In times like these I like to be all or mostly cash and right now I’m all cash.

Markets are due for a bounce here but with the Fed coming out with a decision on monetary policy tomorrow afternoon I’d not expect too much movement until then.

There were some great bounces though off over sold levels from ICPT, NFLX, IDRA, and many others.

Those are only for quick traders though until we can establish better buy areas.

Remember that in corrections, countertrend moves come sharp and hard and that is what we are seeing in many stocks now. Those moves don’t last too long though so don’t get married to any long trades yet.

It’s best to just sit back and watch the action for the most part as this correction morphs.

On that note, I will keep it pretty short tonight so let’s check out the index charts to begin.

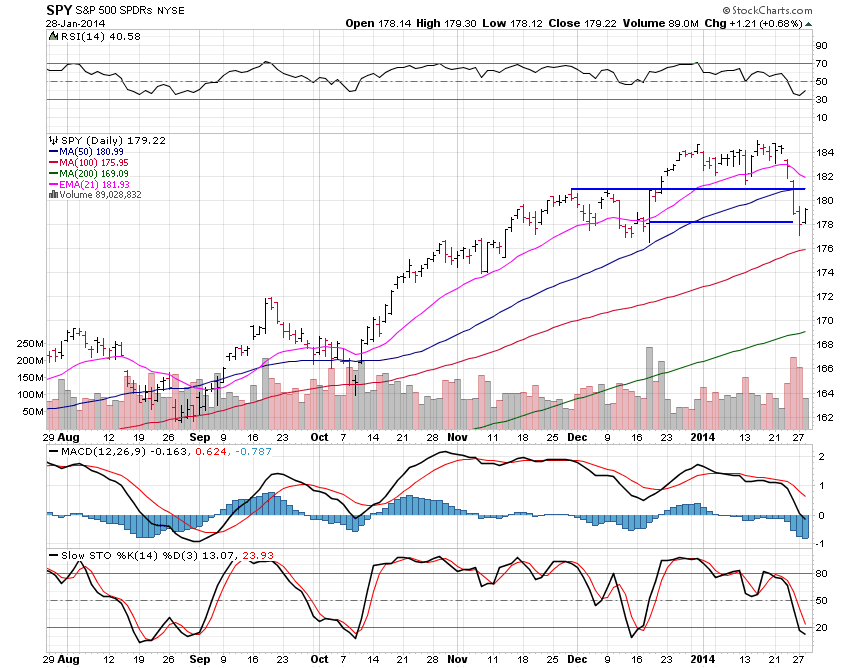

The SPY tested and held its $178 support area and now by all rights should move to $181 before we see resistance.

A huge caveat is that nobody knows what the Fed will say tomorrow and that can move markets large either way.

The Fed does not want markets to move lower with any strength so we have to expect them to ease but that would still be a bet and not a great one in my view.

There is no real rush getting back into stocks yet.

Trying to nail highs and lows is a tough game but catching 80% of the move is much more reasonable so I’m being patient here for now while doing a few day-trades.