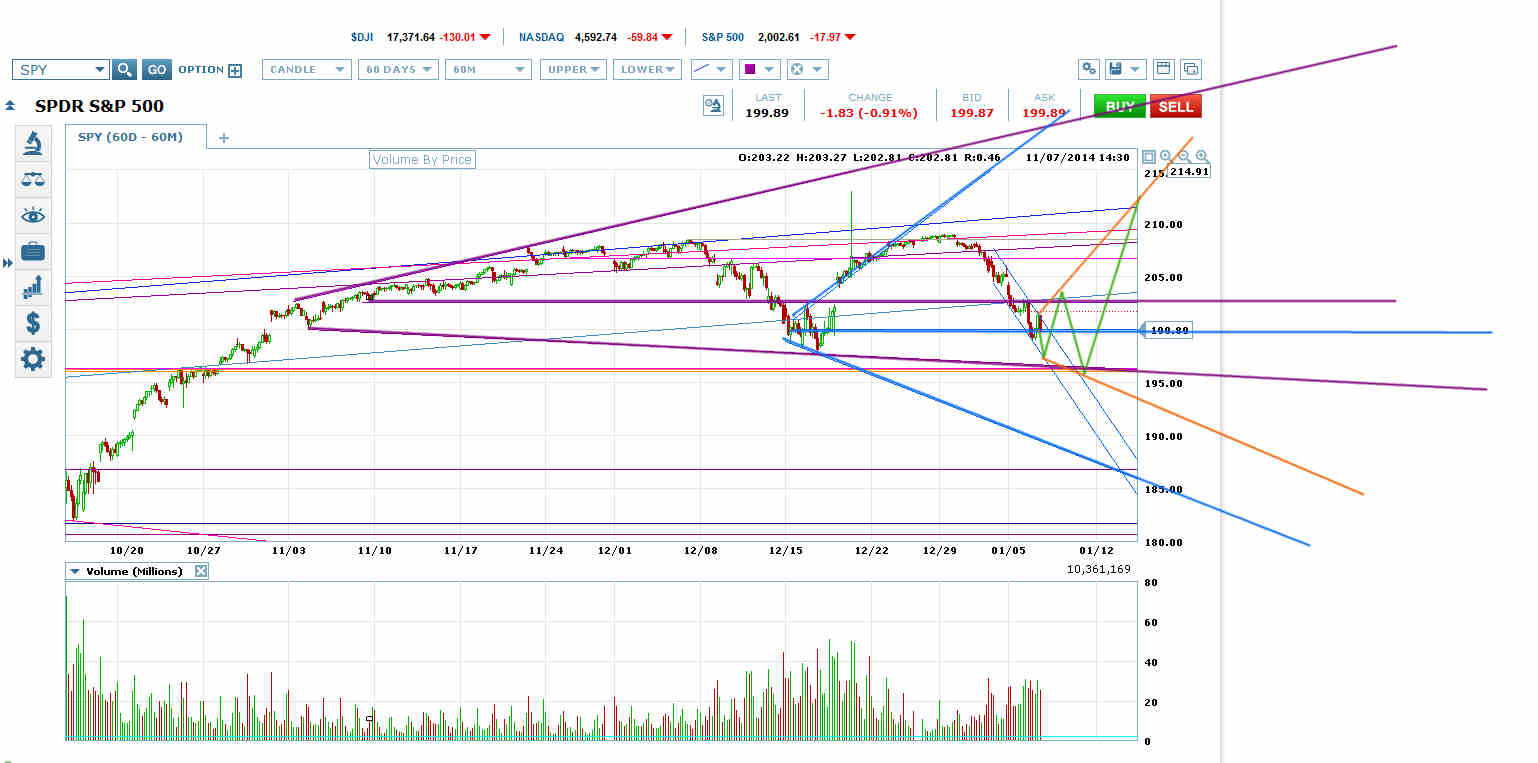

The SPY chart is a little clearer than ES at the moment, so briefly here is what it’s saying.

SPY has essentially formed a price channel (blue on chart) down to the VWAP of its bright blue bottoming megaphone from mid-December. That price channel reached its critical decision point and failed to break out downwards into a steeper melt-down channel. That suggests SPY has started forming a new megaphone across that VWAP (green scenario).

What’s happening is that the market keeps breaking the price out to slightly new highs that get heavily sold into. That’s distribution. Then the sellers lay off a little below the SPY 200 level and a megaphone starts forming that takes the price to another new high for them to sell into.

Sooner or later one of these megaphones at SPY 200 will break out downwards. It’s even possible that this one will, but I think the market’s got enough juice for another move up.

A downward breakout from a megaphone across the bright blue megaphone VWAP would target the bright blue megaphone bottom, which would be down near the October 15 low if SPY headed down there now.